Uae Vat Input Tax Credit Rules - This comprehensive guide will walk you through the concept of input tax, the types of expenses eligible for credit, limitations,. Businesses running within the uae must adhere to vat regulations, including claiming input tax credit (itc) under vat. It outlines the eligibility criteria, conditions, time limits, and treatment of input tax credits, ensuring that businesses can recover. The purpose of this guide is to provide guidance on input tax apportionment and the special input tax apportionment methods which may be used. Learn how to recover vat as input tax in uae based on the decree law and executive regulations.

Businesses running within the uae must adhere to vat regulations, including claiming input tax credit (itc) under vat. The purpose of this guide is to provide guidance on input tax apportionment and the special input tax apportionment methods which may be used. It outlines the eligibility criteria, conditions, time limits, and treatment of input tax credits, ensuring that businesses can recover. This comprehensive guide will walk you through the concept of input tax, the types of expenses eligible for credit, limitations,. Learn how to recover vat as input tax in uae based on the decree law and executive regulations.

Businesses running within the uae must adhere to vat regulations, including claiming input tax credit (itc) under vat. It outlines the eligibility criteria, conditions, time limits, and treatment of input tax credits, ensuring that businesses can recover. This comprehensive guide will walk you through the concept of input tax, the types of expenses eligible for credit, limitations,. The purpose of this guide is to provide guidance on input tax apportionment and the special input tax apportionment methods which may be used. Learn how to recover vat as input tax in uae based on the decree law and executive regulations.

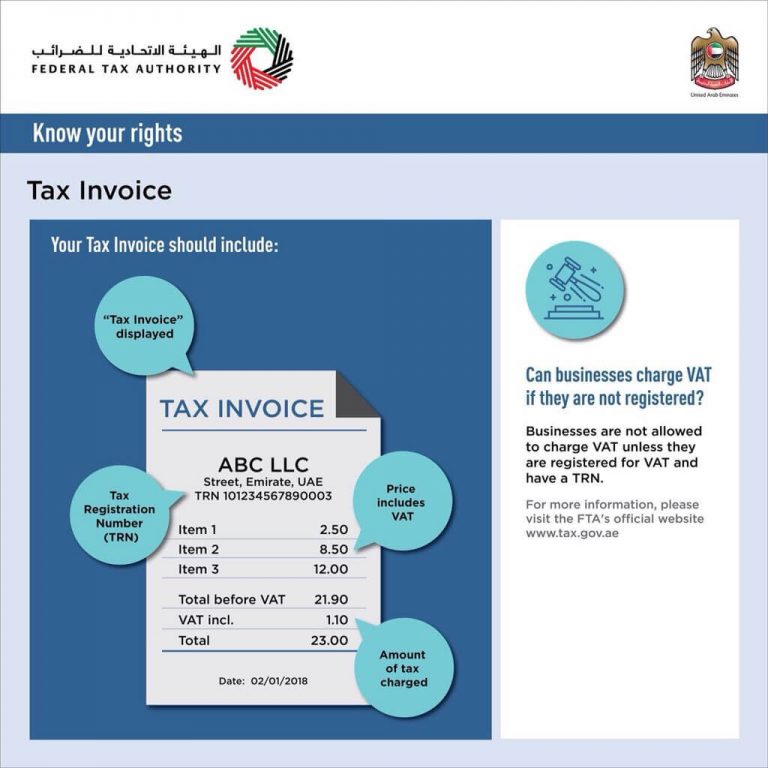

Fully Automated UAE VAT Invoice Template MSOfficeGeek

Businesses running within the uae must adhere to vat regulations, including claiming input tax credit (itc) under vat. This comprehensive guide will walk you through the concept of input tax, the types of expenses eligible for credit, limitations,. Learn how to recover vat as input tax in uae based on the decree law and executive regulations. The purpose of this.

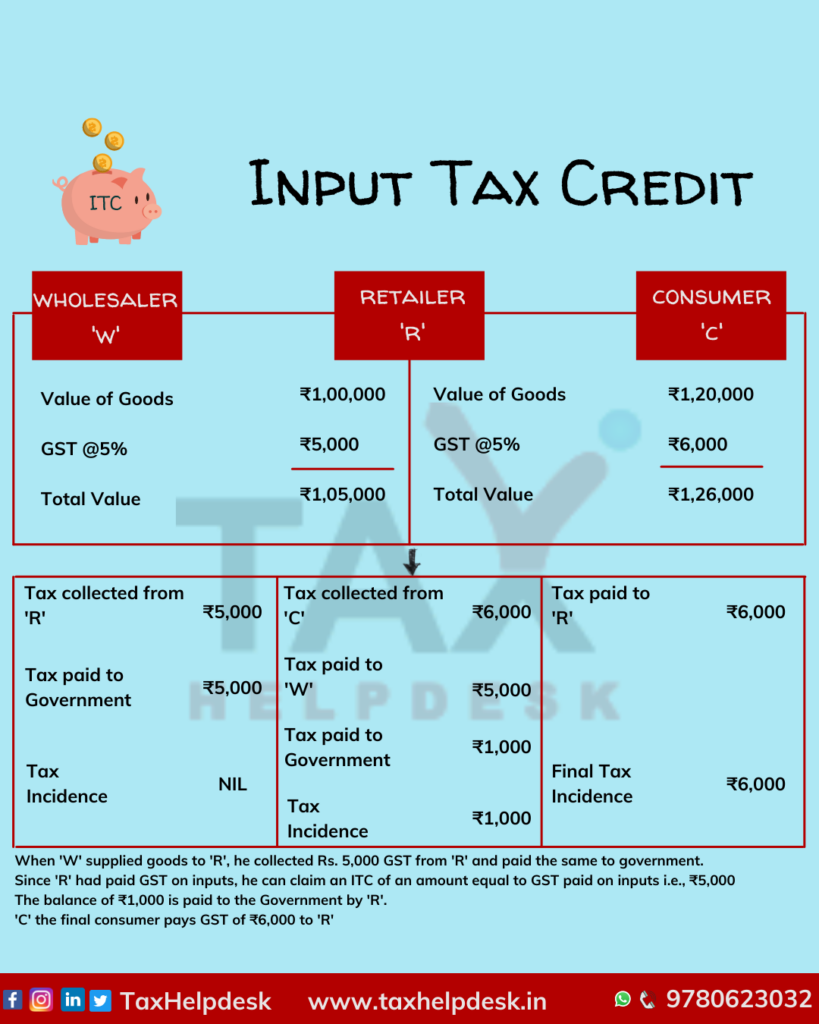

Rules related to setting off of Input Tax Credit

It outlines the eligibility criteria, conditions, time limits, and treatment of input tax credits, ensuring that businesses can recover. This comprehensive guide will walk you through the concept of input tax, the types of expenses eligible for credit, limitations,. The purpose of this guide is to provide guidance on input tax apportionment and the special input tax apportionment methods which.

VAT Videos Archive All About TAX In UAE

This comprehensive guide will walk you through the concept of input tax, the types of expenses eligible for credit, limitations,. Learn how to recover vat as input tax in uae based on the decree law and executive regulations. It outlines the eligibility criteria, conditions, time limits, and treatment of input tax credits, ensuring that businesses can recover. Businesses running within.

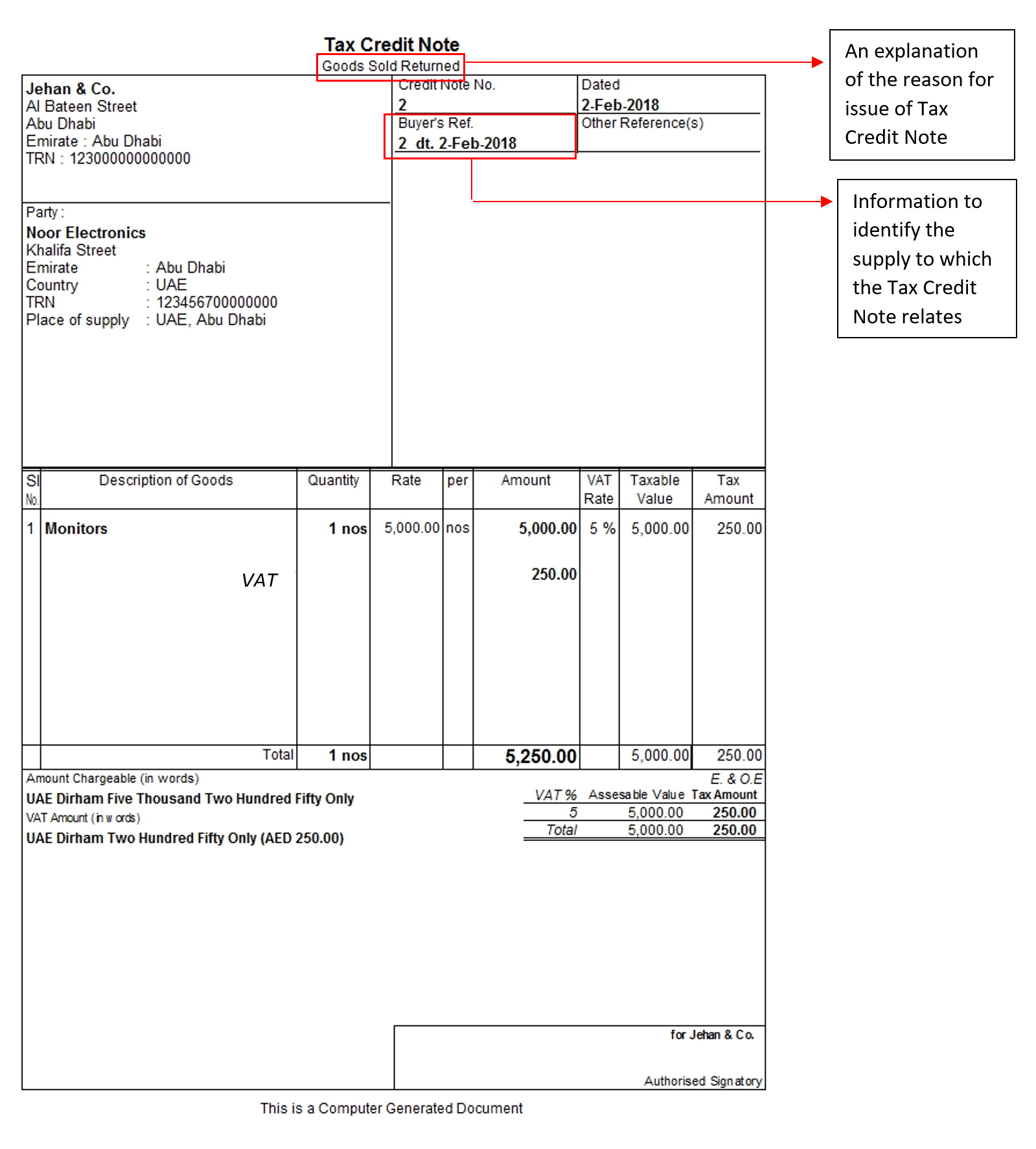

Detailed Tax Invoice All About TAX In UAE

Businesses running within the uae must adhere to vat regulations, including claiming input tax credit (itc) under vat. Learn how to recover vat as input tax in uae based on the decree law and executive regulations. It outlines the eligibility criteria, conditions, time limits, and treatment of input tax credits, ensuring that businesses can recover. The purpose of this guide.

Input Tax Credit Know How Does It Work?

It outlines the eligibility criteria, conditions, time limits, and treatment of input tax credits, ensuring that businesses can recover. This comprehensive guide will walk you through the concept of input tax, the types of expenses eligible for credit, limitations,. The purpose of this guide is to provide guidance on input tax apportionment and the special input tax apportionment methods which.

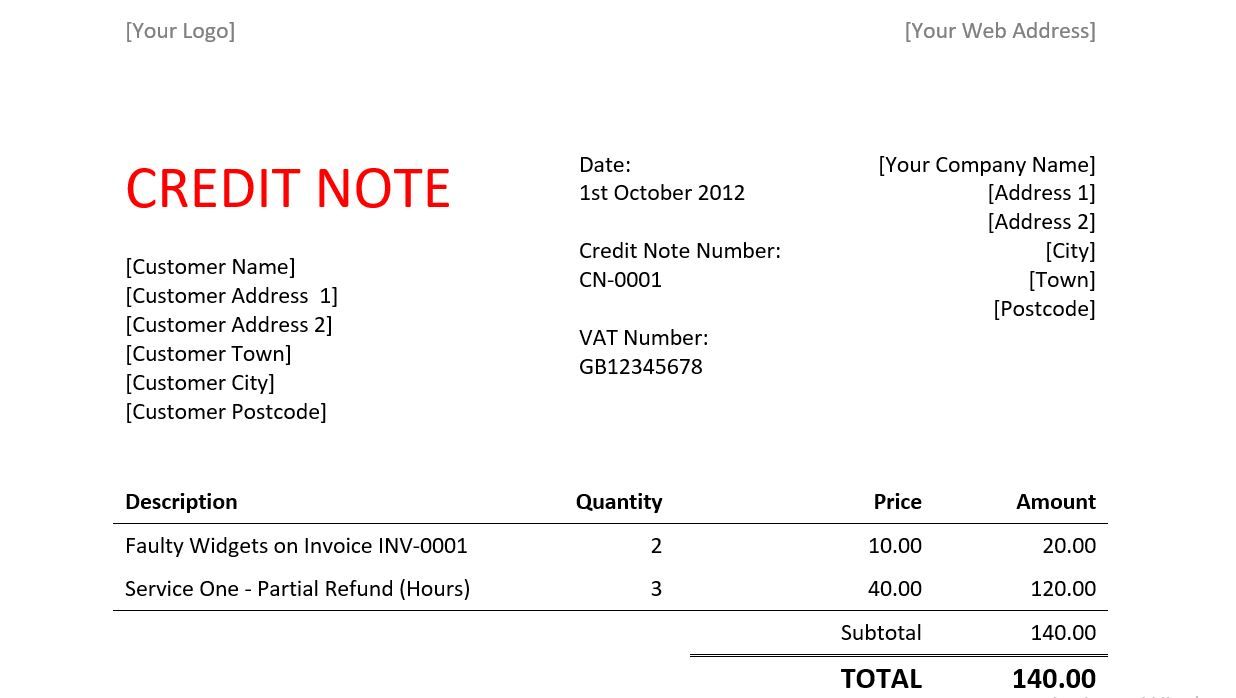

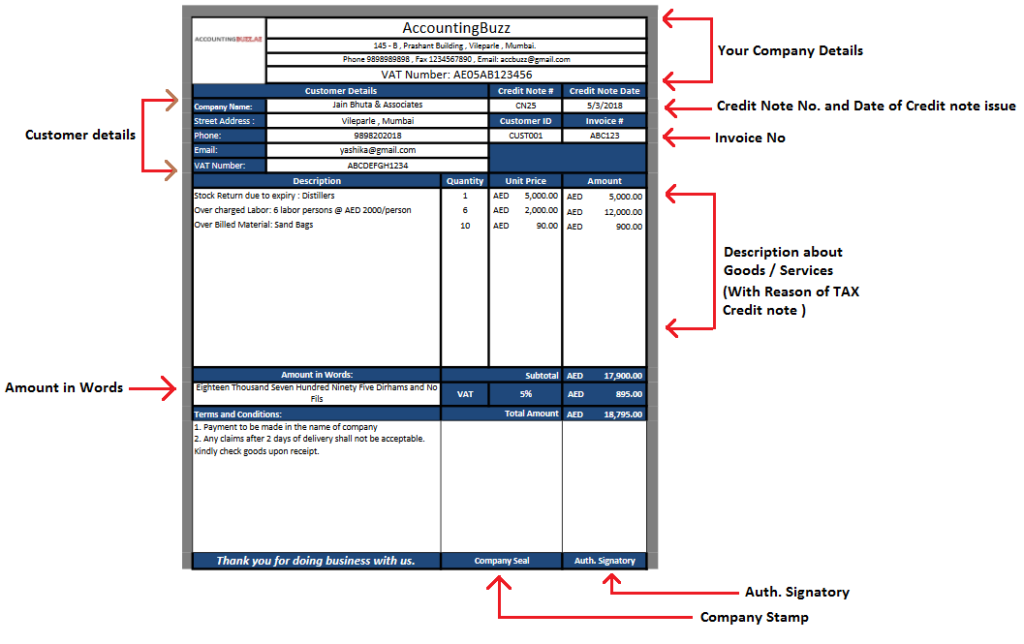

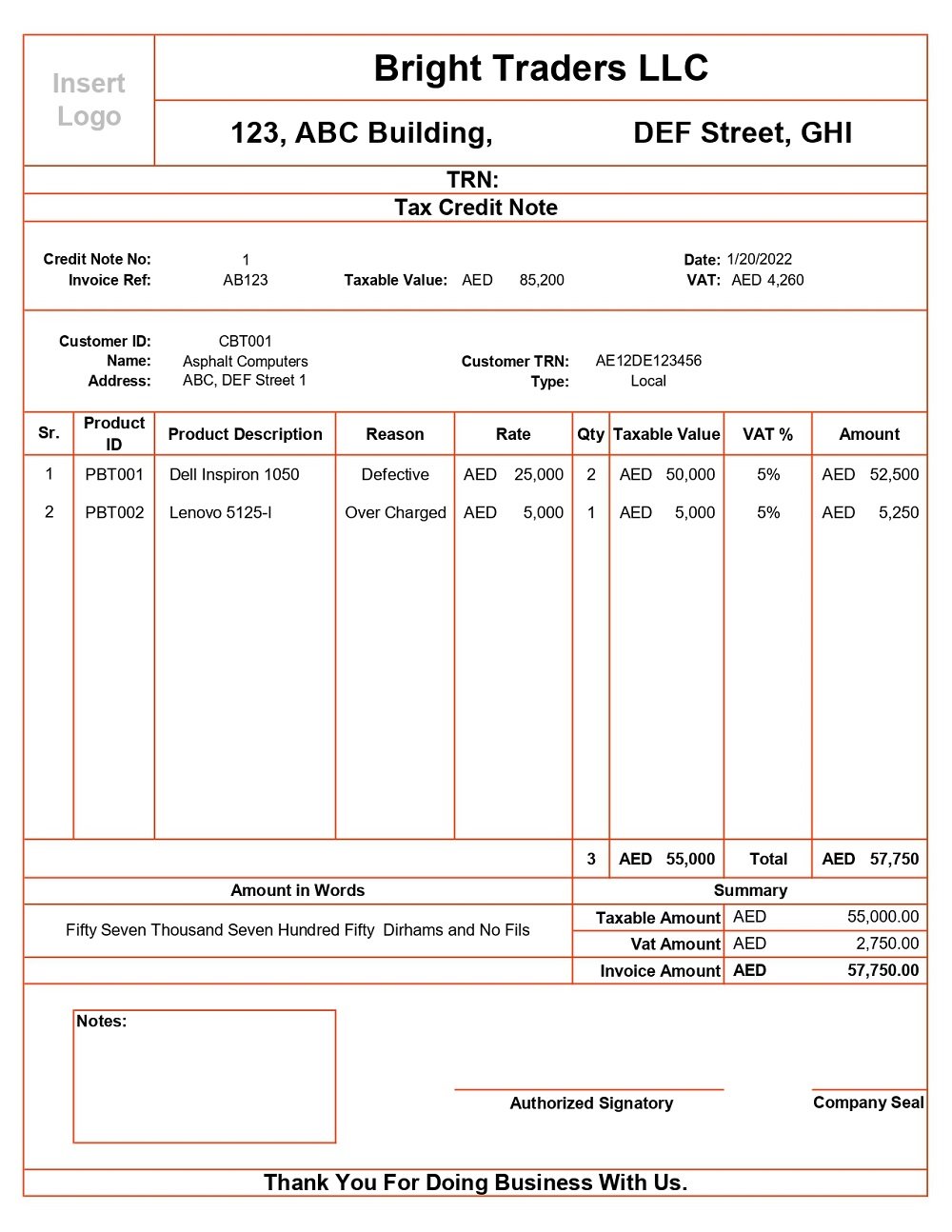

Tax Credit Note under VAT in UAE Tax Credit Note Requirements

This comprehensive guide will walk you through the concept of input tax, the types of expenses eligible for credit, limitations,. Businesses running within the uae must adhere to vat regulations, including claiming input tax credit (itc) under vat. It outlines the eligibility criteria, conditions, time limits, and treatment of input tax credits, ensuring that businesses can recover. Learn how to.

Tax Credit Note under VAT in UAE Tax Credit Note Requirements

The purpose of this guide is to provide guidance on input tax apportionment and the special input tax apportionment methods which may be used. This comprehensive guide will walk you through the concept of input tax, the types of expenses eligible for credit, limitations,. It outlines the eligibility criteria, conditions, time limits, and treatment of input tax credits, ensuring that.

VAT Invoice Format in UAE FTA Tax Invoice Format UAE

The purpose of this guide is to provide guidance on input tax apportionment and the special input tax apportionment methods which may be used. Learn how to recover vat as input tax in uae based on the decree law and executive regulations. It outlines the eligibility criteria, conditions, time limits, and treatment of input tax credits, ensuring that businesses can.

Tax Invoice Format for VAT in UAE by Karna Soneji Medium

Businesses running within the uae must adhere to vat regulations, including claiming input tax credit (itc) under vat. This comprehensive guide will walk you through the concept of input tax, the types of expenses eligible for credit, limitations,. Learn how to recover vat as input tax in uae based on the decree law and executive regulations. The purpose of this.

ReadyToUse UAE VAT Credit Note Format MSOfficeGeek

It outlines the eligibility criteria, conditions, time limits, and treatment of input tax credits, ensuring that businesses can recover. Learn how to recover vat as input tax in uae based on the decree law and executive regulations. The purpose of this guide is to provide guidance on input tax apportionment and the special input tax apportionment methods which may be.

It Outlines The Eligibility Criteria, Conditions, Time Limits, And Treatment Of Input Tax Credits, Ensuring That Businesses Can Recover.

The purpose of this guide is to provide guidance on input tax apportionment and the special input tax apportionment methods which may be used. Businesses running within the uae must adhere to vat regulations, including claiming input tax credit (itc) under vat. This comprehensive guide will walk you through the concept of input tax, the types of expenses eligible for credit, limitations,. Learn how to recover vat as input tax in uae based on the decree law and executive regulations.