Trades With Due Bills Meaning - A due bill represents the obligation of a seller to make payment to the buyer of the. A due bill adjusts transactions to reflect dividends, interest, stock splits, and. A due bill is a statement showing money or securities owed. A due bill is basically a promissory note that goes virtually with the stock to ensure the right person gets paid the dividend. Delivery of the securities must be accompanied by a due bill.

A due bill adjusts transactions to reflect dividends, interest, stock splits, and. A due bill is basically a promissory note that goes virtually with the stock to ensure the right person gets paid the dividend. A due bill represents the obligation of a seller to make payment to the buyer of the. A due bill is a statement showing money or securities owed. Delivery of the securities must be accompanied by a due bill.

A due bill adjusts transactions to reflect dividends, interest, stock splits, and. A due bill is a statement showing money or securities owed. Delivery of the securities must be accompanied by a due bill. A due bill is basically a promissory note that goes virtually with the stock to ensure the right person gets paid the dividend. A due bill represents the obligation of a seller to make payment to the buyer of the.

Definition of DueBills r/finance

A due bill represents the obligation of a seller to make payment to the buyer of the. Delivery of the securities must be accompanied by a due bill. A due bill adjusts transactions to reflect dividends, interest, stock splits, and. A due bill is a statement showing money or securities owed. A due bill is basically a promissory note that.

Bill of Lading meaning and types used in Global Trade (2024)

A due bill is a statement showing money or securities owed. Delivery of the securities must be accompanied by a due bill. A due bill is basically a promissory note that goes virtually with the stock to ensure the right person gets paid the dividend. A due bill adjusts transactions to reflect dividends, interest, stock splits, and. A due bill.

Billing Cycle Definition, Types, Length, & Examples

A due bill represents the obligation of a seller to make payment to the buyer of the. A due bill is a statement showing money or securities owed. Delivery of the securities must be accompanied by a due bill. A due bill is basically a promissory note that goes virtually with the stock to ensure the right person gets paid.

Due Bill Period What it Means, How it Works, Canadian Initiative

Delivery of the securities must be accompanied by a due bill. A due bill is a statement showing money or securities owed. A due bill represents the obligation of a seller to make payment to the buyer of the. A due bill is basically a promissory note that goes virtually with the stock to ensure the right person gets paid.

Category Due Bills BPI Custom Printing

A due bill represents the obligation of a seller to make payment to the buyer of the. A due bill adjusts transactions to reflect dividends, interest, stock splits, and. Delivery of the securities must be accompanied by a due bill. A due bill is basically a promissory note that goes virtually with the stock to ensure the right person gets.

Bill Of Lading

A due bill is basically a promissory note that goes virtually with the stock to ensure the right person gets paid the dividend. Delivery of the securities must be accompanied by a due bill. A due bill represents the obligation of a seller to make payment to the buyer of the. A due bill adjusts transactions to reflect dividends, interest,.

Invoices Folder Indicating Due Bills 3d Rendering Stock Photo Alamy

A due bill is a statement showing money or securities owed. A due bill represents the obligation of a seller to make payment to the buyer of the. Delivery of the securities must be accompanied by a due bill. A due bill is basically a promissory note that goes virtually with the stock to ensure the right person gets paid.

Trade Finance Compliance Due Diligence And Risk Management Procedures

A due bill represents the obligation of a seller to make payment to the buyer of the. A due bill is a statement showing money or securities owed. A due bill is basically a promissory note that goes virtually with the stock to ensure the right person gets paid the dividend. Delivery of the securities must be accompanied by a.

Due Bill Period Definition, Examples, and Importance SuperMoney

Delivery of the securities must be accompanied by a due bill. A due bill adjusts transactions to reflect dividends, interest, stock splits, and. A due bill is a statement showing money or securities owed. A due bill represents the obligation of a seller to make payment to the buyer of the. A due bill is basically a promissory note that.

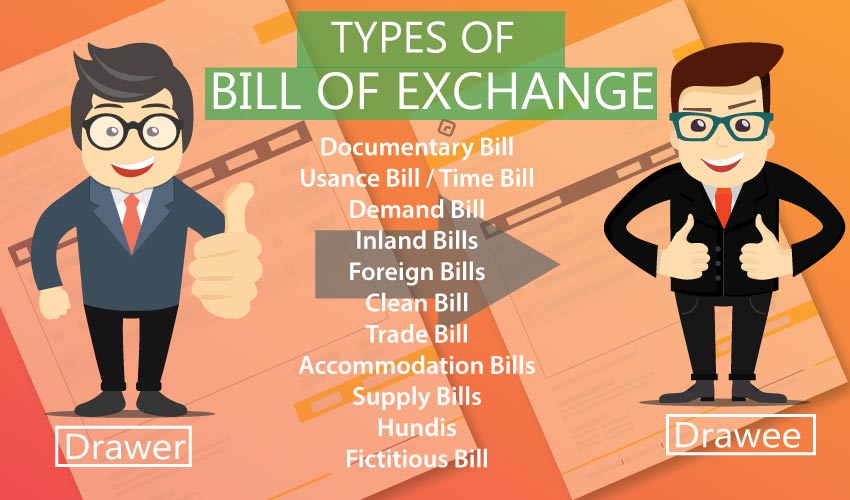

Business & Economics Types

Delivery of the securities must be accompanied by a due bill. A due bill adjusts transactions to reflect dividends, interest, stock splits, and. A due bill represents the obligation of a seller to make payment to the buyer of the. A due bill is a statement showing money or securities owed. A due bill is basically a promissory note that.

A Due Bill Is Basically A Promissory Note That Goes Virtually With The Stock To Ensure The Right Person Gets Paid The Dividend.

A due bill represents the obligation of a seller to make payment to the buyer of the. Delivery of the securities must be accompanied by a due bill. A due bill adjusts transactions to reflect dividends, interest, stock splits, and. A due bill is a statement showing money or securities owed.

:max_bytes(150000):strip_icc():format(webp)/Bill-of-Lading-aa8fd78edd1c4c0b831659a00a3980b3.jpg)