Best Way To Keep Track Of Tax Deductions - Filing taxes requires compiling information from a variety of sources to complete irs forms and claim deductions. With found, you can automatically set aside money for taxes every time you get paid. A taxpayer's filing status determines their filing requirements, standard deduction, eligibility for certain credits and the. It’s a great tool for. No more scrambling or surprises at tax time.

Filing taxes requires compiling information from a variety of sources to complete irs forms and claim deductions. With found, you can automatically set aside money for taxes every time you get paid. It’s a great tool for. A taxpayer's filing status determines their filing requirements, standard deduction, eligibility for certain credits and the. No more scrambling or surprises at tax time.

Filing taxes requires compiling information from a variety of sources to complete irs forms and claim deductions. A taxpayer's filing status determines their filing requirements, standard deduction, eligibility for certain credits and the. With found, you can automatically set aside money for taxes every time you get paid. No more scrambling or surprises at tax time. It’s a great tool for.

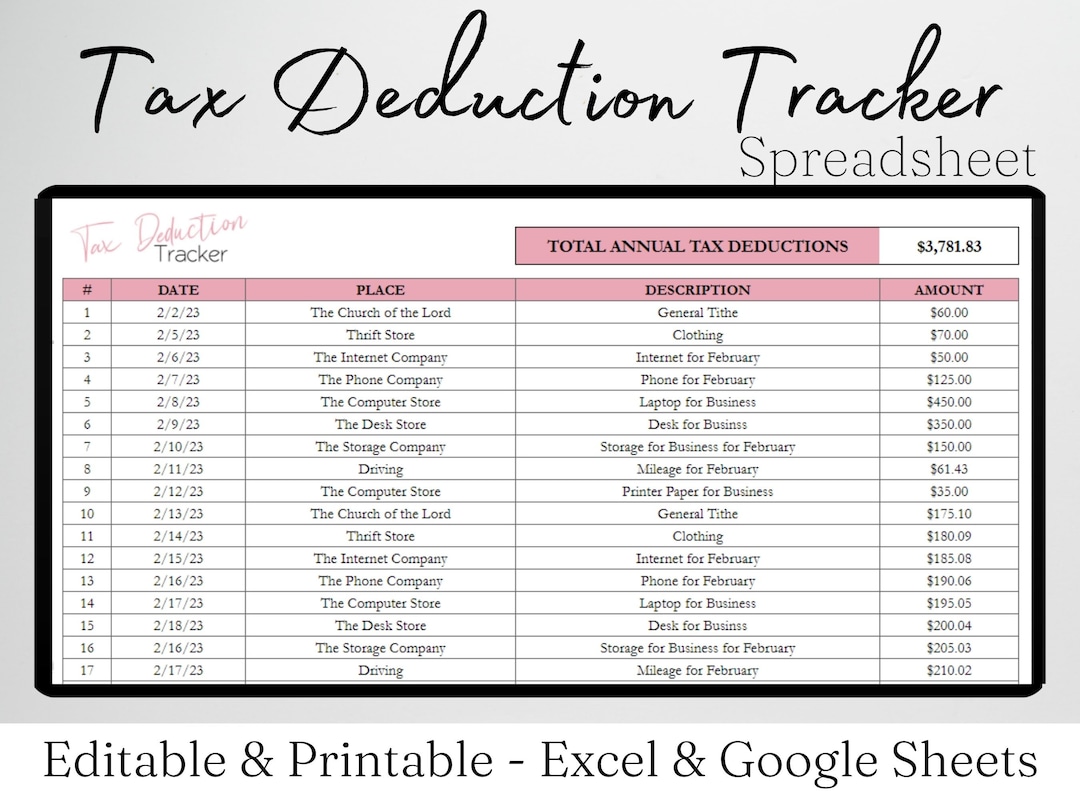

Tax Deduction Tracker Excel Spreadsheet Editable Tax Etsy

It’s a great tool for. A taxpayer's filing status determines their filing requirements, standard deduction, eligibility for certain credits and the. No more scrambling or surprises at tax time. With found, you can automatically set aside money for taxes every time you get paid. Filing taxes requires compiling information from a variety of sources to complete irs forms and claim.

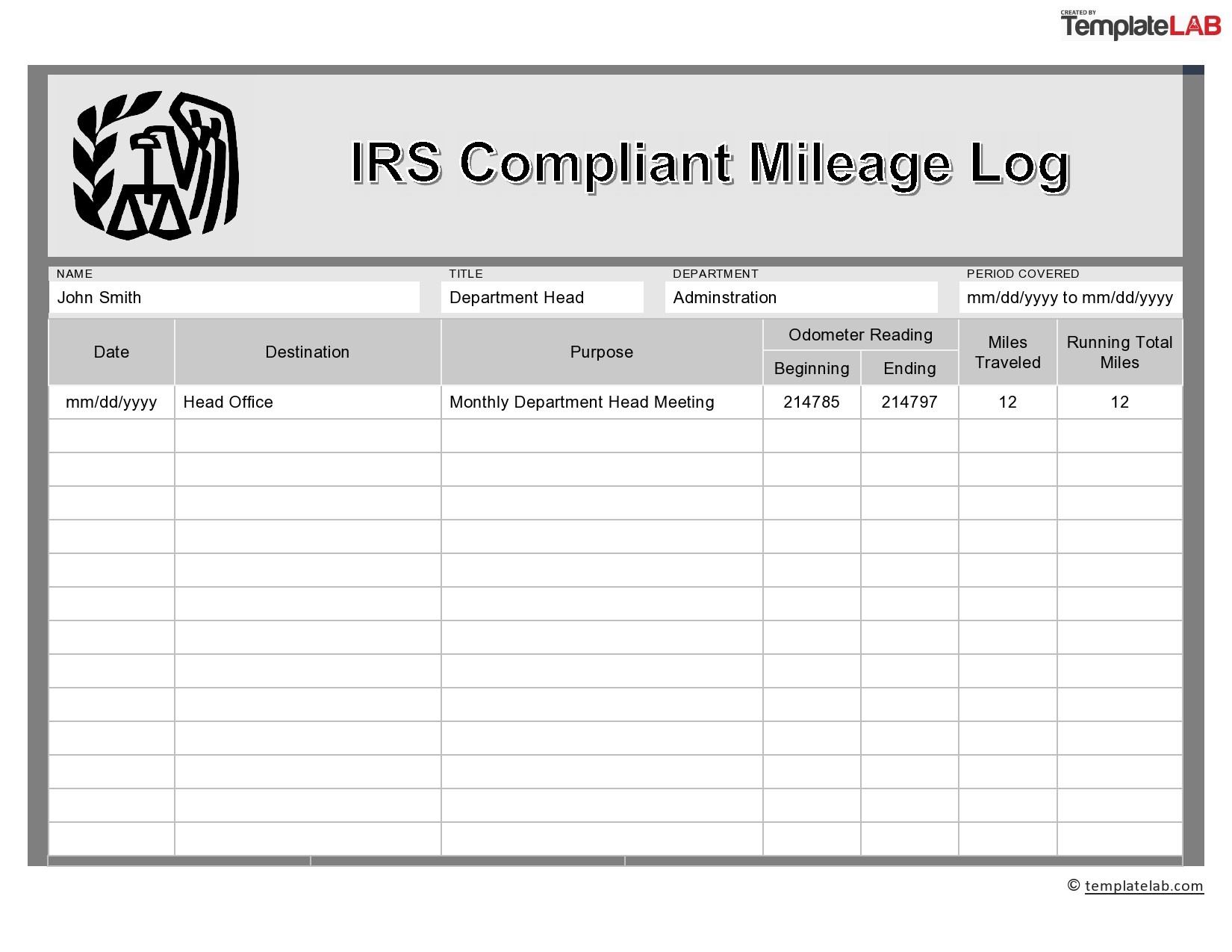

Irs Standard Mileage Rate 2025 Deduction Mary A Smith

A taxpayer's filing status determines their filing requirements, standard deduction, eligibility for certain credits and the. It’s a great tool for. No more scrambling or surprises at tax time. With found, you can automatically set aside money for taxes every time you get paid. Filing taxes requires compiling information from a variety of sources to complete irs forms and claim.

Tax Deduction Log Book Record And Keep Track Of Tax Breaks

Filing taxes requires compiling information from a variety of sources to complete irs forms and claim deductions. With found, you can automatically set aside money for taxes every time you get paid. No more scrambling or surprises at tax time. It’s a great tool for. A taxpayer's filing status determines their filing requirements, standard deduction, eligibility for certain credits and.

Easy Tax Deduction Receipt Tracker / for Small US Business / Etsy

It’s a great tool for. With found, you can automatically set aside money for taxes every time you get paid. No more scrambling or surprises at tax time. A taxpayer's filing status determines their filing requirements, standard deduction, eligibility for certain credits and the. Filing taxes requires compiling information from a variety of sources to complete irs forms and claim.

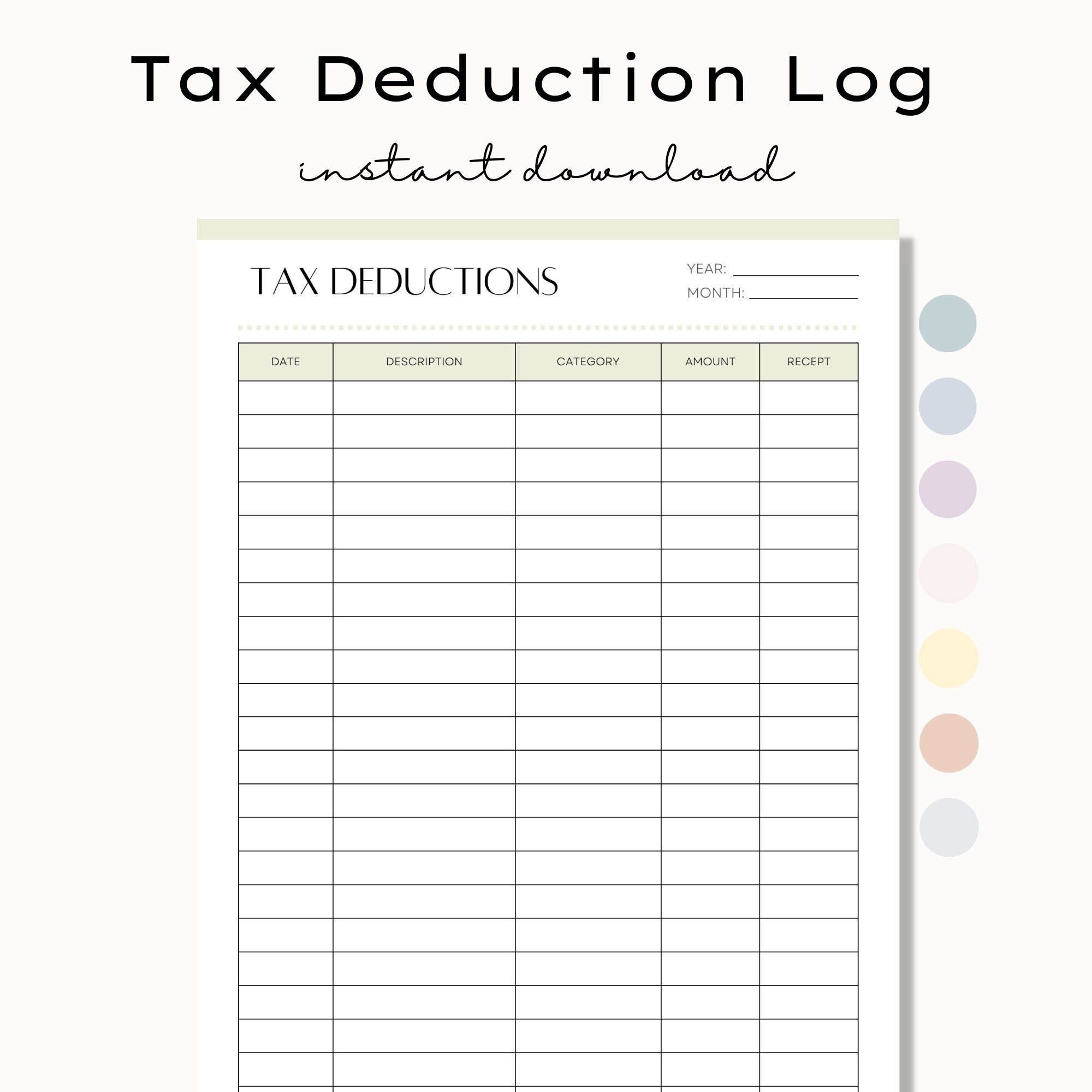

Printable Tax Deduction Tracker, Tax Deduction Log, Business Tax Log

Filing taxes requires compiling information from a variety of sources to complete irs forms and claim deductions. No more scrambling or surprises at tax time. A taxpayer's filing status determines their filing requirements, standard deduction, eligibility for certain credits and the. It’s a great tool for. With found, you can automatically set aside money for taxes every time you get.

Keeper Tax Customers

Filing taxes requires compiling information from a variety of sources to complete irs forms and claim deductions. It’s a great tool for. With found, you can automatically set aside money for taxes every time you get paid. A taxpayer's filing status determines their filing requirements, standard deduction, eligibility for certain credits and the. No more scrambling or surprises at tax.

Printable Tax Deduction Tracker Plan Print Land

It’s a great tool for. Filing taxes requires compiling information from a variety of sources to complete irs forms and claim deductions. No more scrambling or surprises at tax time. With found, you can automatically set aside money for taxes every time you get paid. A taxpayer's filing status determines their filing requirements, standard deduction, eligibility for certain credits and.

EXCEL of Tax Deduction Form.xlsx WPS Free Templates

No more scrambling or surprises at tax time. Filing taxes requires compiling information from a variety of sources to complete irs forms and claim deductions. A taxpayer's filing status determines their filing requirements, standard deduction, eligibility for certain credits and the. With found, you can automatically set aside money for taxes every time you get paid. It’s a great tool.

Tax Deduction Log Book Simple Tax Returns Organizer for

With found, you can automatically set aside money for taxes every time you get paid. Filing taxes requires compiling information from a variety of sources to complete irs forms and claim deductions. No more scrambling or surprises at tax time. It’s a great tool for. A taxpayer's filing status determines their filing requirements, standard deduction, eligibility for certain credits and.

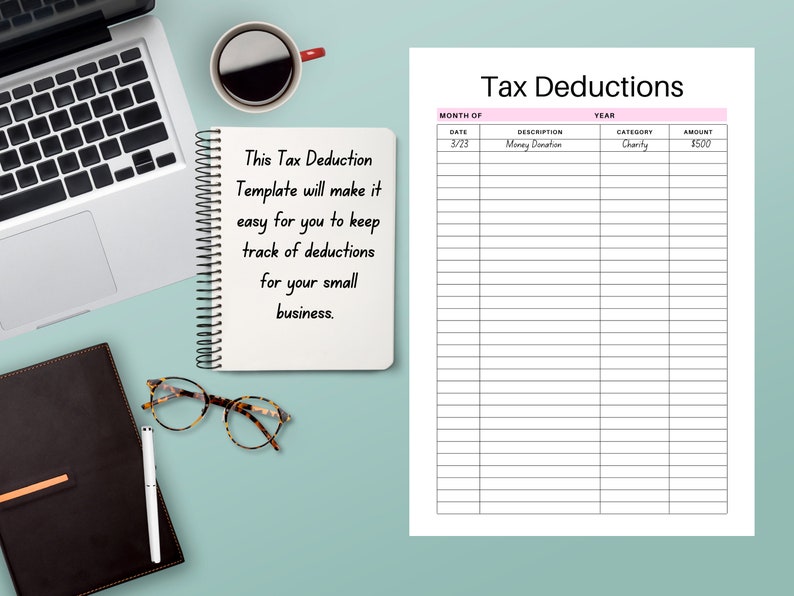

Tax Deduction Tracker Template Printable, Digital Download, Small

A taxpayer's filing status determines their filing requirements, standard deduction, eligibility for certain credits and the. With found, you can automatically set aside money for taxes every time you get paid. Filing taxes requires compiling information from a variety of sources to complete irs forms and claim deductions. No more scrambling or surprises at tax time. It’s a great tool.

Filing Taxes Requires Compiling Information From A Variety Of Sources To Complete Irs Forms And Claim Deductions.

No more scrambling or surprises at tax time. With found, you can automatically set aside money for taxes every time you get paid. It’s a great tool for. A taxpayer's filing status determines their filing requirements, standard deduction, eligibility for certain credits and the.