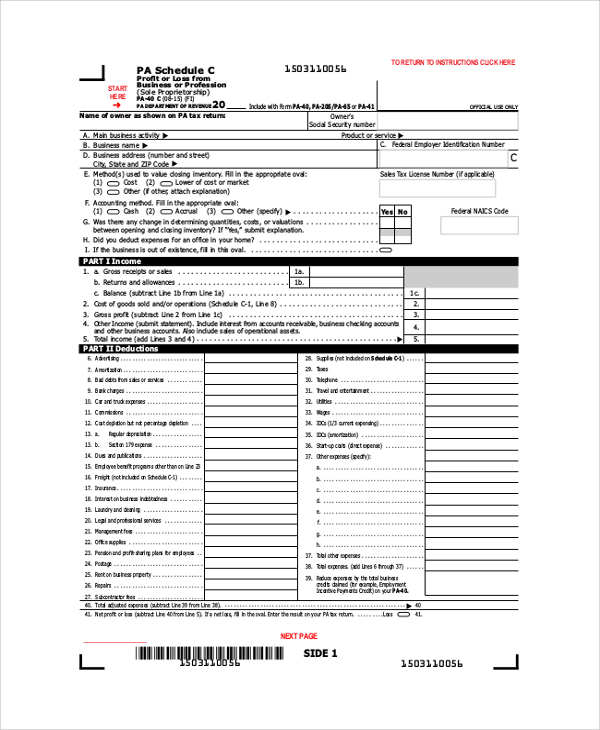

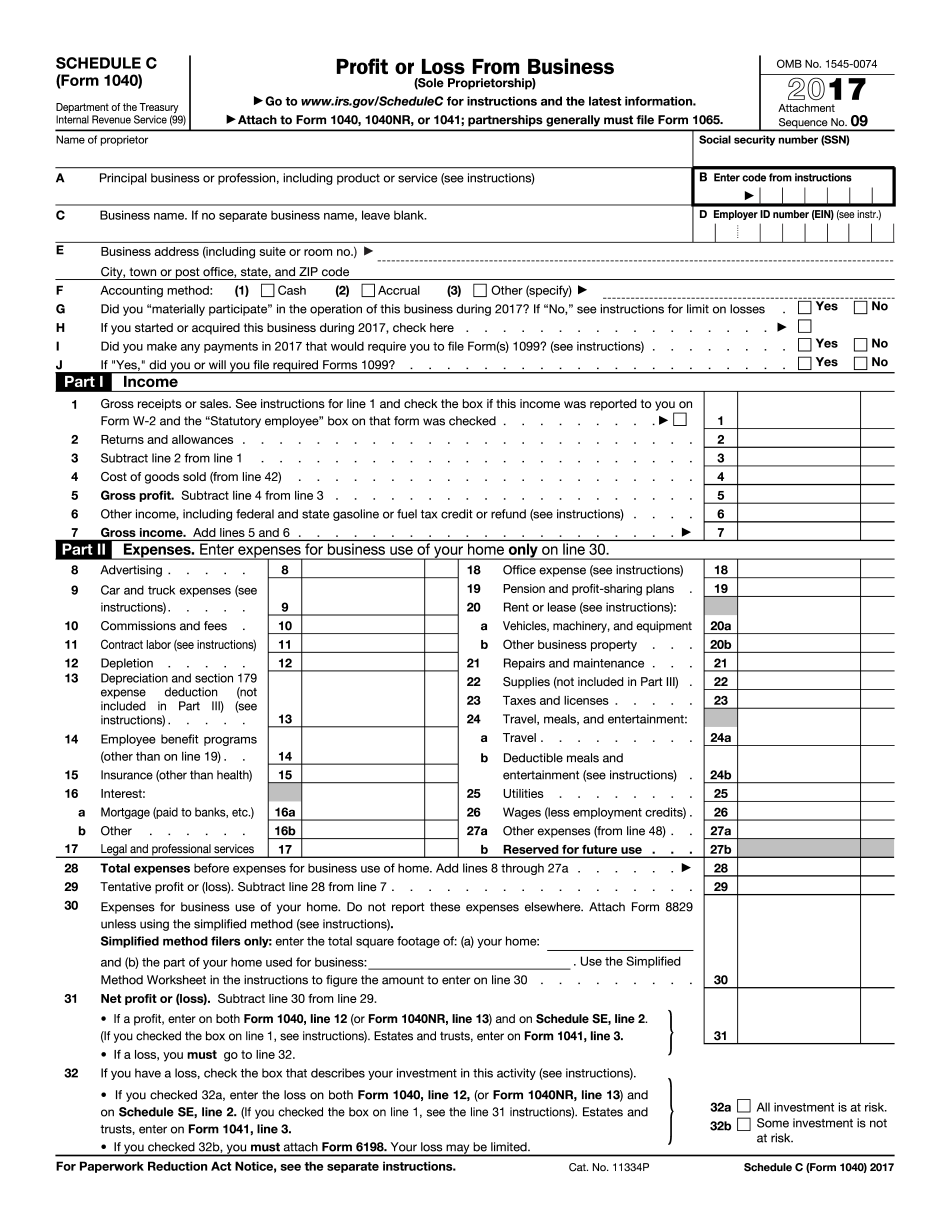

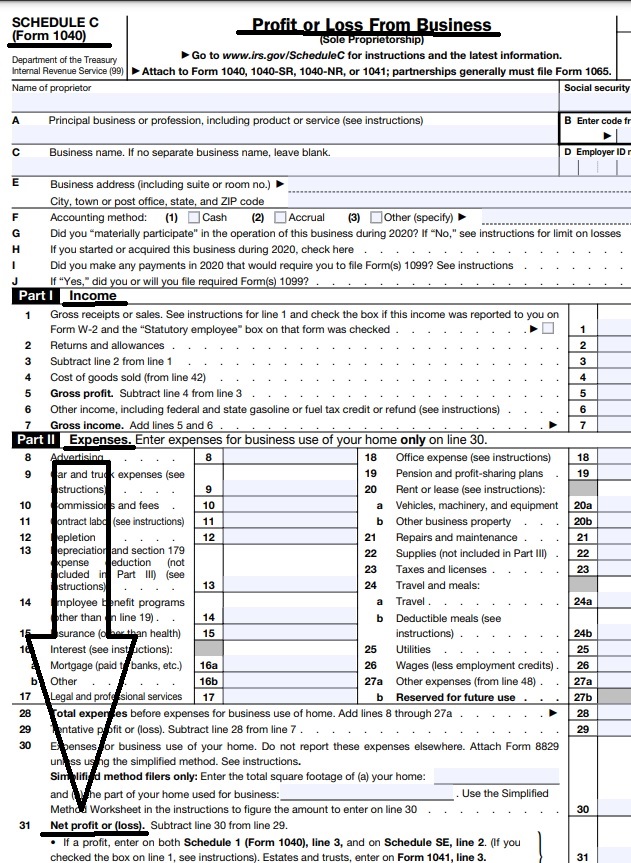

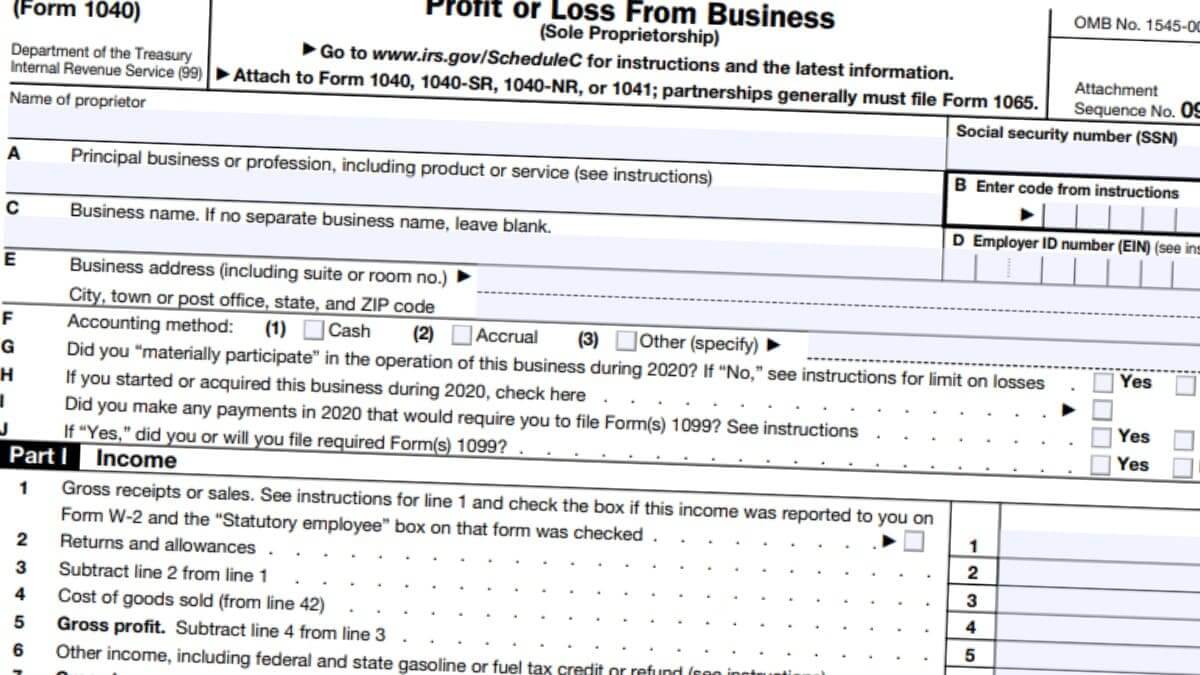

Fillable Schedule C Tax Form 2024 - Download or print the 2024 federal 1040 (schedule c) (profit or loss from business (sole proprietorship)) for free from the federal. If no separate business name, leave blank. The 2024 1040 schedule c is a tax form used by the irs to report the profit or loss from a business operated by a sole proprietor. Go to www.irs.gov/schedulec for instructions and the latest information. 51business income (schedule c) (cont.) Download or print the 2024 federal (profit or loss from business (sole proprietorship)) (2024) and other income tax forms from the federal.

If no separate business name, leave blank. Download or print the 2024 federal (profit or loss from business (sole proprietorship)) (2024) and other income tax forms from the federal. 51business income (schedule c) (cont.) Go to www.irs.gov/schedulec for instructions and the latest information. The 2024 1040 schedule c is a tax form used by the irs to report the profit or loss from a business operated by a sole proprietor. Download or print the 2024 federal 1040 (schedule c) (profit or loss from business (sole proprietorship)) for free from the federal.

If no separate business name, leave blank. Download or print the 2024 federal (profit or loss from business (sole proprietorship)) (2024) and other income tax forms from the federal. 51business income (schedule c) (cont.) Go to www.irs.gov/schedulec for instructions and the latest information. Download or print the 2024 federal 1040 (schedule c) (profit or loss from business (sole proprietorship)) for free from the federal. The 2024 1040 schedule c is a tax form used by the irs to report the profit or loss from a business operated by a sole proprietor.

2024 Schedule C Form Orel Tracey

Download or print the 2024 federal 1040 (schedule c) (profit or loss from business (sole proprietorship)) for free from the federal. The 2024 1040 schedule c is a tax form used by the irs to report the profit or loss from a business operated by a sole proprietor. Go to www.irs.gov/schedulec for instructions and the latest information. If no separate.

2024 Form IRS 1040 Schedule C Fill Online, Printable, Fillable, Blank

51business income (schedule c) (cont.) Go to www.irs.gov/schedulec for instructions and the latest information. If no separate business name, leave blank. Download or print the 2024 federal (profit or loss from business (sole proprietorship)) (2024) and other income tax forms from the federal. The 2024 1040 schedule c is a tax form used by the irs to report the profit.

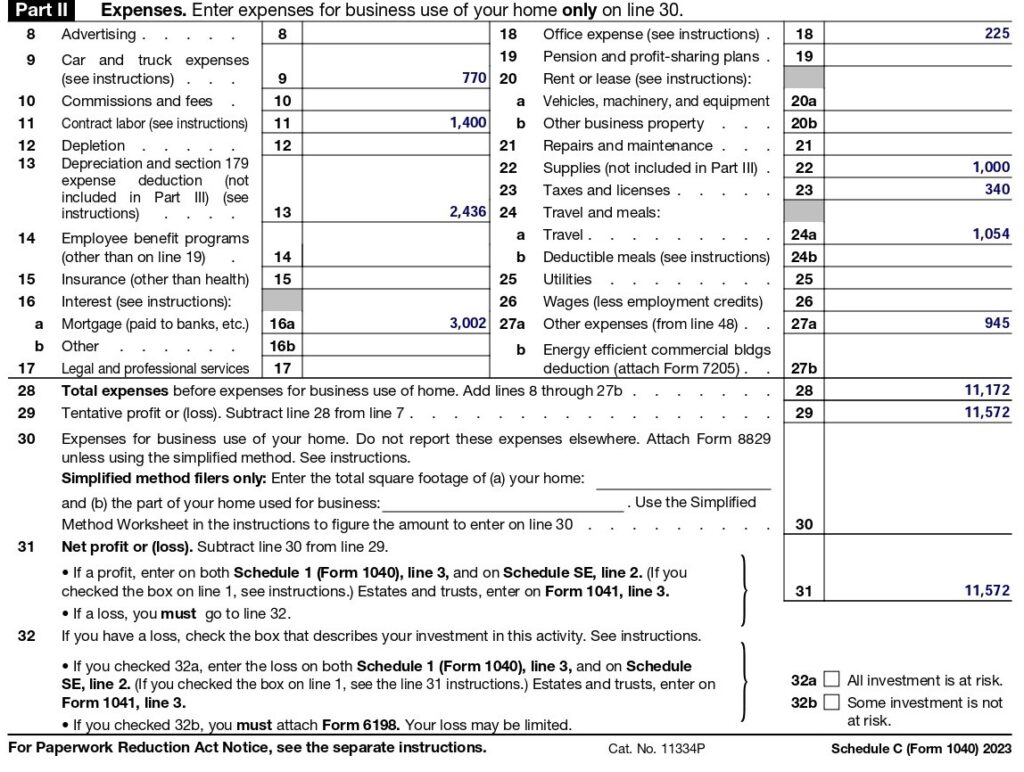

IRS Schedule C (Form 1040) Instructions 2024 Guide Excel Capital

The 2024 1040 schedule c is a tax form used by the irs to report the profit or loss from a business operated by a sole proprietor. If no separate business name, leave blank. 51business income (schedule c) (cont.) Download or print the 2024 federal 1040 (schedule c) (profit or loss from business (sole proprietorship)) for free from the federal..

Irs Fillable Forms 2024 Schedule C Micki Stormie

The 2024 1040 schedule c is a tax form used by the irs to report the profit or loss from a business operated by a sole proprietor. Download or print the 2024 federal 1040 (schedule c) (profit or loss from business (sole proprietorship)) for free from the federal. Download or print the 2024 federal (profit or loss from business (sole.

How To Fill Out Schedule C in 2024 (With Example)

51business income (schedule c) (cont.) If no separate business name, leave blank. Go to www.irs.gov/schedulec for instructions and the latest information. Download or print the 2024 federal (profit or loss from business (sole proprietorship)) (2024) and other income tax forms from the federal. The 2024 1040 schedule c is a tax form used by the irs to report the profit.

Irs Fillable Forms 2024 Schedule C Penny Blondell

The 2024 1040 schedule c is a tax form used by the irs to report the profit or loss from a business operated by a sole proprietor. Go to www.irs.gov/schedulec for instructions and the latest information. 51business income (schedule c) (cont.) If no separate business name, leave blank. Download or print the 2024 federal (profit or loss from business (sole.

2024 Schedule C Form Maren Florentia

Go to www.irs.gov/schedulec for instructions and the latest information. The 2024 1040 schedule c is a tax form used by the irs to report the profit or loss from a business operated by a sole proprietor. 51business income (schedule c) (cont.) If no separate business name, leave blank. Download or print the 2024 federal 1040 (schedule c) (profit or loss.

Schedule C Instructions 2024 Instructions Ivett Letisha

Download or print the 2024 federal 1040 (schedule c) (profit or loss from business (sole proprietorship)) for free from the federal. If no separate business name, leave blank. 51business income (schedule c) (cont.) Go to www.irs.gov/schedulec for instructions and the latest information. Download or print the 2024 federal (profit or loss from business (sole proprietorship)) (2024) and other income tax.

2024 Irs Schedule C 2024 Calendar Template Excel

Download or print the 2024 federal (profit or loss from business (sole proprietorship)) (2024) and other income tax forms from the federal. The 2024 1040 schedule c is a tax form used by the irs to report the profit or loss from a business operated by a sole proprietor. 51business income (schedule c) (cont.) Go to www.irs.gov/schedulec for instructions and.

2024 Schedule C Form Tine Stephenie

Go to www.irs.gov/schedulec for instructions and the latest information. The 2024 1040 schedule c is a tax form used by the irs to report the profit or loss from a business operated by a sole proprietor. 51business income (schedule c) (cont.) If no separate business name, leave blank. Download or print the 2024 federal (profit or loss from business (sole.

51Business Income (Schedule C) (Cont.)

Download or print the 2024 federal (profit or loss from business (sole proprietorship)) (2024) and other income tax forms from the federal. Download or print the 2024 federal 1040 (schedule c) (profit or loss from business (sole proprietorship)) for free from the federal. If no separate business name, leave blank. Go to www.irs.gov/schedulec for instructions and the latest information.