Schedule C Worksheet 2024 - It is important that the information you provide is summarized in the categories that are indicated on schedule c. Net profit or (loss) buildings and machinery sold outright (no trades): I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. Please complete this form and.

Please complete this form and. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. It is important that the information you provide is summarized in the categories that are indicated on schedule c. I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. Net profit or (loss) buildings and machinery sold outright (no trades):

It is important that the information you provide is summarized in the categories that are indicated on schedule c. I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. Net profit or (loss) buildings and machinery sold outright (no trades): Please complete this form and. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule.

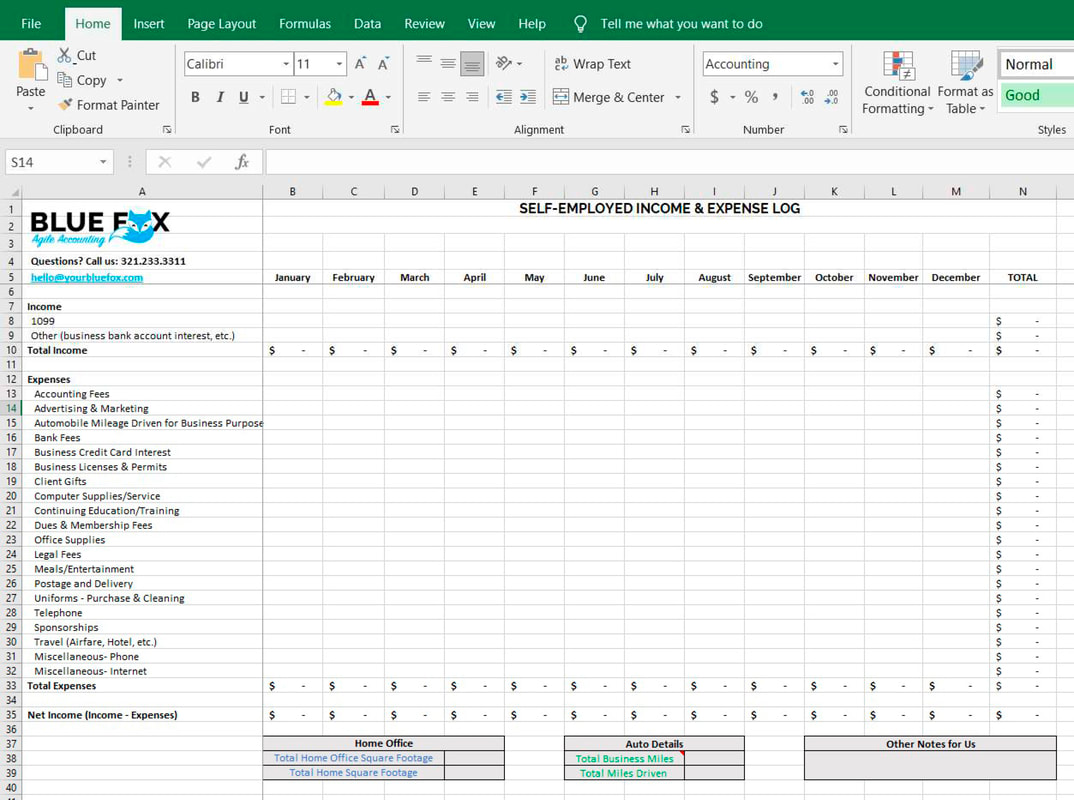

Schedule C Worksheet 2024 Form Grata Karlene

I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. Net profit or (loss) buildings and machinery sold outright (no trades): It is important that the information you provide is summarized in.

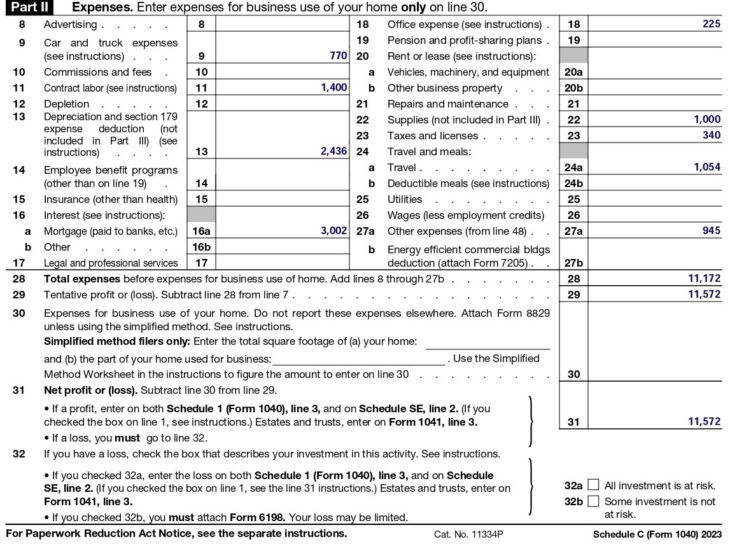

Irs Fillable Forms 2024 Schedule C Penny Blondell

Net profit or (loss) buildings and machinery sold outright (no trades): I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. It is important that the information you provide is summarized in.

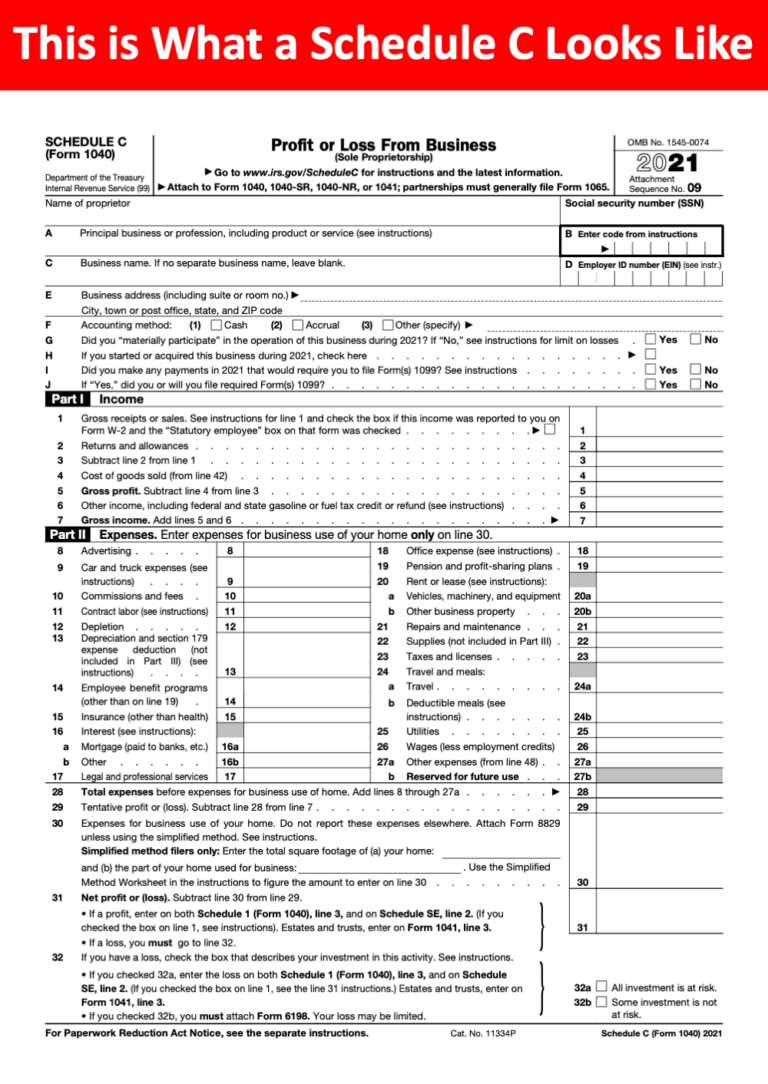

Schedule C Printable Form

Please complete this form and. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. It is important that the information you provide is summarized in the categories that are indicated on schedule c. Net profit or (loss) buildings and machinery sold outright (no trades): I hereby verify that the.

How To Fill Out Schedule C in 2024 (With Example)

I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. Please complete this form and. It is important that the information you provide is summarized in the categories that are indicated on.

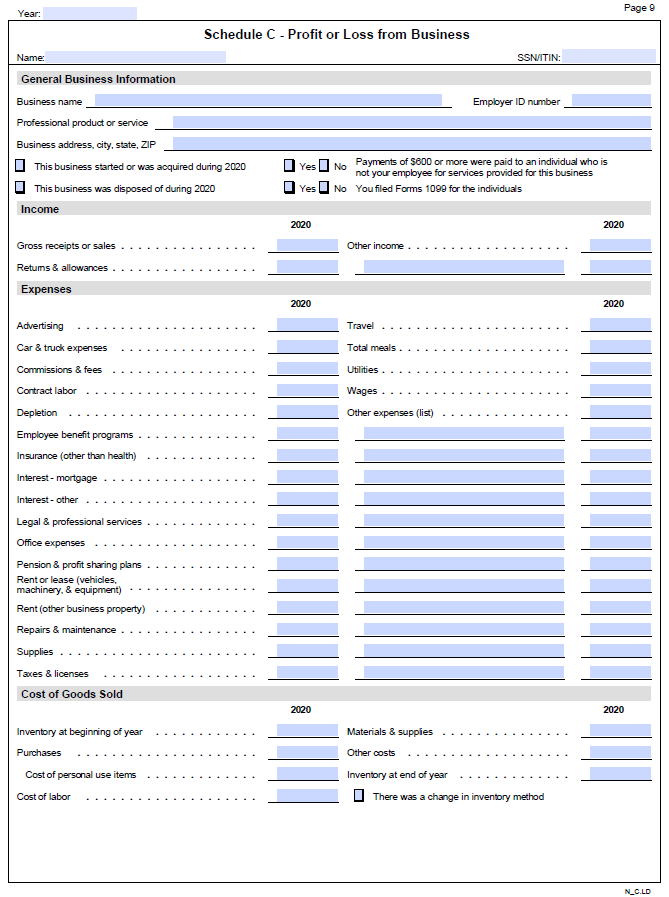

2024 Schedule C Form Orel Tracey

It is important that the information you provide is summarized in the categories that are indicated on schedule c. Net profit or (loss) buildings and machinery sold outright (no trades): I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. Please complete this form and. Schedule c worksheet for self employed businesses.

Irs Schedule C 2024 Tove Ainslie

I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. It is important that the information you provide is summarized in the categories that are indicated on schedule c. Net profit or (loss) buildings and machinery sold outright (no trades): Schedule c worksheet for self employed businesses and/or independent contractors irs requires.

Printable Schedule C Worksheet Free Printable Schedules

Please complete this form and. It is important that the information you provide is summarized in the categories that are indicated on schedule c. I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. Net profit or (loss) buildings and machinery sold outright (no trades): Schedule c worksheet for self employed businesses.

2024 Schedule C Form Maren Florentia

I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. Net profit or (loss) buildings and machinery sold outright (no trades): Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. Please complete this form and. It is important that the information.

Schedule C Deductions 2024 Form Nita Terese

Please complete this form and. It is important that the information you provide is summarized in the categories that are indicated on schedule c. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. I hereby verify that the income and expense information set forth on this worksheet is substantiated.

IRS Schedule C (Form 1040) Instructions 2024 Guide Excel Capital

It is important that the information you provide is summarized in the categories that are indicated on schedule c. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. Net profit or (loss) buildings and machinery sold outright (no trades): Please complete this form and. I hereby verify that the.

Schedule C Worksheet For Self Employed Businesses And/Or Independent Contractors Irs Requires We Have On File To Support All Schedule.

I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. It is important that the information you provide is summarized in the categories that are indicated on schedule c. Net profit or (loss) buildings and machinery sold outright (no trades): Please complete this form and.