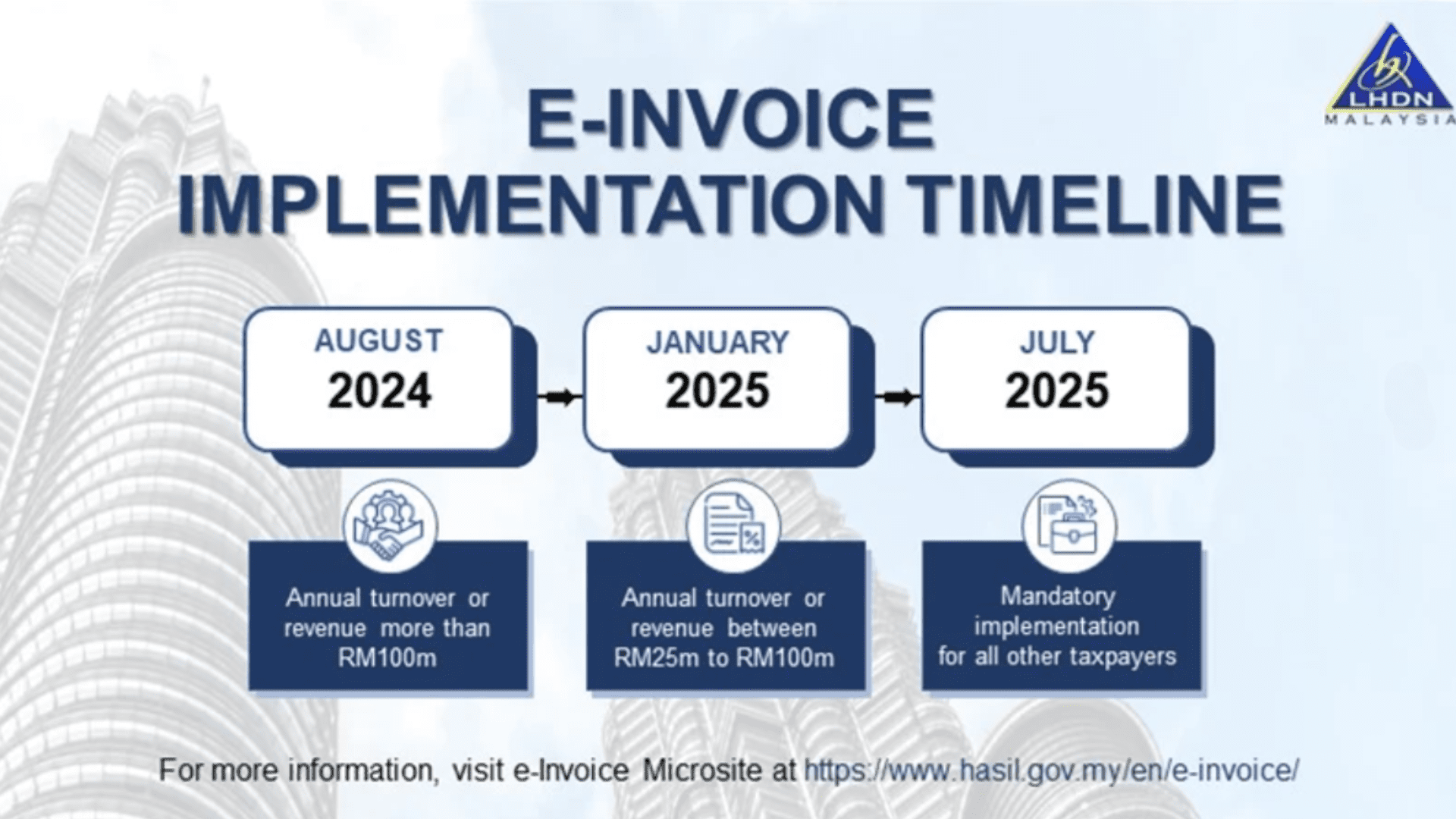

Latest E Invoice Implementation Date Malaysia - Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026. Update as of 6 june 2025: This guide explains the phased implementation timeline, starting august 2024. Lhdn has introduced a phased implementation plan based on annual.

Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026. Lhdn has introduced a phased implementation plan based on annual. This guide explains the phased implementation timeline, starting august 2024. Update as of 6 june 2025:

Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026. This guide explains the phased implementation timeline, starting august 2024. Update as of 6 june 2025: Lhdn has introduced a phased implementation plan based on annual.

eInvois HASiL Info Lembaga Hasil Dalam Negeri Malaysia

Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026. Update as of 6 june 2025: This guide explains the phased implementation timeline, starting august 2024. Lhdn has introduced a phased implementation plan based on annual.

Malaysia E Invoicing 2024 Magda Roselle

Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026. Lhdn has introduced a phased implementation plan based on annual. Update as of 6 june 2025: This guide explains the phased implementation timeline, starting august 2024.

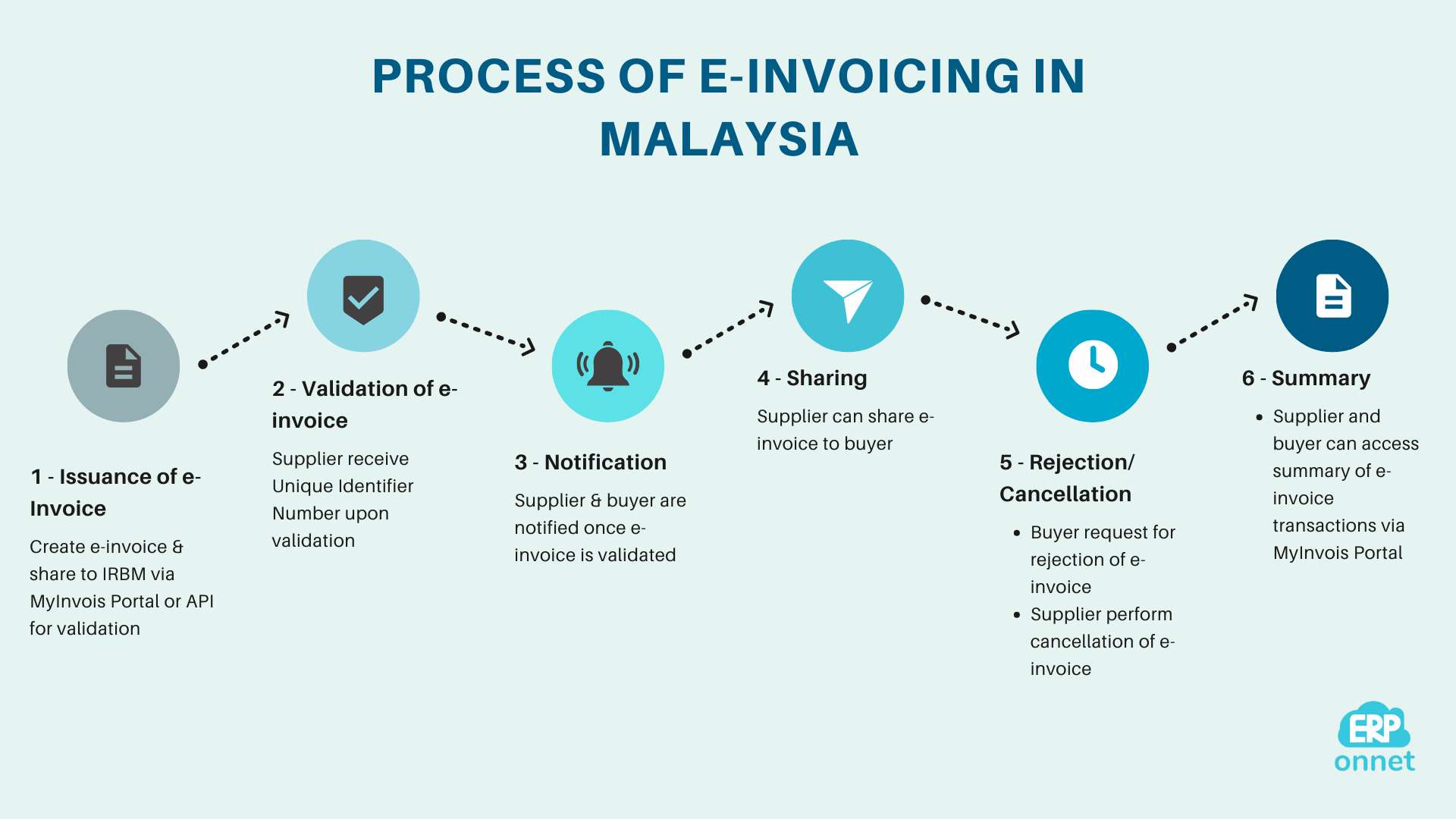

EInvoicing in Malaysia Transformation’s Next Frontier

Update as of 6 june 2025: This guide explains the phased implementation timeline, starting august 2024. Lhdn has introduced a phased implementation plan based on annual. Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026.

Navigating EInvoice Regulations IRB Malaysia's 2023 Guidelines

Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026. Update as of 6 june 2025: Lhdn has introduced a phased implementation plan based on annual. This guide explains the phased implementation timeline, starting august 2024.

Malaysia LHDN eInvoice Guidelines 50 QnA L & Co Accountants

Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026. This guide explains the phased implementation timeline, starting august 2024. Lhdn has introduced a phased implementation plan based on annual. Update as of 6 june 2025:

Adapting to EInvoicing A New Era for Malaysian Businesses SiteGiant

Lhdn has introduced a phased implementation plan based on annual. This guide explains the phased implementation timeline, starting august 2024. Update as of 6 june 2025: Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026.

eInvoice Malaysia Latest Implementation Updates 2025 YYC taxPOD

This guide explains the phased implementation timeline, starting august 2024. Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026. Update as of 6 june 2025: Lhdn has introduced a phased implementation plan based on annual.

eInvoicing in Malaysia What You Need to Know (2024 Guide)

This guide explains the phased implementation timeline, starting august 2024. Update as of 6 june 2025: Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026. Lhdn has introduced a phased implementation plan based on annual.

National EInvoicing Initiative My Software Solutions

Update as of 6 june 2025: Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026. Lhdn has introduced a phased implementation plan based on annual. This guide explains the phased implementation timeline, starting august 2024.

Pelaksanaan eInvois di Malaysia Apa maksudnya

Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026. This guide explains the phased implementation timeline, starting august 2024. Update as of 6 june 2025: Lhdn has introduced a phased implementation plan based on annual.

Implementation For Those With Annual Income Or Sales Up To Rm1 Million Will Be Deferred To 1 July 2026.

Lhdn has introduced a phased implementation plan based on annual. This guide explains the phased implementation timeline, starting august 2024. Update as of 6 june 2025: