Excel Business Mileage Tracker - The mileage log and expense report template in excel makes it easy to record your mileage, calculate related costs, and organize business. In this article, we will discuss the benefits. Our free mileage log templates will enable you to comply with all irs regulations, thus allowing you to legally and conveniently deduct business. Mileage log is used to trace or schedule how many miles a vehicle has traveled in a specific or assigned period of time. To simplify this task, we have created a free 2025 mileage log template that you can download and use.

In this article, we will discuss the benefits. To simplify this task, we have created a free 2025 mileage log template that you can download and use. Our free mileage log templates will enable you to comply with all irs regulations, thus allowing you to legally and conveniently deduct business. The mileage log and expense report template in excel makes it easy to record your mileage, calculate related costs, and organize business. Mileage log is used to trace or schedule how many miles a vehicle has traveled in a specific or assigned period of time.

Our free mileage log templates will enable you to comply with all irs regulations, thus allowing you to legally and conveniently deduct business. To simplify this task, we have created a free 2025 mileage log template that you can download and use. The mileage log and expense report template in excel makes it easy to record your mileage, calculate related costs, and organize business. Mileage log is used to trace or schedule how many miles a vehicle has traveled in a specific or assigned period of time. In this article, we will discuss the benefits.

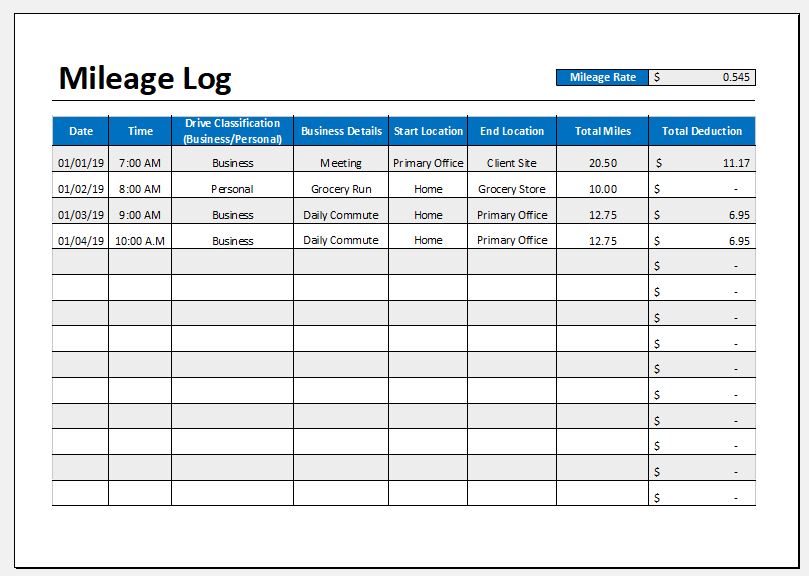

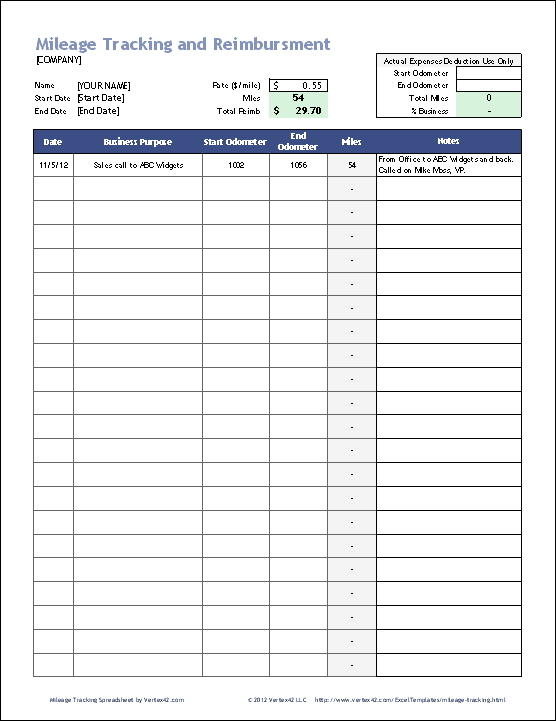

Microsoft Excel Mileage Log Template

Mileage log is used to trace or schedule how many miles a vehicle has traveled in a specific or assigned period of time. To simplify this task, we have created a free 2025 mileage log template that you can download and use. Our free mileage log templates will enable you to comply with all irs regulations, thus allowing you to.

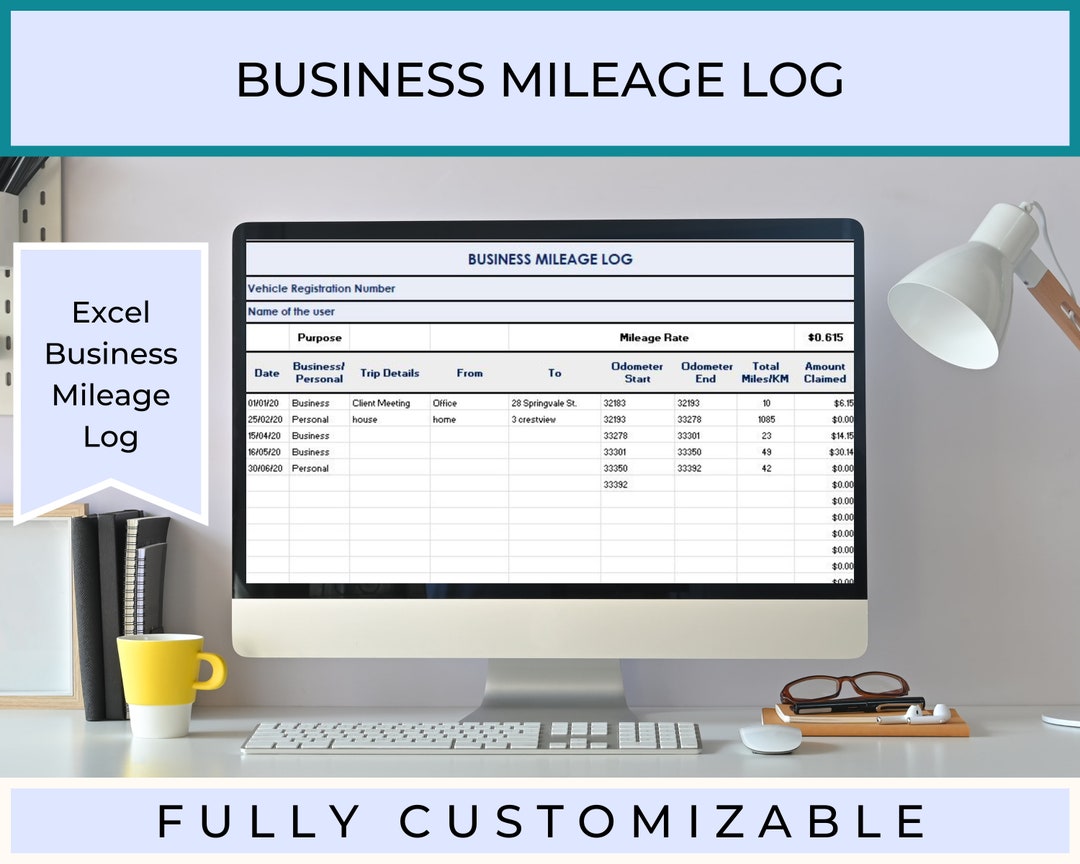

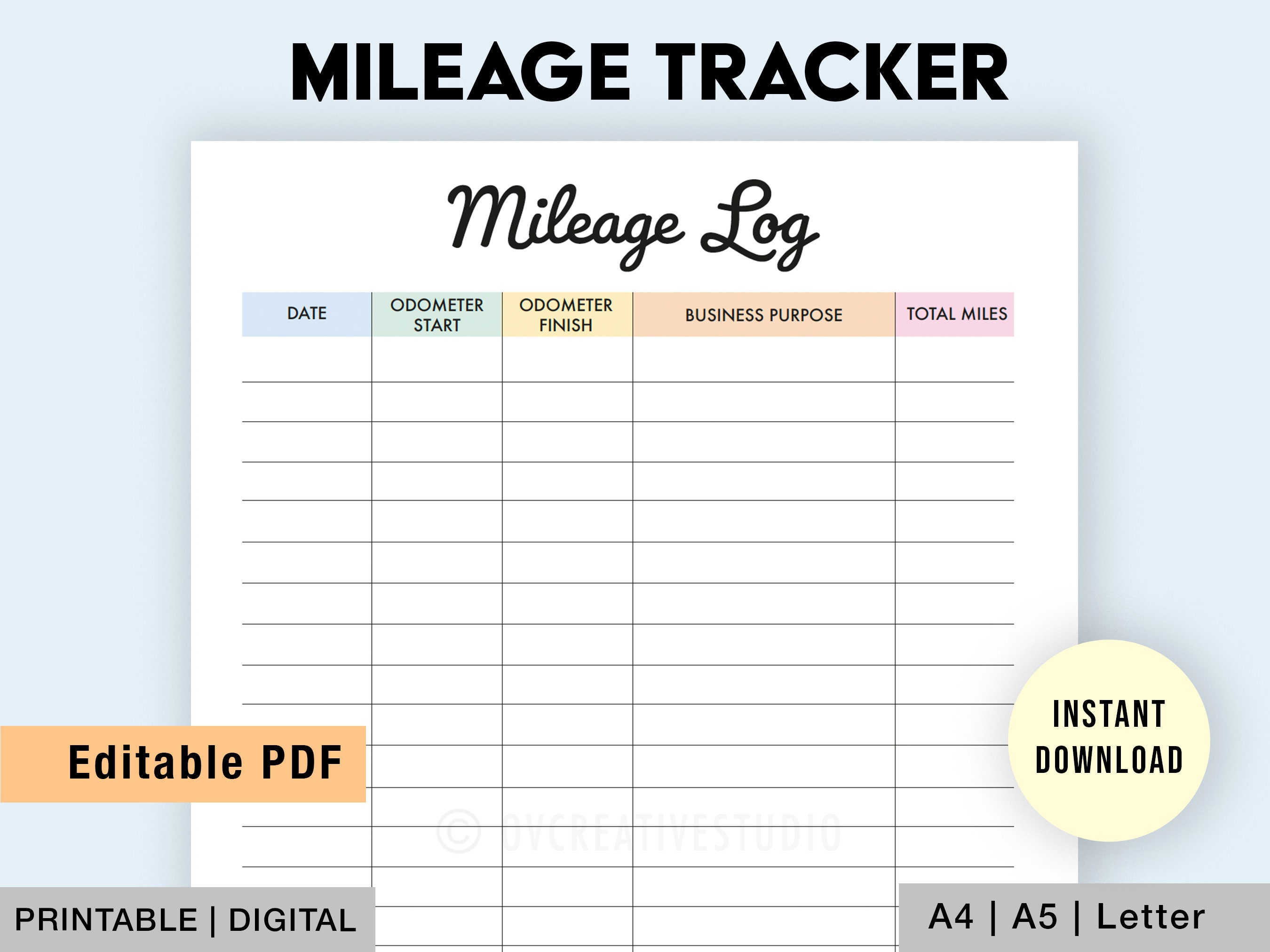

Business Mileage Excel Log for Small Business, Driving Mileage Tracker

Our free mileage log templates will enable you to comply with all irs regulations, thus allowing you to legally and conveniently deduct business. In this article, we will discuss the benefits. To simplify this task, we have created a free 2025 mileage log template that you can download and use. The mileage log and expense report template in excel makes.

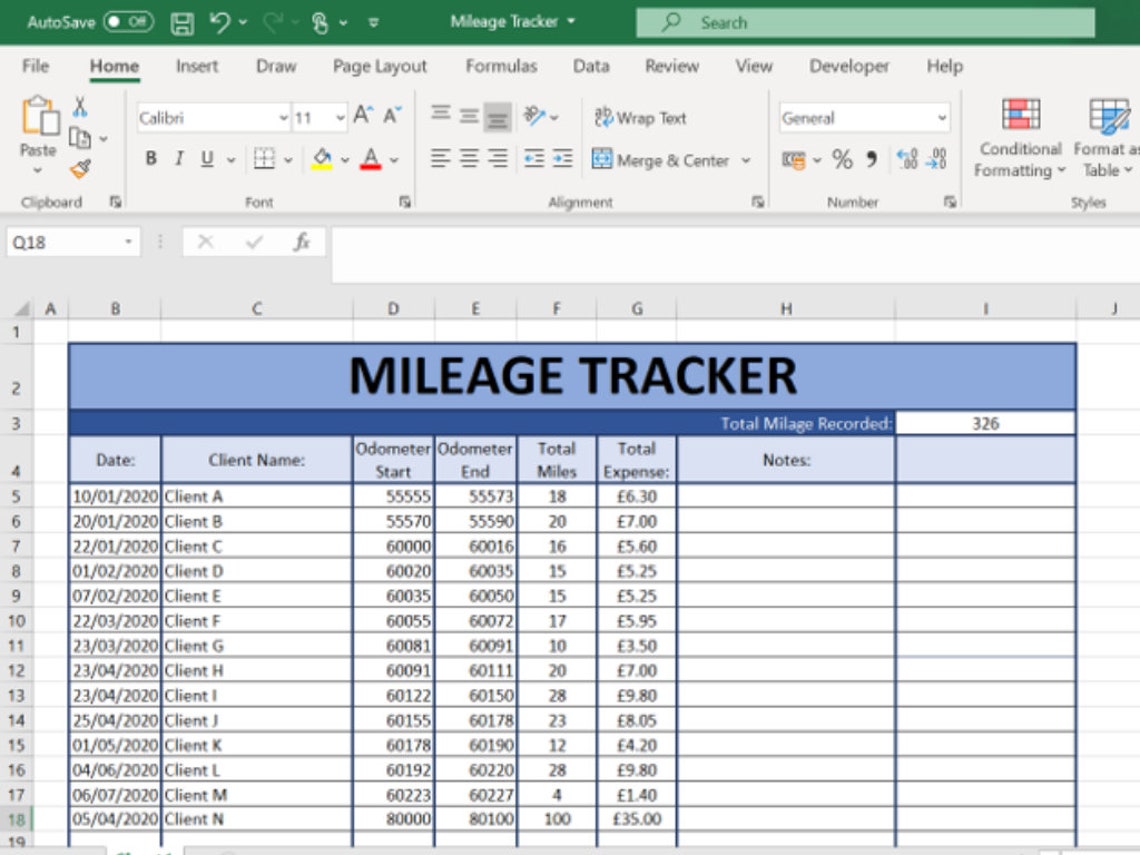

Microsoft Excel Mileage Log Template

Mileage log is used to trace or schedule how many miles a vehicle has traveled in a specific or assigned period of time. The mileage log and expense report template in excel makes it easy to record your mileage, calculate related costs, and organize business. To simplify this task, we have created a free 2025 mileage log template that you.

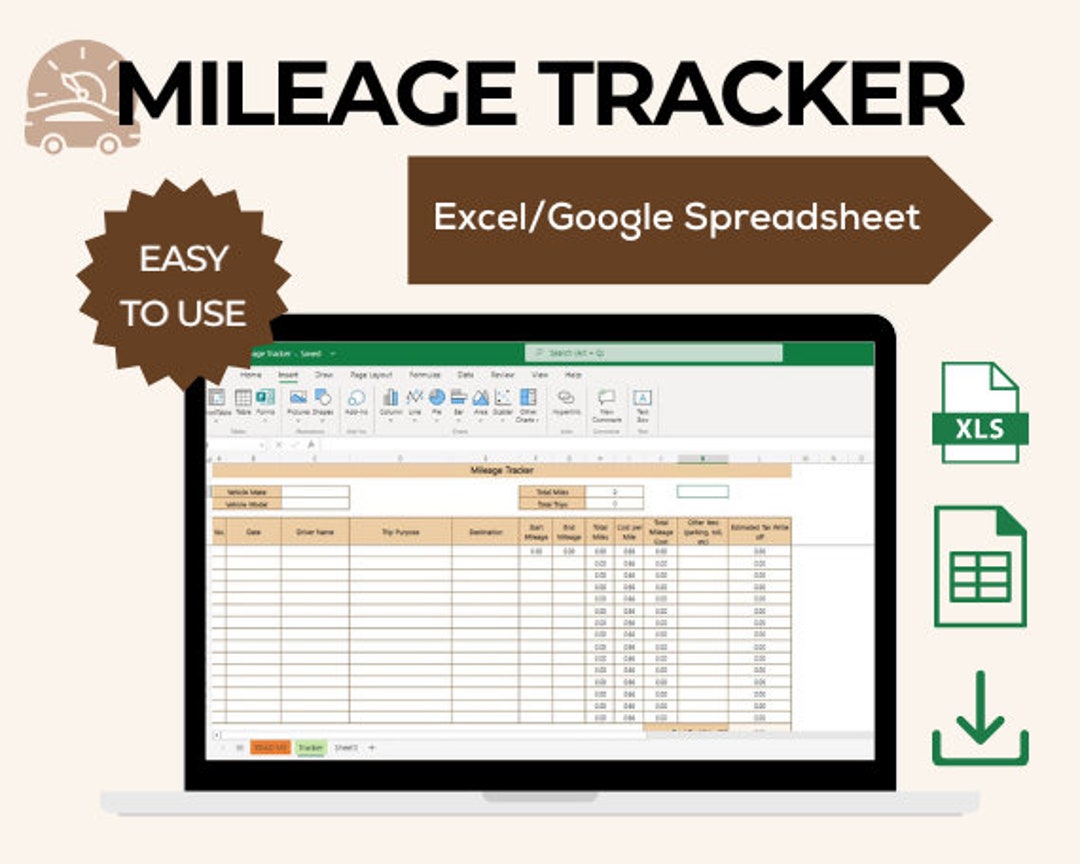

Excel Mileage Tracker Template

To simplify this task, we have created a free 2025 mileage log template that you can download and use. Our free mileage log templates will enable you to comply with all irs regulations, thus allowing you to legally and conveniently deduct business. Mileage log is used to trace or schedule how many miles a vehicle has traveled in a specific.

Business Mileage Log Tracker Calculator Excel Template, Spreadsheet for

To simplify this task, we have created a free 2025 mileage log template that you can download and use. Our free mileage log templates will enable you to comply with all irs regulations, thus allowing you to legally and conveniently deduct business. In this article, we will discuss the benefits. Mileage log is used to trace or schedule how many.

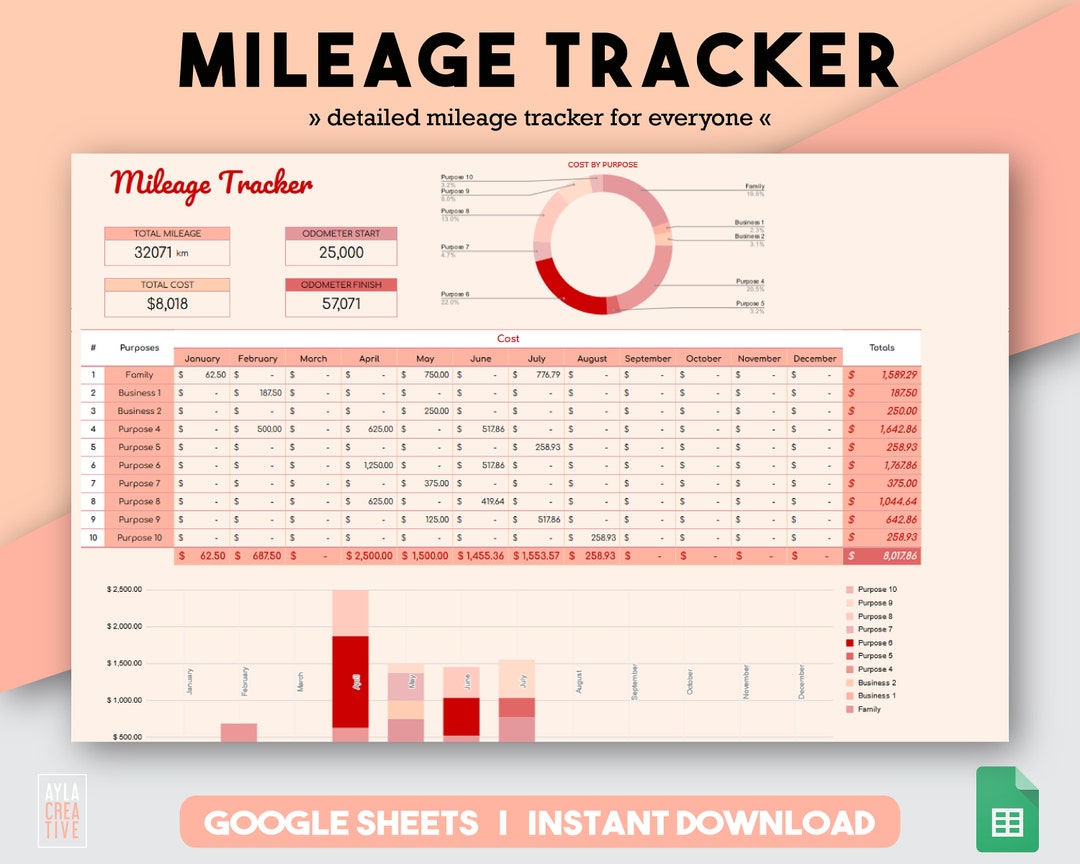

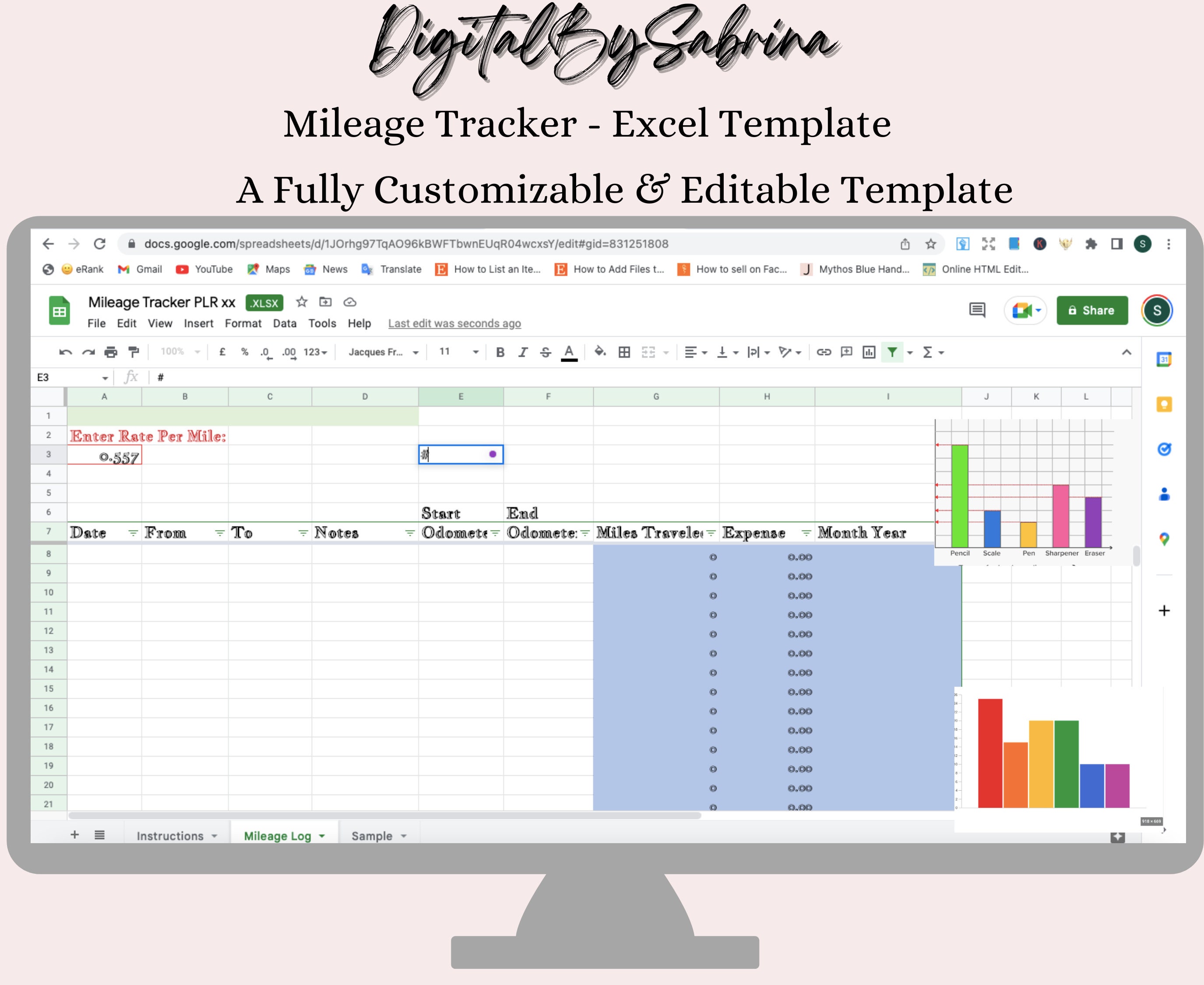

Mileage Tracker Mileage Excel Business Spreadsheet Mileage Log

The mileage log and expense report template in excel makes it easy to record your mileage, calculate related costs, and organize business. Our free mileage log templates will enable you to comply with all irs regulations, thus allowing you to legally and conveniently deduct business. In this article, we will discuss the benefits. To simplify this task, we have created.

Mileage Excel Template

To simplify this task, we have created a free 2025 mileage log template that you can download and use. Our free mileage log templates will enable you to comply with all irs regulations, thus allowing you to legally and conveniently deduct business. In this article, we will discuss the benefits. Mileage log is used to trace or schedule how many.

Excel Mileage Template

To simplify this task, we have created a free 2025 mileage log template that you can download and use. Mileage log is used to trace or schedule how many miles a vehicle has traveled in a specific or assigned period of time. Our free mileage log templates will enable you to comply with all irs regulations, thus allowing you to.

Business Mileage Tracker Vehicle Mileage Tracker Mileage Log Google

Mileage log is used to trace or schedule how many miles a vehicle has traveled in a specific or assigned period of time. To simplify this task, we have created a free 2025 mileage log template that you can download and use. The mileage log and expense report template in excel makes it easy to record your mileage, calculate related.

Excel Spreadsheet Template, , Business Mileage Log, Monthly Mileage

Our free mileage log templates will enable you to comply with all irs regulations, thus allowing you to legally and conveniently deduct business. To simplify this task, we have created a free 2025 mileage log template that you can download and use. The mileage log and expense report template in excel makes it easy to record your mileage, calculate related.

In This Article, We Will Discuss The Benefits.

To simplify this task, we have created a free 2025 mileage log template that you can download and use. The mileage log and expense report template in excel makes it easy to record your mileage, calculate related costs, and organize business. Mileage log is used to trace or schedule how many miles a vehicle has traveled in a specific or assigned period of time. Our free mileage log templates will enable you to comply with all irs regulations, thus allowing you to legally and conveniently deduct business.