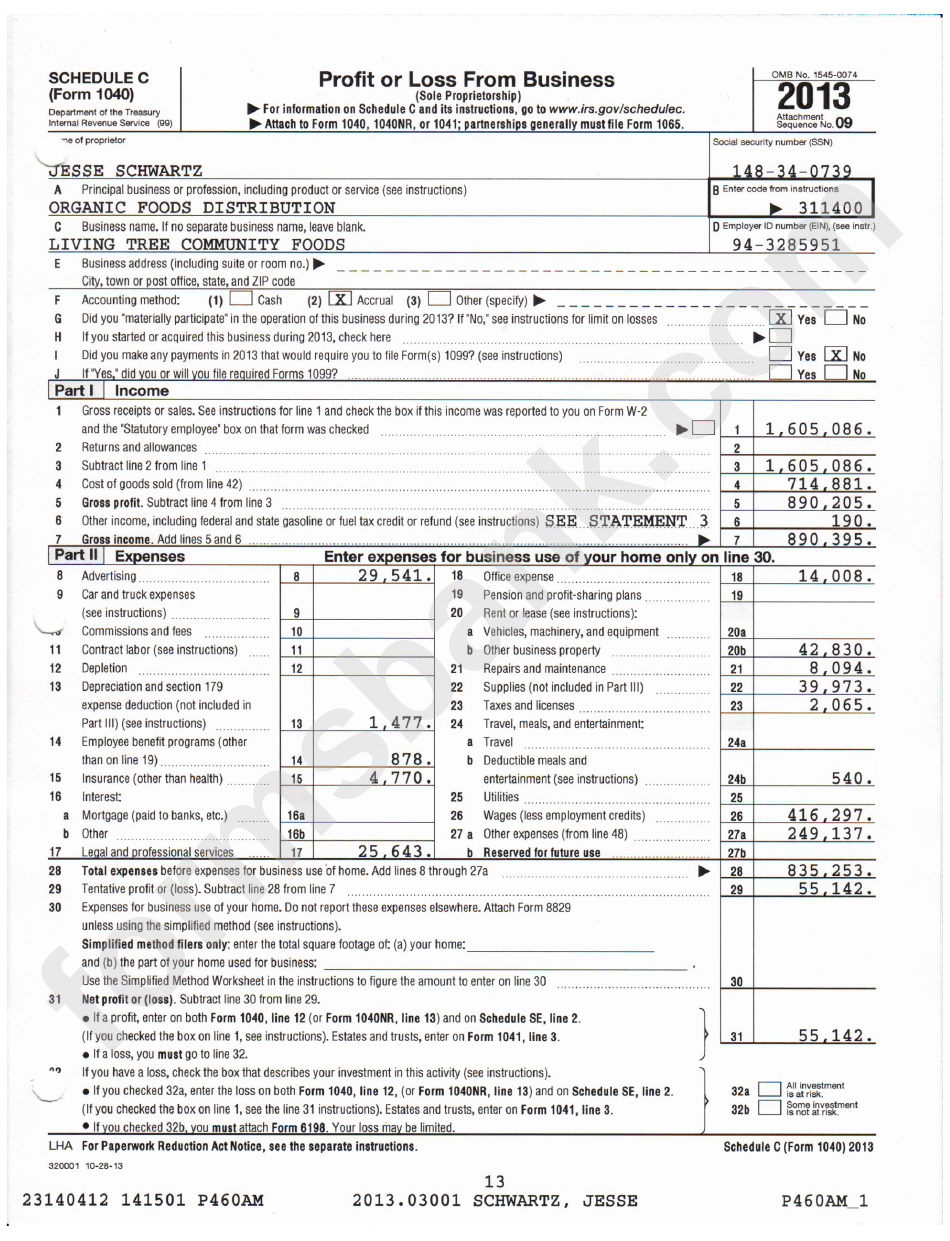

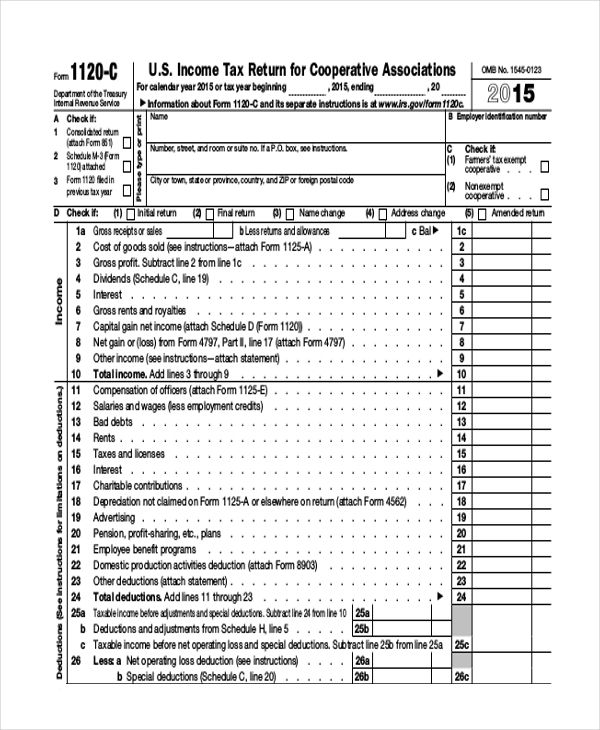

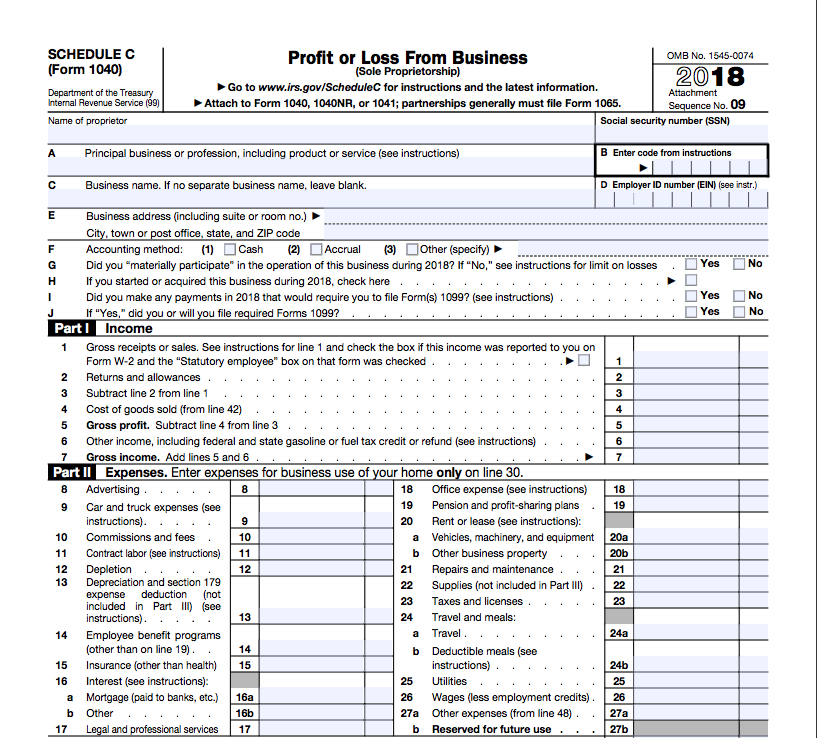

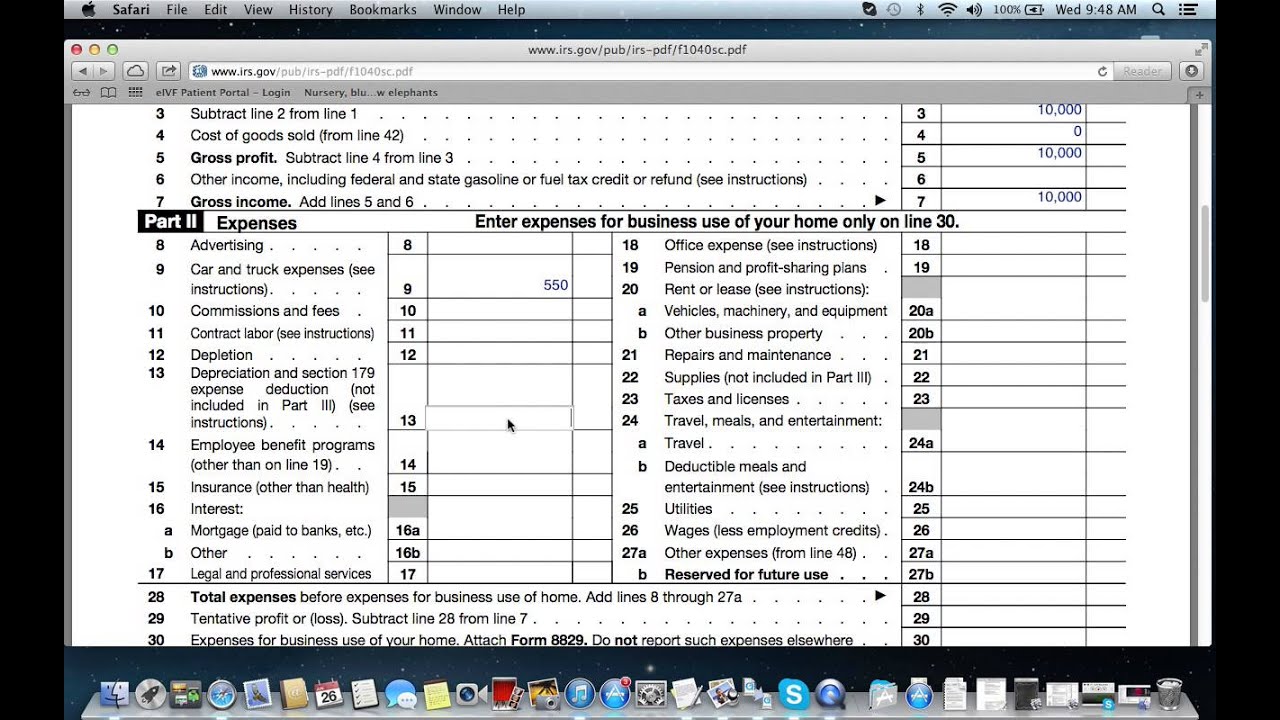

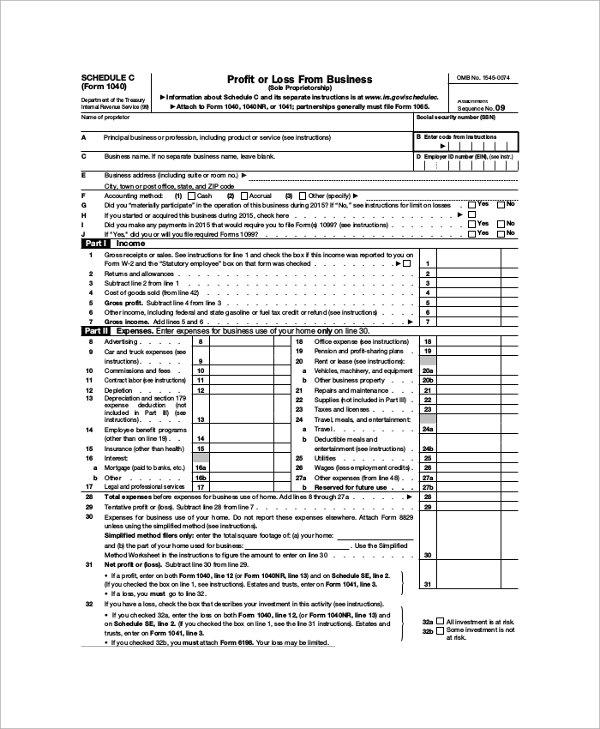

Schedule C Form Example - To complete schedule c for your small business taxes, you'll need your business income, costs of goods sold, and more. Here’s what the schedule c (form 1040) looks like: Go to www.irs.gov/schedulec for instructions and the latest information. What is schedule c form? The schedule c tax form, also known as the “profit or loss from business” form, is used by sole proprietors to report income or. A schedule c is a tax form to report your. If no separate business name, leave blank.

The schedule c tax form, also known as the “profit or loss from business” form, is used by sole proprietors to report income or. Here’s what the schedule c (form 1040) looks like: If no separate business name, leave blank. To complete schedule c for your small business taxes, you'll need your business income, costs of goods sold, and more. What is schedule c form? A schedule c is a tax form to report your. Go to www.irs.gov/schedulec for instructions and the latest information.

To complete schedule c for your small business taxes, you'll need your business income, costs of goods sold, and more. A schedule c is a tax form to report your. Go to www.irs.gov/schedulec for instructions and the latest information. What is schedule c form? If no separate business name, leave blank. Here’s what the schedule c (form 1040) looks like: The schedule c tax form, also known as the “profit or loss from business” form, is used by sole proprietors to report income or.

Free Printable Schedule C Tax Form

Here’s what the schedule c (form 1040) looks like: If no separate business name, leave blank. To complete schedule c for your small business taxes, you'll need your business income, costs of goods sold, and more. A schedule c is a tax form to report your. The schedule c tax form, also known as the “profit or loss from business”.

Free Printable Schedule C Tax Form

To complete schedule c for your small business taxes, you'll need your business income, costs of goods sold, and more. Go to www.irs.gov/schedulec for instructions and the latest information. Here’s what the schedule c (form 1040) looks like: If no separate business name, leave blank. A schedule c is a tax form to report your.

Calculate Schedule C Tax

If no separate business name, leave blank. A schedule c is a tax form to report your. Here’s what the schedule c (form 1040) looks like: What is schedule c form? Go to www.irs.gov/schedulec for instructions and the latest information.

Schedule C Form Template

Go to www.irs.gov/schedulec for instructions and the latest information. What is schedule c form? The schedule c tax form, also known as the “profit or loss from business” form, is used by sole proprietors to report income or. Here’s what the schedule c (form 1040) looks like: To complete schedule c for your small business taxes, you'll need your business.

Schedule C Instructions How to Fill Out Form 1040 Excel Capital

Here’s what the schedule c (form 1040) looks like: What is schedule c form? If no separate business name, leave blank. Go to www.irs.gov/schedulec for instructions and the latest information. The schedule c tax form, also known as the “profit or loss from business” form, is used by sole proprietors to report income or.

Schedule C What Is It, How To Fill, Example, Vs Schedule E

The schedule c tax form, also known as the “profit or loss from business” form, is used by sole proprietors to report income or. To complete schedule c for your small business taxes, you'll need your business income, costs of goods sold, and more. A schedule c is a tax form to report your. Go to www.irs.gov/schedulec for instructions and.

Schedule C Printable Guide

To complete schedule c for your small business taxes, you'll need your business income, costs of goods sold, and more. Go to www.irs.gov/schedulec for instructions and the latest information. The schedule c tax form, also known as the “profit or loss from business” form, is used by sole proprietors to report income or. What is schedule c form? If no.

How to Fill Out Your Schedule C Perfectly (With Examples!)

To complete schedule c for your small business taxes, you'll need your business income, costs of goods sold, and more. If no separate business name, leave blank. Go to www.irs.gov/schedulec for instructions and the latest information. A schedule c is a tax form to report your. The schedule c tax form, also known as the “profit or loss from business”.

Irs Form 1040 Schedule C 2025 Michael Harris

Here’s what the schedule c (form 1040) looks like: If no separate business name, leave blank. Go to www.irs.gov/schedulec for instructions and the latest information. To complete schedule c for your small business taxes, you'll need your business income, costs of goods sold, and more. A schedule c is a tax form to report your.

Schedule C What Is It, How To Fill, Example, Vs Schedule E

To complete schedule c for your small business taxes, you'll need your business income, costs of goods sold, and more. If no separate business name, leave blank. Go to www.irs.gov/schedulec for instructions and the latest information. What is schedule c form? Here’s what the schedule c (form 1040) looks like:

If No Separate Business Name, Leave Blank.

To complete schedule c for your small business taxes, you'll need your business income, costs of goods sold, and more. A schedule c is a tax form to report your. The schedule c tax form, also known as the “profit or loss from business” form, is used by sole proprietors to report income or. Here’s what the schedule c (form 1040) looks like:

What Is Schedule C Form?

Go to www.irs.gov/schedulec for instructions and the latest information.

:max_bytes(150000):strip_icc()/ScheduleC-ProfitorLossfromBusiness-1-2b9fe42e669342c783bbaae69e570415.png)