Stamp Duty For Service Contract Malaysia - Understanding the applicable stamp duty when entering an agreement/contract enables you to anticipate the fees involved. Understanding stamp duty in malaysia is crucial for property transactions and loan agreements. The assessment and collection of stamp duties is. The person liable to pay stamp duty is set out in the third schedule of stamp act 1949. On july 3, 2025, malaysia’s inland revenue board (lhdn) released an official faq to clarify the mandatory stamp duty requirement.

The assessment and collection of stamp duties is. On july 3, 2025, malaysia’s inland revenue board (lhdn) released an official faq to clarify the mandatory stamp duty requirement. The person liable to pay stamp duty is set out in the third schedule of stamp act 1949. Understanding the applicable stamp duty when entering an agreement/contract enables you to anticipate the fees involved. Understanding stamp duty in malaysia is crucial for property transactions and loan agreements.

The assessment and collection of stamp duties is. Understanding stamp duty in malaysia is crucial for property transactions and loan agreements. On july 3, 2025, malaysia’s inland revenue board (lhdn) released an official faq to clarify the mandatory stamp duty requirement. The person liable to pay stamp duty is set out in the third schedule of stamp act 1949. Understanding the applicable stamp duty when entering an agreement/contract enables you to anticipate the fees involved.

Malaysian Tax Law Stamp Duty Lexology

On july 3, 2025, malaysia’s inland revenue board (lhdn) released an official faq to clarify the mandatory stamp duty requirement. The assessment and collection of stamp duties is. Understanding the applicable stamp duty when entering an agreement/contract enables you to anticipate the fees involved. Understanding stamp duty in malaysia is crucial for property transactions and loan agreements. The person liable.

Malaysian Tax Law Stamp Duty Lexology

The person liable to pay stamp duty is set out in the third schedule of stamp act 1949. The assessment and collection of stamp duties is. On july 3, 2025, malaysia’s inland revenue board (lhdn) released an official faq to clarify the mandatory stamp duty requirement. Understanding stamp duty in malaysia is crucial for property transactions and loan agreements. Understanding.

【房地产如何做】EP06计算印花税 第六步 Stamp Duty calculation formula 投资房产

Understanding stamp duty in malaysia is crucial for property transactions and loan agreements. The assessment and collection of stamp duties is. On july 3, 2025, malaysia’s inland revenue board (lhdn) released an official faq to clarify the mandatory stamp duty requirement. Understanding the applicable stamp duty when entering an agreement/contract enables you to anticipate the fees involved. The person liable.

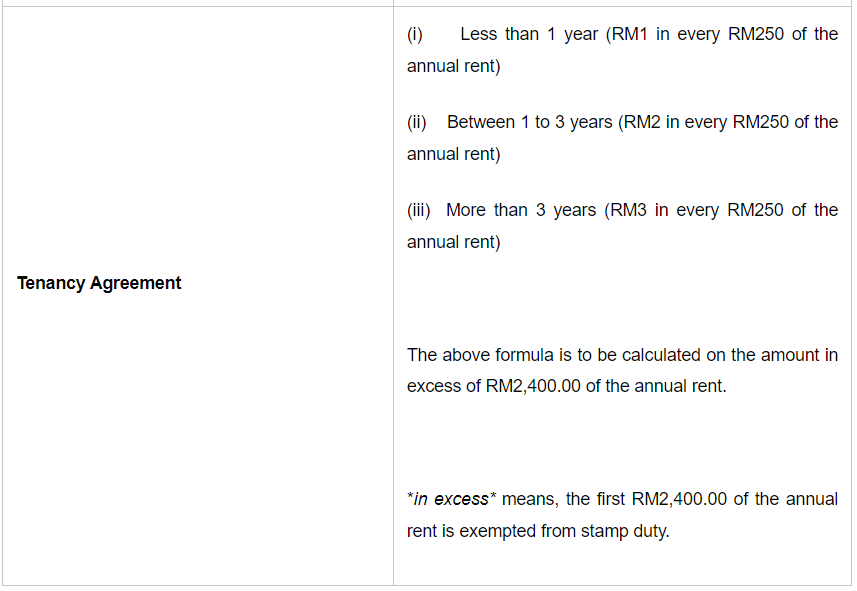

Tenancy Agreement Stamp Duty Calculation

On july 3, 2025, malaysia’s inland revenue board (lhdn) released an official faq to clarify the mandatory stamp duty requirement. Understanding the applicable stamp duty when entering an agreement/contract enables you to anticipate the fees involved. The person liable to pay stamp duty is set out in the third schedule of stamp act 1949. Understanding stamp duty in malaysia is.

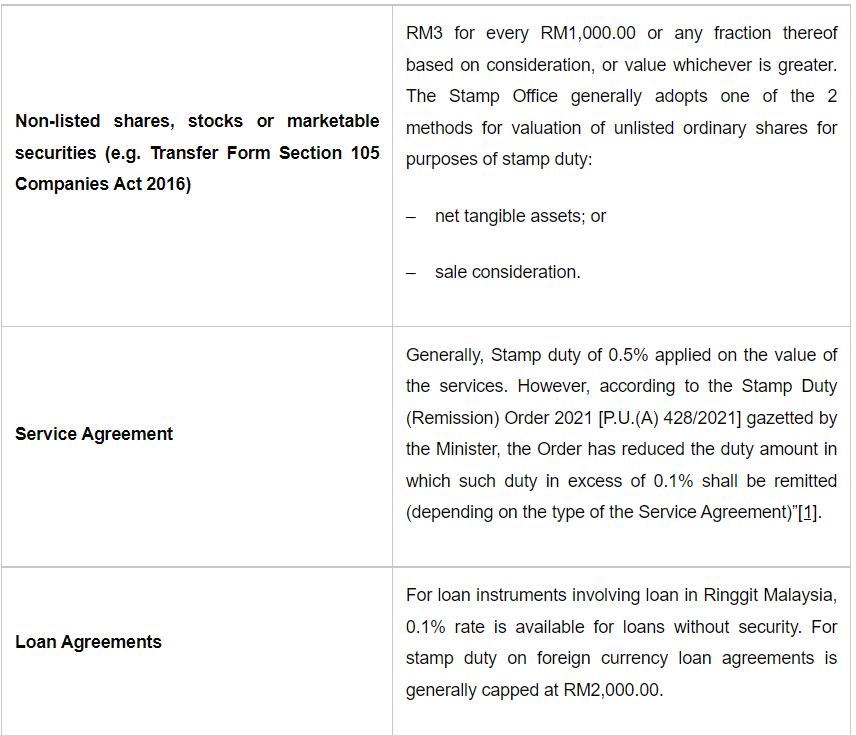

stamp duty on contract agreement malaysia

The person liable to pay stamp duty is set out in the third schedule of stamp act 1949. Understanding the applicable stamp duty when entering an agreement/contract enables you to anticipate the fees involved. On july 3, 2025, malaysia’s inland revenue board (lhdn) released an official faq to clarify the mandatory stamp duty requirement. Understanding stamp duty in malaysia is.

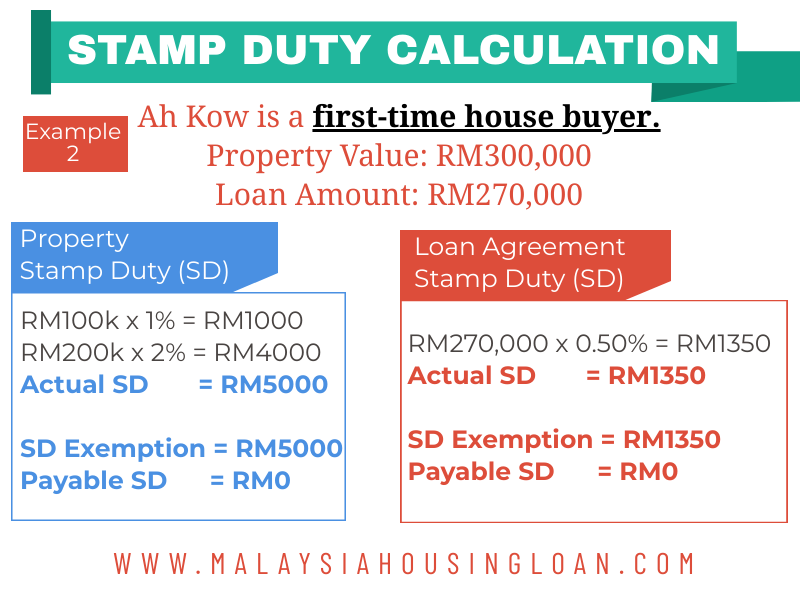

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Understanding the applicable stamp duty when entering an agreement/contract enables you to anticipate the fees involved. On july 3, 2025, malaysia’s inland revenue board (lhdn) released an official faq to clarify the mandatory stamp duty requirement. The person liable to pay stamp duty is set out in the third schedule of stamp act 1949. The assessment and collection of stamp.

stamp duty act malaysia Nathan Hudson

Understanding the applicable stamp duty when entering an agreement/contract enables you to anticipate the fees involved. The assessment and collection of stamp duties is. Understanding stamp duty in malaysia is crucial for property transactions and loan agreements. On july 3, 2025, malaysia’s inland revenue board (lhdn) released an official faq to clarify the mandatory stamp duty requirement. The person liable.

stamping tenancy agreement malaysia Adam Terry

On july 3, 2025, malaysia’s inland revenue board (lhdn) released an official faq to clarify the mandatory stamp duty requirement. The assessment and collection of stamp duties is. Understanding stamp duty in malaysia is crucial for property transactions and loan agreements. Understanding the applicable stamp duty when entering an agreement/contract enables you to anticipate the fees involved. The person liable.

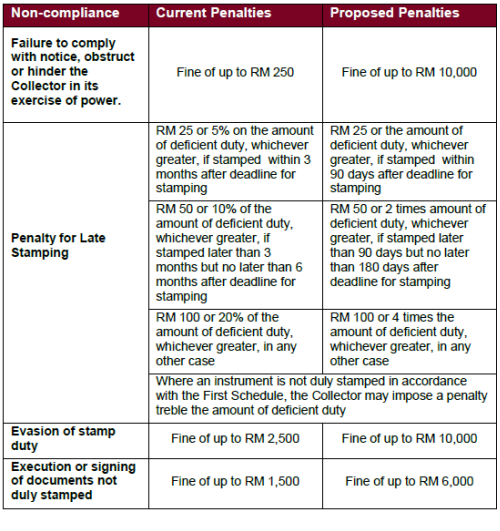

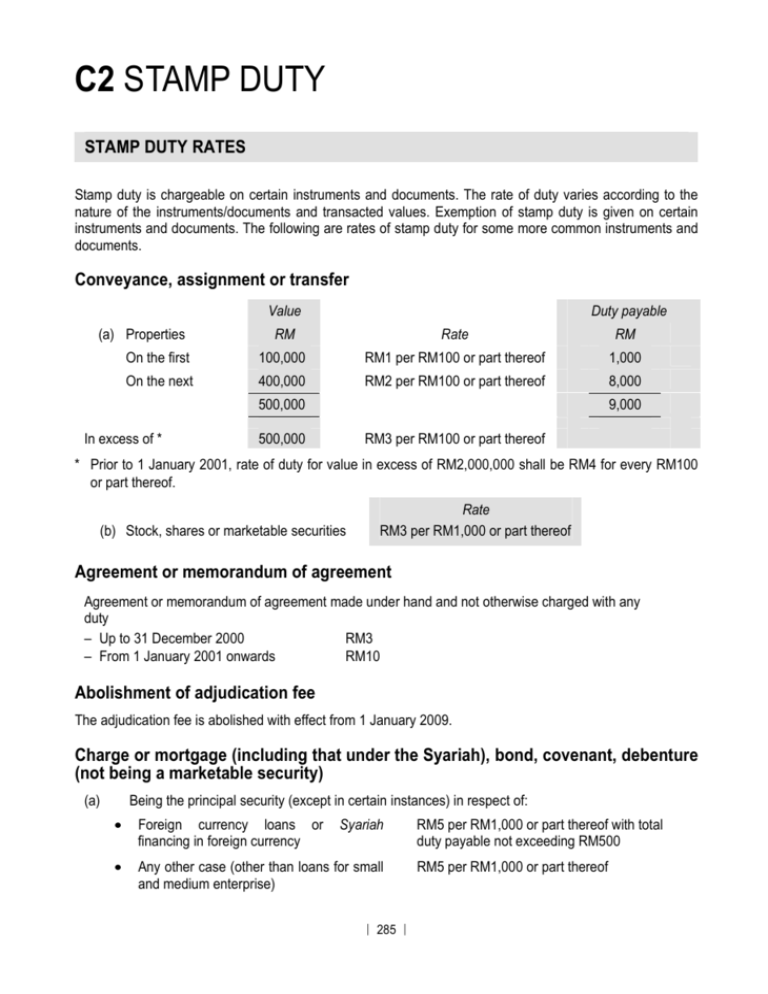

Malaysia Stamp Duty Rates & Regulations

Understanding stamp duty in malaysia is crucial for property transactions and loan agreements. The assessment and collection of stamp duties is. The person liable to pay stamp duty is set out in the third schedule of stamp act 1949. On july 3, 2025, malaysia’s inland revenue board (lhdn) released an official faq to clarify the mandatory stamp duty requirement. Understanding.

What to Remember About Stamp Duty in Malaysia

The assessment and collection of stamp duties is. The person liable to pay stamp duty is set out in the third schedule of stamp act 1949. Understanding the applicable stamp duty when entering an agreement/contract enables you to anticipate the fees involved. On july 3, 2025, malaysia’s inland revenue board (lhdn) released an official faq to clarify the mandatory stamp.

On July 3, 2025, Malaysia’s Inland Revenue Board (Lhdn) Released An Official Faq To Clarify The Mandatory Stamp Duty Requirement.

The assessment and collection of stamp duties is. Understanding the applicable stamp duty when entering an agreement/contract enables you to anticipate the fees involved. The person liable to pay stamp duty is set out in the third schedule of stamp act 1949. Understanding stamp duty in malaysia is crucial for property transactions and loan agreements.