Discounted Cash Flow Method Calculator - Discounted cash flow is a valuation method that calculates the value of an investment based on the present value of its future income. Free discounted cash flow (dcf), reverse dcf calculator calculates the value of business using the discounted cash flow model based on eps. Estimate intrinsic value of investments using projected cash flows, growth rates, and. Discounted cash flows calculator this calculator finds the fair value of a stock investment the theoretically correct way, as the. Free 2025 discounted cash flow (dcf) calculator. Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is worth. Use this dcf calculator to compute the discounted present value (dpv) of an investment using an analysis based on the discounted.

Estimate intrinsic value of investments using projected cash flows, growth rates, and. Free discounted cash flow (dcf), reverse dcf calculator calculates the value of business using the discounted cash flow model based on eps. Discounted cash flows calculator this calculator finds the fair value of a stock investment the theoretically correct way, as the. Discounted cash flow is a valuation method that calculates the value of an investment based on the present value of its future income. Use this dcf calculator to compute the discounted present value (dpv) of an investment using an analysis based on the discounted. Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is worth. Free 2025 discounted cash flow (dcf) calculator.

Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is worth. Discounted cash flows calculator this calculator finds the fair value of a stock investment the theoretically correct way, as the. Estimate intrinsic value of investments using projected cash flows, growth rates, and. Discounted cash flow is a valuation method that calculates the value of an investment based on the present value of its future income. Use this dcf calculator to compute the discounted present value (dpv) of an investment using an analysis based on the discounted. Free 2025 discounted cash flow (dcf) calculator. Free discounted cash flow (dcf), reverse dcf calculator calculates the value of business using the discounted cash flow model based on eps.

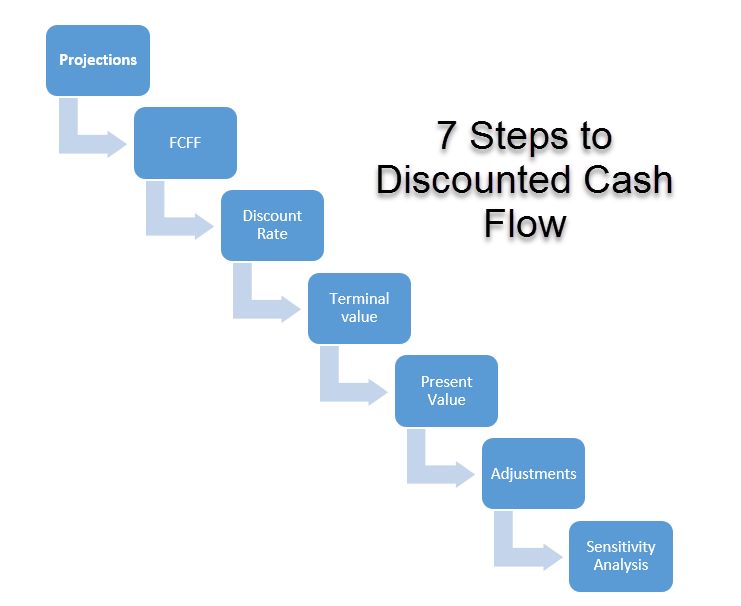

Discounted Cash Flow Method

Free 2025 discounted cash flow (dcf) calculator. Discounted cash flow is a valuation method that calculates the value of an investment based on the present value of its future income. Discounted cash flows calculator this calculator finds the fair value of a stock investment the theoretically correct way, as the. Estimate intrinsic value of investments using projected cash flows, growth.

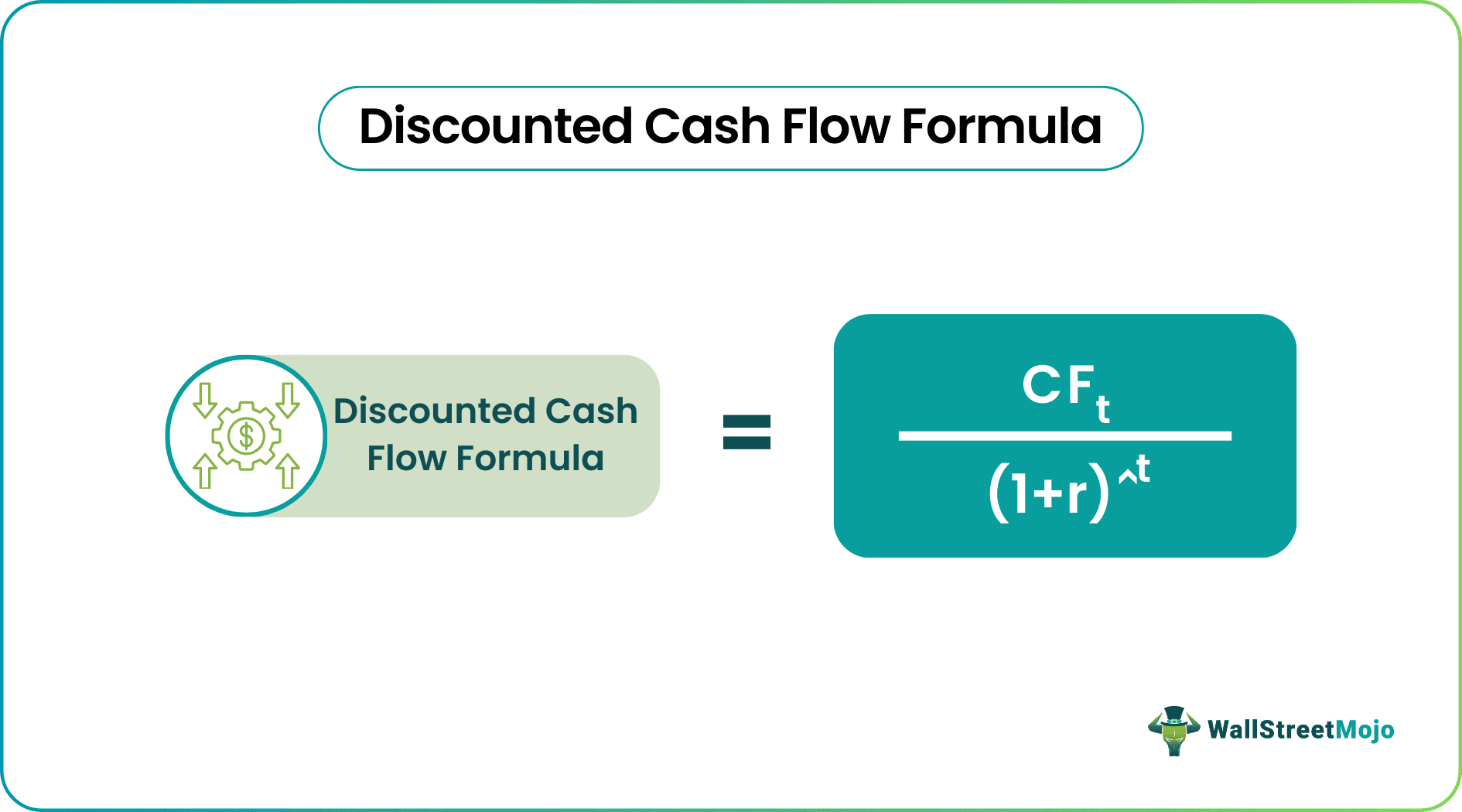

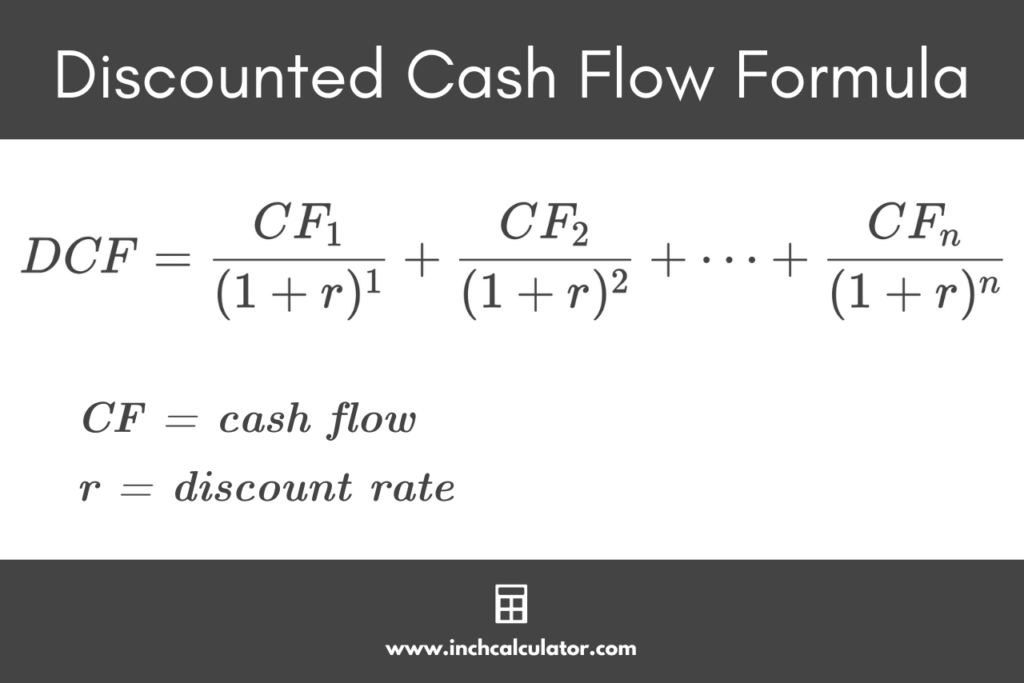

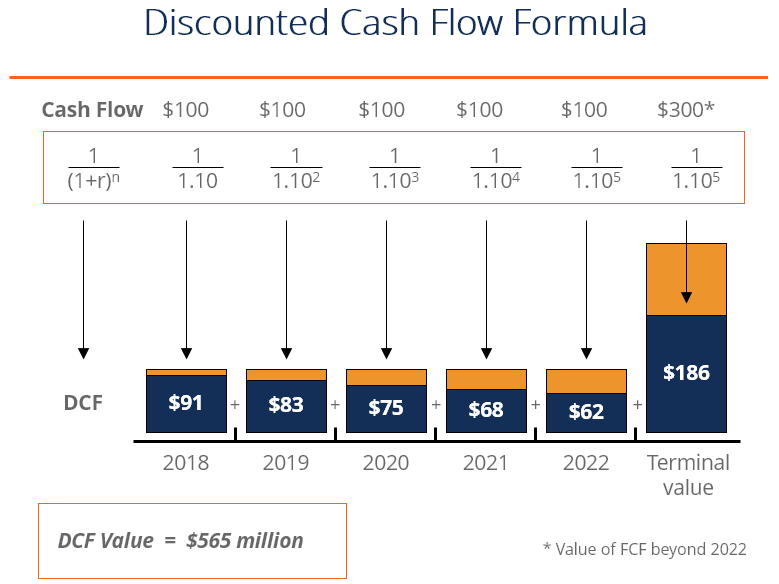

DCF Formula What Is It, Examples, How To Calculate

Free 2025 discounted cash flow (dcf) calculator. Estimate intrinsic value of investments using projected cash flows, growth rates, and. Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is worth. Free discounted cash flow (dcf), reverse dcf calculator calculates the value of business using the discounted cash flow model based on.

Discounted cash flow calculator online SachaSorcha

Estimate intrinsic value of investments using projected cash flows, growth rates, and. Free discounted cash flow (dcf), reverse dcf calculator calculates the value of business using the discounted cash flow model based on eps. Free 2025 discounted cash flow (dcf) calculator. Use this dcf calculator to compute the discounted present value (dpv) of an investment using an analysis based on.

Discounted future cash flow calculator JohnAnnaleigh

Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is worth. Use this dcf calculator to compute the discounted present value (dpv) of an investment using an analysis based on the discounted. Discounted cash flow is a valuation method that calculates the value of an investment based on the present value.

Discounted Cash Flow Valuation Calculator Plan Projections

Free discounted cash flow (dcf), reverse dcf calculator calculates the value of business using the discounted cash flow model based on eps. Use this dcf calculator to compute the discounted present value (dpv) of an investment using an analysis based on the discounted. Free 2025 discounted cash flow (dcf) calculator. Estimate intrinsic value of investments using projected cash flows, growth.

Discounted Cash Flow Model in Excel Solving Finance

Estimate intrinsic value of investments using projected cash flows, growth rates, and. Use this dcf calculator to compute the discounted present value (dpv) of an investment using an analysis based on the discounted. Free discounted cash flow (dcf), reverse dcf calculator calculates the value of business using the discounted cash flow model based on eps. Free 2025 discounted cash flow.

Discounted Cash Flow Formula Intrinsic Value Stock Analysis Method

Discounted cash flows calculator this calculator finds the fair value of a stock investment the theoretically correct way, as the. Free discounted cash flow (dcf), reverse dcf calculator calculates the value of business using the discounted cash flow model based on eps. Use this dcf calculator to compute the discounted present value (dpv) of an investment using an analysis based.

Discounted Cash Flow Method

Discounted cash flow is a valuation method that calculates the value of an investment based on the present value of its future income. Estimate intrinsic value of investments using projected cash flows, growth rates, and. Free discounted cash flow (dcf), reverse dcf calculator calculates the value of business using the discounted cash flow model based on eps. Calculating the sum.

Discounted Cash Flow Calculator Inch Calculator

Free 2025 discounted cash flow (dcf) calculator. Estimate intrinsic value of investments using projected cash flows, growth rates, and. Free discounted cash flow (dcf), reverse dcf calculator calculates the value of business using the discounted cash flow model based on eps. Use this dcf calculator to compute the discounted present value (dpv) of an investment using an analysis based on.

Discounted Cash Flow DCF Formula

Free discounted cash flow (dcf), reverse dcf calculator calculates the value of business using the discounted cash flow model based on eps. Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is worth. Use this dcf calculator to compute the discounted present value (dpv) of an investment using an analysis based.

Use This Dcf Calculator To Compute The Discounted Present Value (Dpv) Of An Investment Using An Analysis Based On The Discounted.

Estimate intrinsic value of investments using projected cash flows, growth rates, and. Free 2025 discounted cash flow (dcf) calculator. Discounted cash flow is a valuation method that calculates the value of an investment based on the present value of its future income. Discounted cash flows calculator this calculator finds the fair value of a stock investment the theoretically correct way, as the.

Calculating The Sum Of Future Discounted Cash Flows Is The Gold Standard To Determine How Much An Investment Is Worth.

Free discounted cash flow (dcf), reverse dcf calculator calculates the value of business using the discounted cash flow model based on eps.