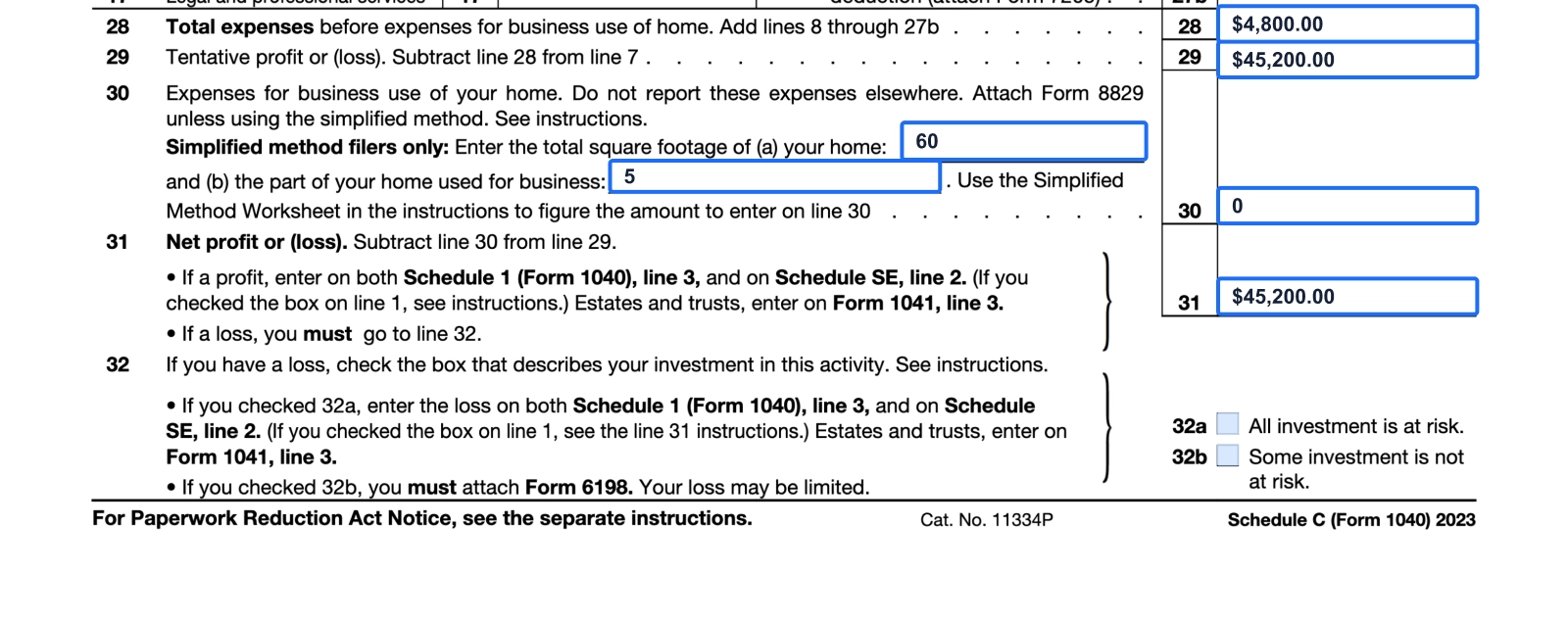

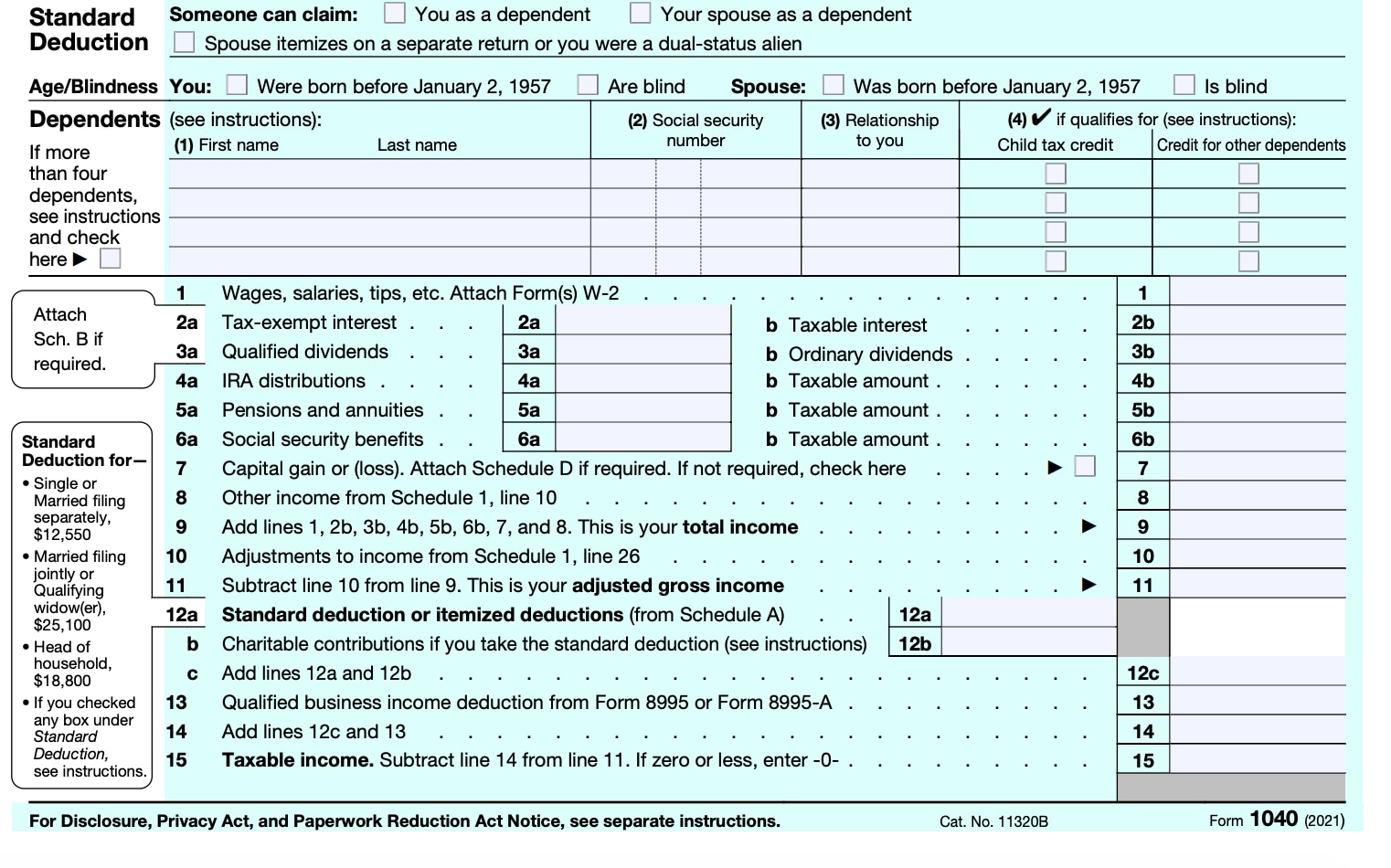

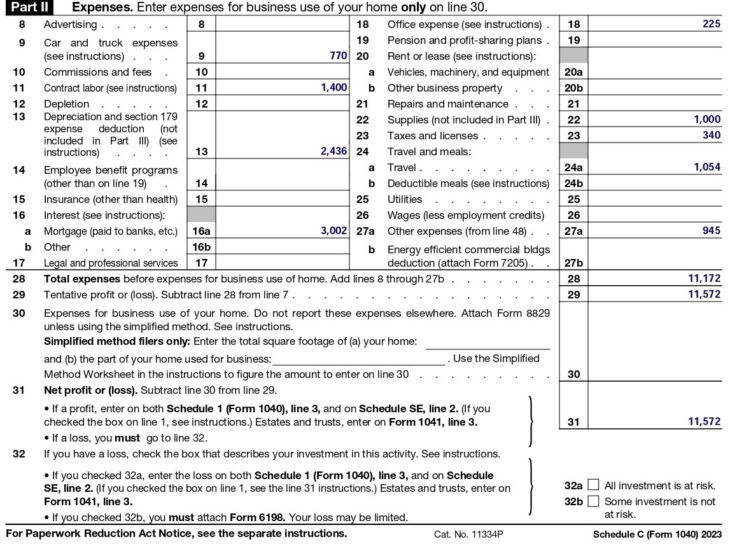

Fillable Schedule C Form 1040 2024 - The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. If no separate business name, leave blank. Go to www.irs.gov/schedulec for instructions and the latest information. 51business income (schedule c) (cont.)

The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. Go to www.irs.gov/schedulec for instructions and the latest information. 51business income (schedule c) (cont.) If no separate business name, leave blank.

The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. Go to www.irs.gov/schedulec for instructions and the latest information. If no separate business name, leave blank. 51business income (schedule c) (cont.)

Taxes Schedule C Form 1040 (20242025) PDFliner

Go to www.irs.gov/schedulec for instructions and the latest information. 51business income (schedule c) (cont.) The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. If no separate business name, leave blank.

Schedule C Tax Form 2024 Libbi Roseanne

51business income (schedule c) (cont.) Go to www.irs.gov/schedulec for instructions and the latest information. The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. If no separate business name, leave blank.

1040 form 2024 Fill out & sign online DocHub

If no separate business name, leave blank. The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. 51business income (schedule c) (cont.) Go to www.irs.gov/schedulec for instructions and the latest information.

Schedule C Form 1040 For 2024 Tax nike laurena

The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. Go to www.irs.gov/schedulec for instructions and the latest information. 51business income (schedule c) (cont.) If no separate business name, leave blank.

Irs 2024 Form 1040 Schedule C Tasha Fredelia

51business income (schedule c) (cont.) Go to www.irs.gov/schedulec for instructions and the latest information. The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. If no separate business name, leave blank.

2024 Irs Schedule C 2024 Calendar Template Excel

If no separate business name, leave blank. Go to www.irs.gov/schedulec for instructions and the latest information. The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. 51business income (schedule c) (cont.)

2024 Form 1040 Schedule C Ez Glen Philly

Go to www.irs.gov/schedulec for instructions and the latest information. The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. If no separate business name, leave blank. 51business income (schedule c) (cont.)

How To Fill Out Schedule C in 2024 (With Example)

51business income (schedule c) (cont.) If no separate business name, leave blank. The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. Go to www.irs.gov/schedulec for instructions and the latest information.

Irs Fillable Forms 2024 Schedule C Penny Blondell

51business income (schedule c) (cont.) The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. If no separate business name, leave blank. Go to www.irs.gov/schedulec for instructions and the latest information.

IRS Schedule C (Form 1040) Instructions 2024 Guide Excel Capital

Go to www.irs.gov/schedulec for instructions and the latest information. If no separate business name, leave blank. 51business income (schedule c) (cont.) The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole.

The 2024 Form 1040 Schedule C Profit Or Loss From Business (Sole Proprietorship) Is Used To Report The Income And Expenses Of A Sole.

Go to www.irs.gov/schedulec for instructions and the latest information. 51business income (schedule c) (cont.) If no separate business name, leave blank.