Calculating Unlevered Free Cash Flow - Unlevered free cash flow (ufcf) is an essential financial metric that provides investors and analysts with a clear picture of a. Real time datasimple to use The formula for calculating unlevered free cash flow (ufcf) is nopat plus d&a, subtracted by increase in net working. In this tutorial, you’ll learn why unlevered free cash flow is important, the items you should include and exclude, and how to calculate it for.

In this tutorial, you’ll learn why unlevered free cash flow is important, the items you should include and exclude, and how to calculate it for. Unlevered free cash flow (ufcf) is an essential financial metric that provides investors and analysts with a clear picture of a. Real time datasimple to use The formula for calculating unlevered free cash flow (ufcf) is nopat plus d&a, subtracted by increase in net working.

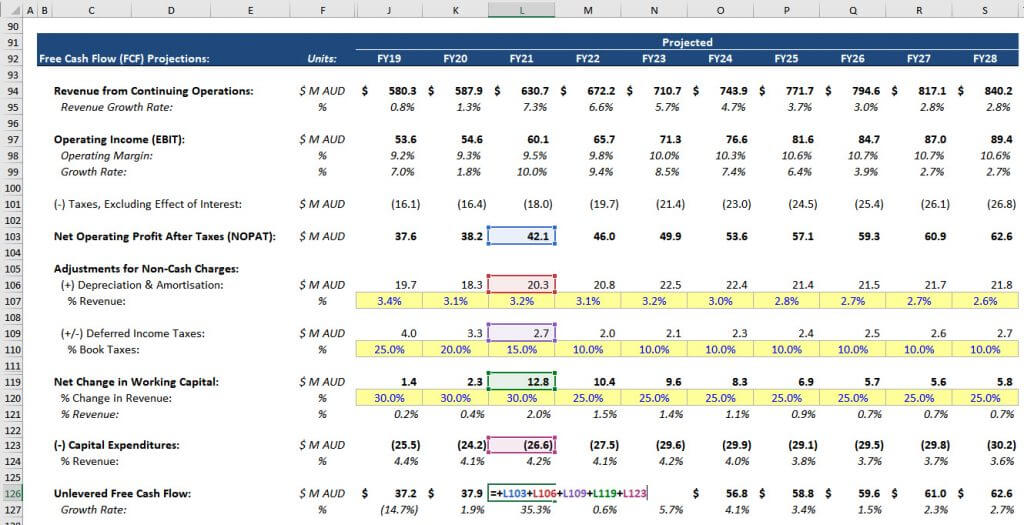

The formula for calculating unlevered free cash flow (ufcf) is nopat plus d&a, subtracted by increase in net working. Unlevered free cash flow (ufcf) is an essential financial metric that provides investors and analysts with a clear picture of a. In this tutorial, you’ll learn why unlevered free cash flow is important, the items you should include and exclude, and how to calculate it for. Real time datasimple to use

How to Calculate Unlevered Free Cash Flow in a DCF

Real time datasimple to use The formula for calculating unlevered free cash flow (ufcf) is nopat plus d&a, subtracted by increase in net working. In this tutorial, you’ll learn why unlevered free cash flow is important, the items you should include and exclude, and how to calculate it for. Unlevered free cash flow (ufcf) is an essential financial metric that.

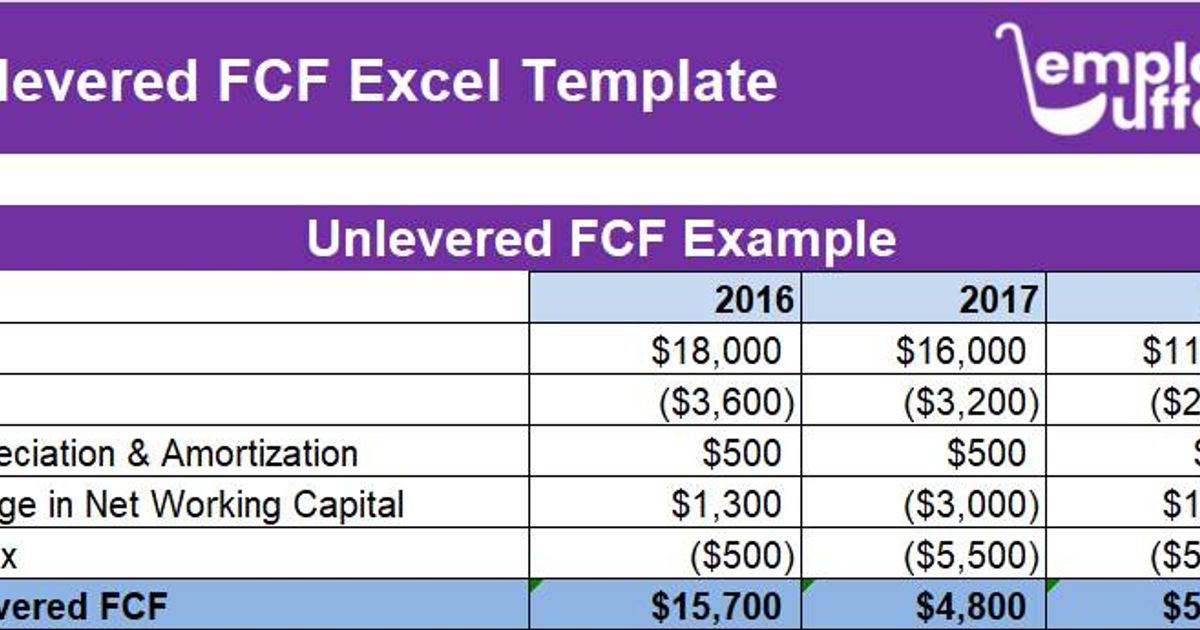

Unlevered Free Cash Flow Excel Template Easily Calculate FCF Now

Real time datasimple to use In this tutorial, you’ll learn why unlevered free cash flow is important, the items you should include and exclude, and how to calculate it for. Unlevered free cash flow (ufcf) is an essential financial metric that provides investors and analysts with a clear picture of a. The formula for calculating unlevered free cash flow (ufcf).

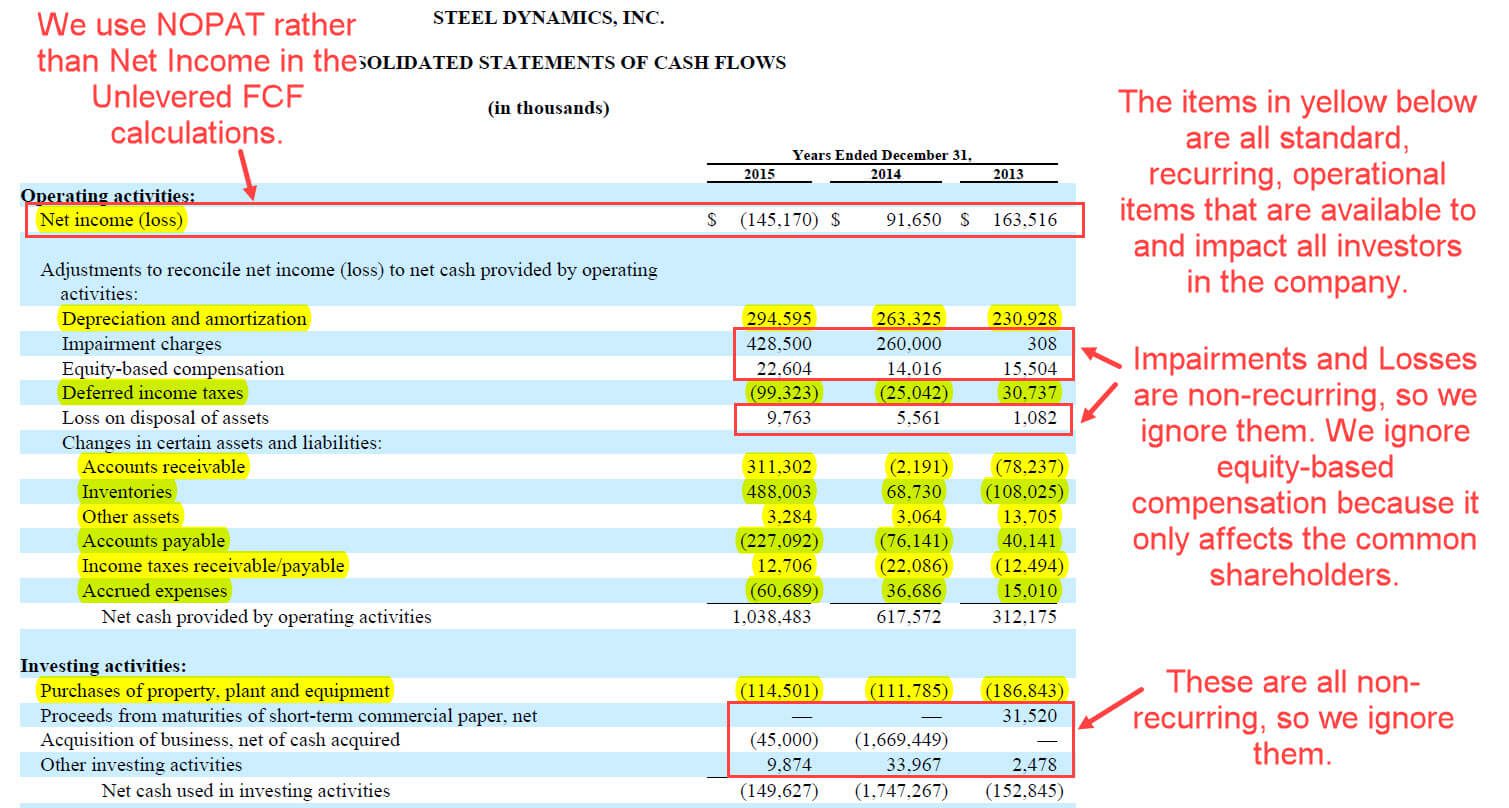

Unlevered Free Cash Flow Formulas, Calculations, and Full Tutorial

Real time datasimple to use In this tutorial, you’ll learn why unlevered free cash flow is important, the items you should include and exclude, and how to calculate it for. Unlevered free cash flow (ufcf) is an essential financial metric that provides investors and analysts with a clear picture of a. The formula for calculating unlevered free cash flow (ufcf).

How to Calculate Unlevered Free Cash Flow in a DCF

In this tutorial, you’ll learn why unlevered free cash flow is important, the items you should include and exclude, and how to calculate it for. Unlevered free cash flow (ufcf) is an essential financial metric that provides investors and analysts with a clear picture of a. Real time datasimple to use The formula for calculating unlevered free cash flow (ufcf).

Levered vs. unlevered free cash flow explained (formulas, examples

The formula for calculating unlevered free cash flow (ufcf) is nopat plus d&a, subtracted by increase in net working. In this tutorial, you’ll learn why unlevered free cash flow is important, the items you should include and exclude, and how to calculate it for. Unlevered free cash flow (ufcf) is an essential financial metric that provides investors and analysts with.

How to Calculate Unlevered Free Cash Flow in a DCF

In this tutorial, you’ll learn why unlevered free cash flow is important, the items you should include and exclude, and how to calculate it for. Real time datasimple to use The formula for calculating unlevered free cash flow (ufcf) is nopat plus d&a, subtracted by increase in net working. Unlevered free cash flow (ufcf) is an essential financial metric that.

Unlevered Free Cash Flow Formulas, Calculations, and Full Tutorial

In this tutorial, you’ll learn why unlevered free cash flow is important, the items you should include and exclude, and how to calculate it for. The formula for calculating unlevered free cash flow (ufcf) is nopat plus d&a, subtracted by increase in net working. Unlevered free cash flow (ufcf) is an essential financial metric that provides investors and analysts with.

Calculating Unlevered Free Cash Flow 2019 YouTube

In this tutorial, you’ll learn why unlevered free cash flow is important, the items you should include and exclude, and how to calculate it for. The formula for calculating unlevered free cash flow (ufcf) is nopat plus d&a, subtracted by increase in net working. Unlevered free cash flow (ufcf) is an essential financial metric that provides investors and analysts with.

Unlevered Free Cash Flow Formulas, Calculations, and Full Tutorial

Unlevered free cash flow (ufcf) is an essential financial metric that provides investors and analysts with a clear picture of a. In this tutorial, you’ll learn why unlevered free cash flow is important, the items you should include and exclude, and how to calculate it for. The formula for calculating unlevered free cash flow (ufcf) is nopat plus d&a, subtracted.

Unlevered Free Cash Flow Formulas, Calculations, and Full Tutorial

Unlevered free cash flow (ufcf) is an essential financial metric that provides investors and analysts with a clear picture of a. In this tutorial, you’ll learn why unlevered free cash flow is important, the items you should include and exclude, and how to calculate it for. The formula for calculating unlevered free cash flow (ufcf) is nopat plus d&a, subtracted.

Real Time Datasimple To Use

The formula for calculating unlevered free cash flow (ufcf) is nopat plus d&a, subtracted by increase in net working. In this tutorial, you’ll learn why unlevered free cash flow is important, the items you should include and exclude, and how to calculate it for. Unlevered free cash flow (ufcf) is an essential financial metric that provides investors and analysts with a clear picture of a.