Aggrg Deduction In Salary Slip - Each allowance and perquisite is. For a employee agg of chapter vi is coming wrong. Generally shift allowance and overtime is irregular taxable income. A salary slip or payslip is a document issued monthly by an employer to its employees. Total income wage type (/434) = gross. As the employee does not have any section 80 deductions, agg of chapter vi wage type (/432) = 00.00. It contains a detailed summary of an. 10k+ visitors in the past month It means that all wage type is regular taxable income. 10k+ visitors in the past month

Total income wage type (/434) = gross. For a employee agg of chapter vi is coming wrong. Generally shift allowance and overtime is irregular taxable income. A salary slip or payslip is a document issued monthly by an employer to its employees. I have check it0585 = no data is there and in it0586= 97,554 in proposed. Each allowance and perquisite is. As the employee does not have any section 80 deductions, agg of chapter vi wage type (/432) = 00.00. It means that all wage type is regular taxable income. 10k+ visitors in the past month It contains a detailed summary of an.

It means that all wage type is regular taxable income. For a employee agg of chapter vi is coming wrong. Generally shift allowance and overtime is irregular taxable income. 10k+ visitors in the past month A salary slip or payslip is a document issued monthly by an employer to its employees. Each allowance and perquisite is. Salary packages or ctcs for employees include various allowances and perquisites; As the employee does not have any section 80 deductions, agg of chapter vi wage type (/432) = 00.00. It contains a detailed summary of an. 10k+ visitors in the past month

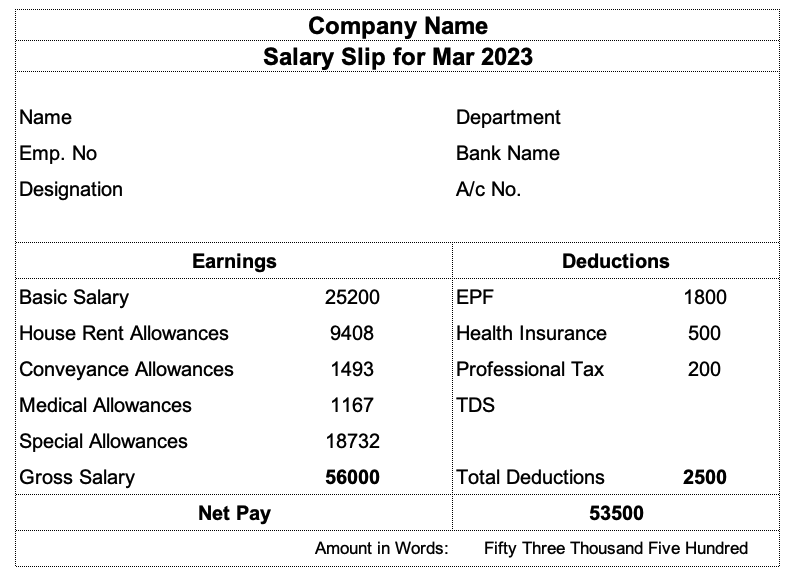

Payslip Templates Excel

It means that all wage type is regular taxable income. It contains a detailed summary of an. Total income wage type (/434) = gross. 10k+ visitors in the past month For a employee agg of chapter vi is coming wrong.

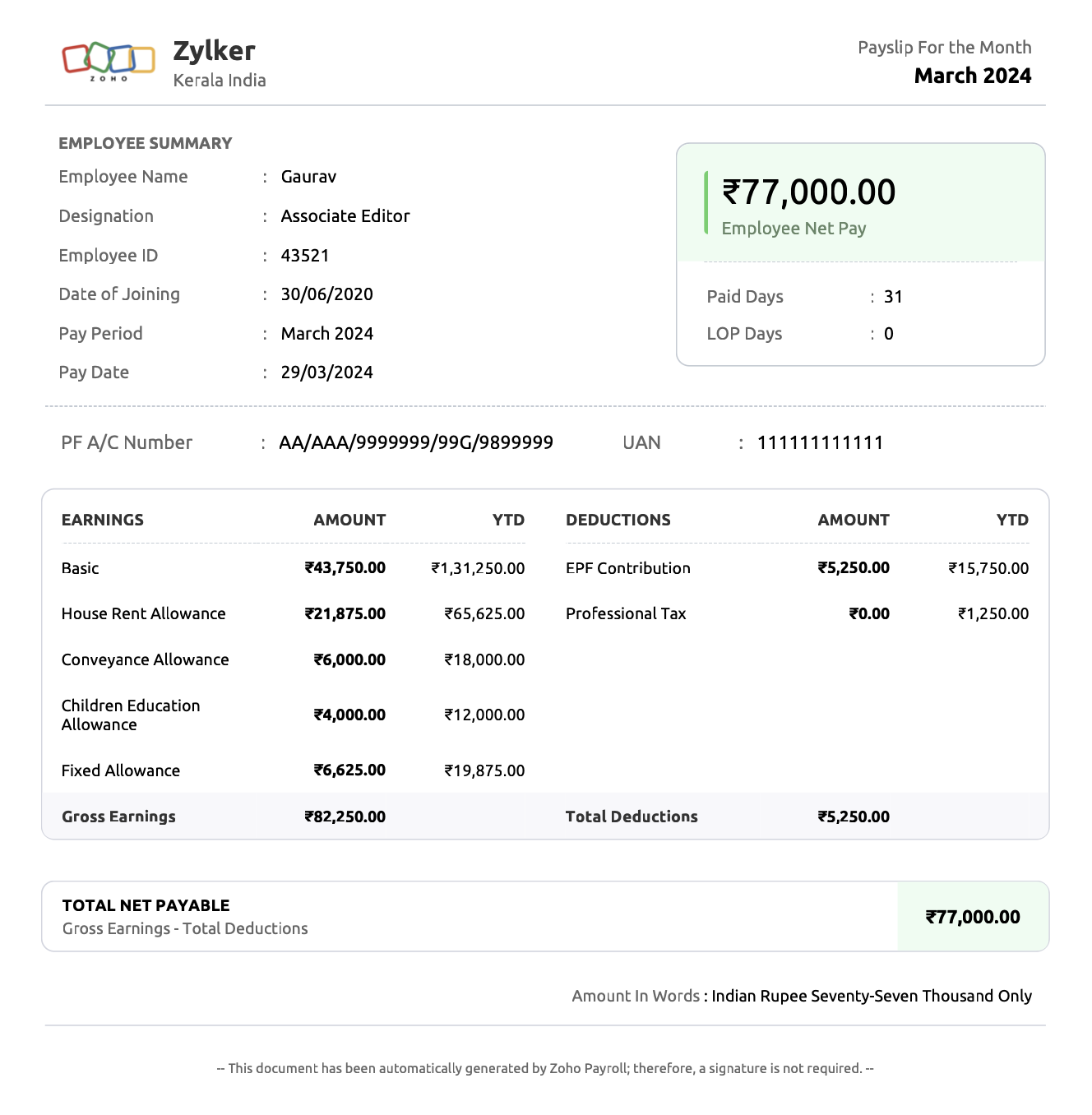

What is salary slip or payslip? Format & components Zoho Payroll

Each allowance and perquisite is. 10k+ visitors in the past month As the employee does not have any section 80 deductions, agg of chapter vi wage type (/432) = 00.00. It means that all wage type is regular taxable income. I have check it0585 = no data is there and in it0586= 97,554 in proposed.

Employee Salary Slip What is Earnings & Deductions?

Generally shift allowance and overtime is irregular taxable income. For a employee agg of chapter vi is coming wrong. 10k+ visitors in the past month It means that all wage type is regular taxable income. It contains a detailed summary of an.

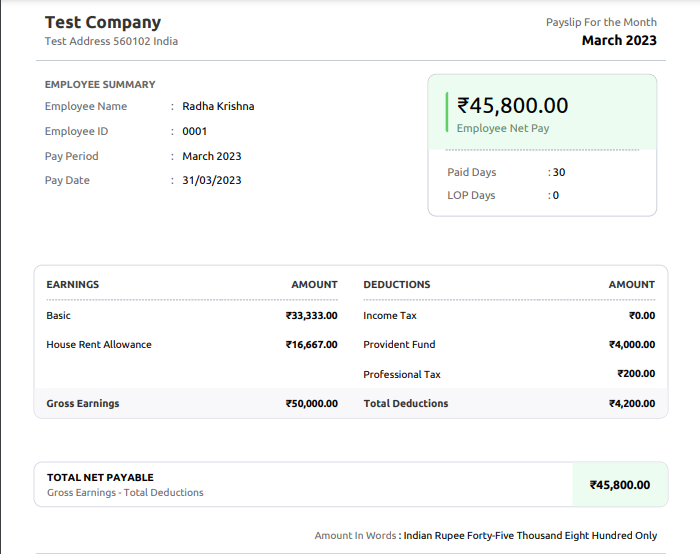

Salary Slip Meaning, Format and Components

It means that all wage type is regular taxable income. For a employee agg of chapter vi is coming wrong. Each allowance and perquisite is. A salary slip or payslip is a document issued monthly by an employer to its employees. Total income wage type (/434) = gross.

Analysis of Salary slip

A salary slip or payslip is a document issued monthly by an employer to its employees. I have check it0585 = no data is there and in it0586= 97,554 in proposed. Total income wage type (/434) = gross. Salary packages or ctcs for employees include various allowances and perquisites; As the employee does not have any section 80 deductions, agg.

What is Salary Slip Components of Salary Slip, Format & Payslip Breakdown

10k+ visitors in the past month I have check it0585 = no data is there and in it0586= 97,554 in proposed. As the employee does not have any section 80 deductions, agg of chapter vi wage type (/432) = 00.00. Salary packages or ctcs for employees include various allowances and perquisites; A salary slip or payslip is a document issued.

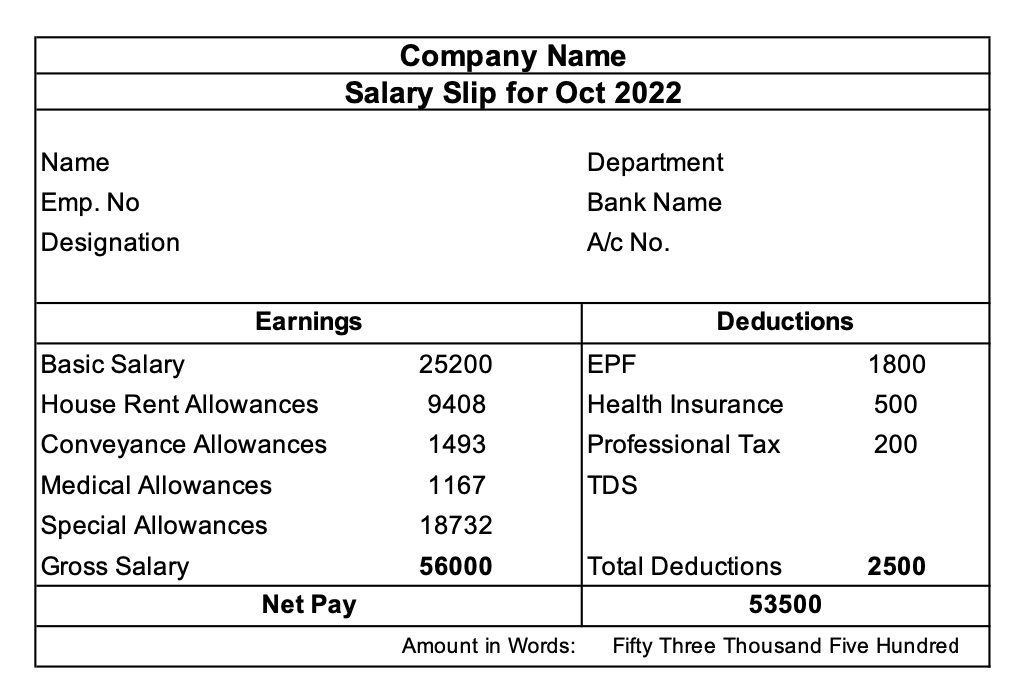

Salary Slip PDF Tax Deduction Taxes

Salary packages or ctcs for employees include various allowances and perquisites; It means that all wage type is regular taxable income. A salary slip or payslip is a document issued monthly by an employer to its employees. 10k+ visitors in the past month I have check it0585 = no data is there and in it0586= 97,554 in proposed.

Salary Slip कैसे बनायें

10k+ visitors in the past month It contains a detailed summary of an. I have check it0585 = no data is there and in it0586= 97,554 in proposed. As the employee does not have any section 80 deductions, agg of chapter vi wage type (/432) = 00.00. Total income wage type (/434) = gross.

Editable salary slip format in excel tokera

As the employee does not have any section 80 deductions, agg of chapter vi wage type (/432) = 00.00. I have check it0585 = no data is there and in it0586= 97,554 in proposed. 10k+ visitors in the past month 10k+ visitors in the past month For a employee agg of chapter vi is coming wrong.

It Contains A Detailed Summary Of An.

Salary packages or ctcs for employees include various allowances and perquisites; I have check it0585 = no data is there and in it0586= 97,554 in proposed. A salary slip or payslip is a document issued monthly by an employer to its employees. For a employee agg of chapter vi is coming wrong.

As The Employee Does Not Have Any Section 80 Deductions, Agg Of Chapter Vi Wage Type (/432) = 00.00.

Each allowance and perquisite is. Total income wage type (/434) = gross. It means that all wage type is regular taxable income. 10k+ visitors in the past month

Generally Shift Allowance And Overtime Is Irregular Taxable Income.

10k+ visitors in the past month