Accounting For Spare Parts - It is common for manufacturing. The accounting treatment of spare parts is a critical aspect of financial reporting that requires careful consideration and adherence to. Spare parts are standby items that companies use if an asset gets lost, broken or worn out. Companies keep these items to reduce or. 4.5/5 (7,359) See fsp 8.3.2, fsp 8.5, ppe 1.5.3, and iv 1.5.2 for the accounting for spare parts inventory.

It is common for manufacturing. Companies keep these items to reduce or. See fsp 8.3.2, fsp 8.5, ppe 1.5.3, and iv 1.5.2 for the accounting for spare parts inventory. 4.5/5 (7,359) The accounting treatment of spare parts is a critical aspect of financial reporting that requires careful consideration and adherence to. Spare parts are standby items that companies use if an asset gets lost, broken or worn out.

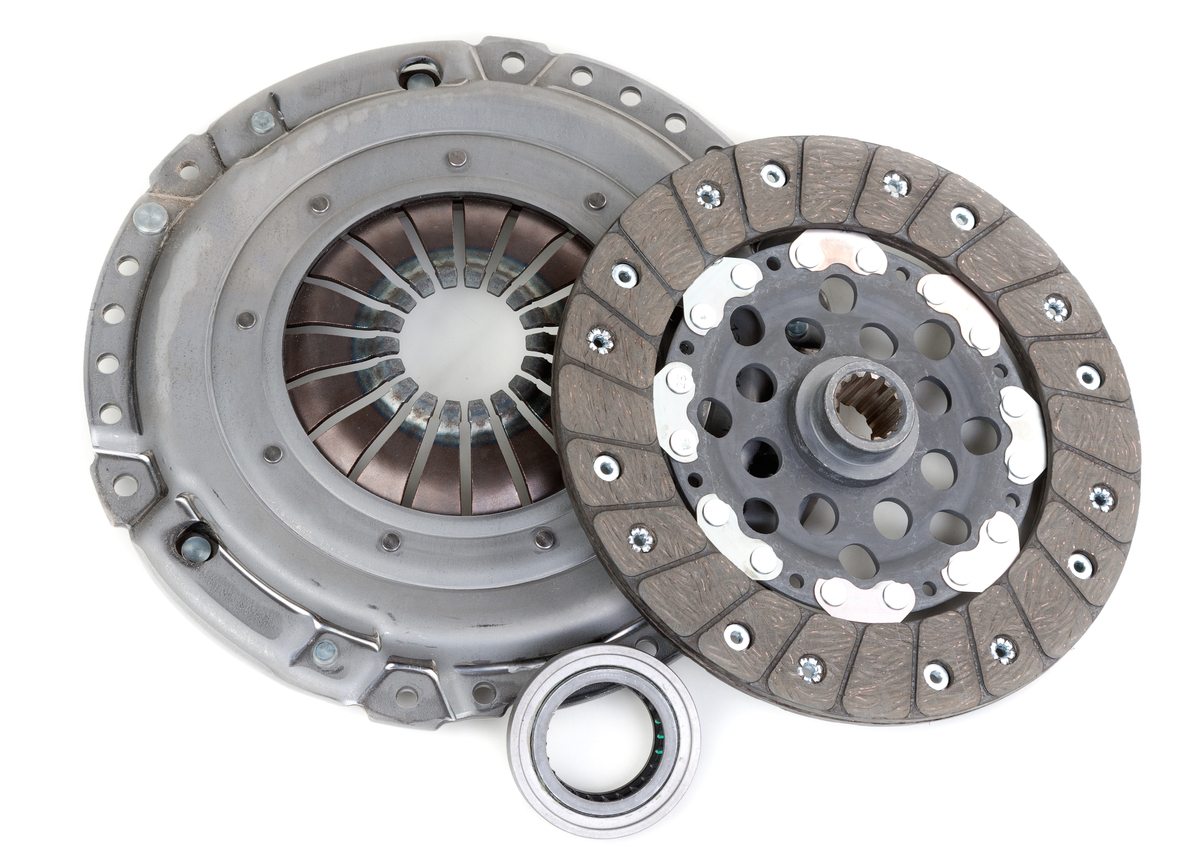

Spare parts are standby items that companies use if an asset gets lost, broken or worn out. It is common for manufacturing. 4.5/5 (7,359) Companies keep these items to reduce or. See fsp 8.3.2, fsp 8.5, ppe 1.5.3, and iv 1.5.2 for the accounting for spare parts inventory. The accounting treatment of spare parts is a critical aspect of financial reporting that requires careful consideration and adherence to.

Rotable Spare Parts Inventory Accounting Reviewmotors.co

4.5/5 (7,359) It is common for manufacturing. Companies keep these items to reduce or. See fsp 8.3.2, fsp 8.5, ppe 1.5.3, and iv 1.5.2 for the accounting for spare parts inventory. The accounting treatment of spare parts is a critical aspect of financial reporting that requires careful consideration and adherence to.

Accounting Treatment of Spare Parts PDF Depreciation Inventory

The accounting treatment of spare parts is a critical aspect of financial reporting that requires careful consideration and adherence to. It is common for manufacturing. Companies keep these items to reduce or. See fsp 8.3.2, fsp 8.5, ppe 1.5.3, and iv 1.5.2 for the accounting for spare parts inventory. Spare parts are standby items that companies use if an asset.

Spare Parts Inventory Accounting Ifrs Reviewmotors.co

4.5/5 (7,359) See fsp 8.3.2, fsp 8.5, ppe 1.5.3, and iv 1.5.2 for the accounting for spare parts inventory. The accounting treatment of spare parts is a critical aspect of financial reporting that requires careful consideration and adherence to. Spare parts are standby items that companies use if an asset gets lost, broken or worn out. It is common.

5 Things to Consider When Doing Spare Parts Inventory Management

4.5/5 (7,359) The accounting treatment of spare parts is a critical aspect of financial reporting that requires careful consideration and adherence to. Companies keep these items to reduce or. Spare parts are standby items that companies use if an asset gets lost, broken or worn out. It is common for manufacturing.

Spare Parts Inventory Excel Template at Pamela Navarrette blog

The accounting treatment of spare parts is a critical aspect of financial reporting that requires careful consideration and adherence to. Companies keep these items to reduce or. Spare parts are standby items that companies use if an asset gets lost, broken or worn out. It is common for manufacturing. See fsp 8.3.2, fsp 8.5, ppe 1.5.3, and iv 1.5.2 for.

Definition Of Spare Parts Management In Accounting Reviewmotors.co

The accounting treatment of spare parts is a critical aspect of financial reporting that requires careful consideration and adherence to. Companies keep these items to reduce or. Spare parts are standby items that companies use if an asset gets lost, broken or worn out. 4.5/5 (7,359) See fsp 8.3.2, fsp 8.5, ppe 1.5.3, and iv 1.5.2 for the accounting.

EXCEL of Simple Spare Parts Management Chart.xlsx WPS Free Templates

The accounting treatment of spare parts is a critical aspect of financial reporting that requires careful consideration and adherence to. See fsp 8.3.2, fsp 8.5, ppe 1.5.3, and iv 1.5.2 for the accounting for spare parts inventory. It is common for manufacturing. 4.5/5 (7,359) Companies keep these items to reduce or.

7 Spare Parts Inventory Management Best Practices

4.5/5 (7,359) It is common for manufacturing. The accounting treatment of spare parts is a critical aspect of financial reporting that requires careful consideration and adherence to. Spare parts are standby items that companies use if an asset gets lost, broken or worn out. See fsp 8.3.2, fsp 8.5, ppe 1.5.3, and iv 1.5.2 for the accounting for spare.

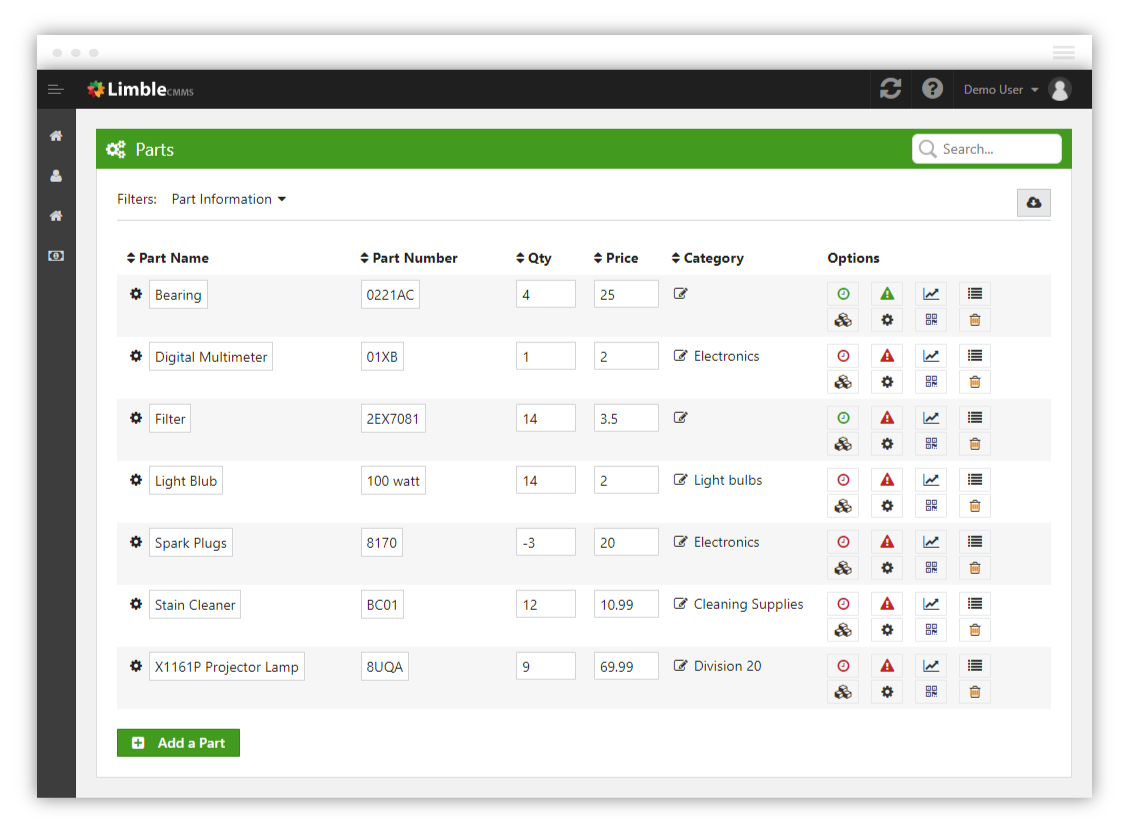

A Simple Guide to Spare Parts Management Limble CMMS

The accounting treatment of spare parts is a critical aspect of financial reporting that requires careful consideration and adherence to. Companies keep these items to reduce or. 4.5/5 (7,359) Spare parts are standby items that companies use if an asset gets lost, broken or worn out. It is common for manufacturing.

Spare Parts Management at Santiago Vanmatre blog

Companies keep these items to reduce or. 4.5/5 (7,359) It is common for manufacturing. The accounting treatment of spare parts is a critical aspect of financial reporting that requires careful consideration and adherence to. Spare parts are standby items that companies use if an asset gets lost, broken or worn out.

Companies Keep These Items To Reduce Or.

It is common for manufacturing. Spare parts are standby items that companies use if an asset gets lost, broken or worn out. The accounting treatment of spare parts is a critical aspect of financial reporting that requires careful consideration and adherence to. 4.5/5 (7,359)

:max_bytes(150000):strip_icc()/management.asp-ADD-V1-9c41a55b7e2045bfbf066797daee0b4e.jpg?resize=806%2C539&ssl=1)