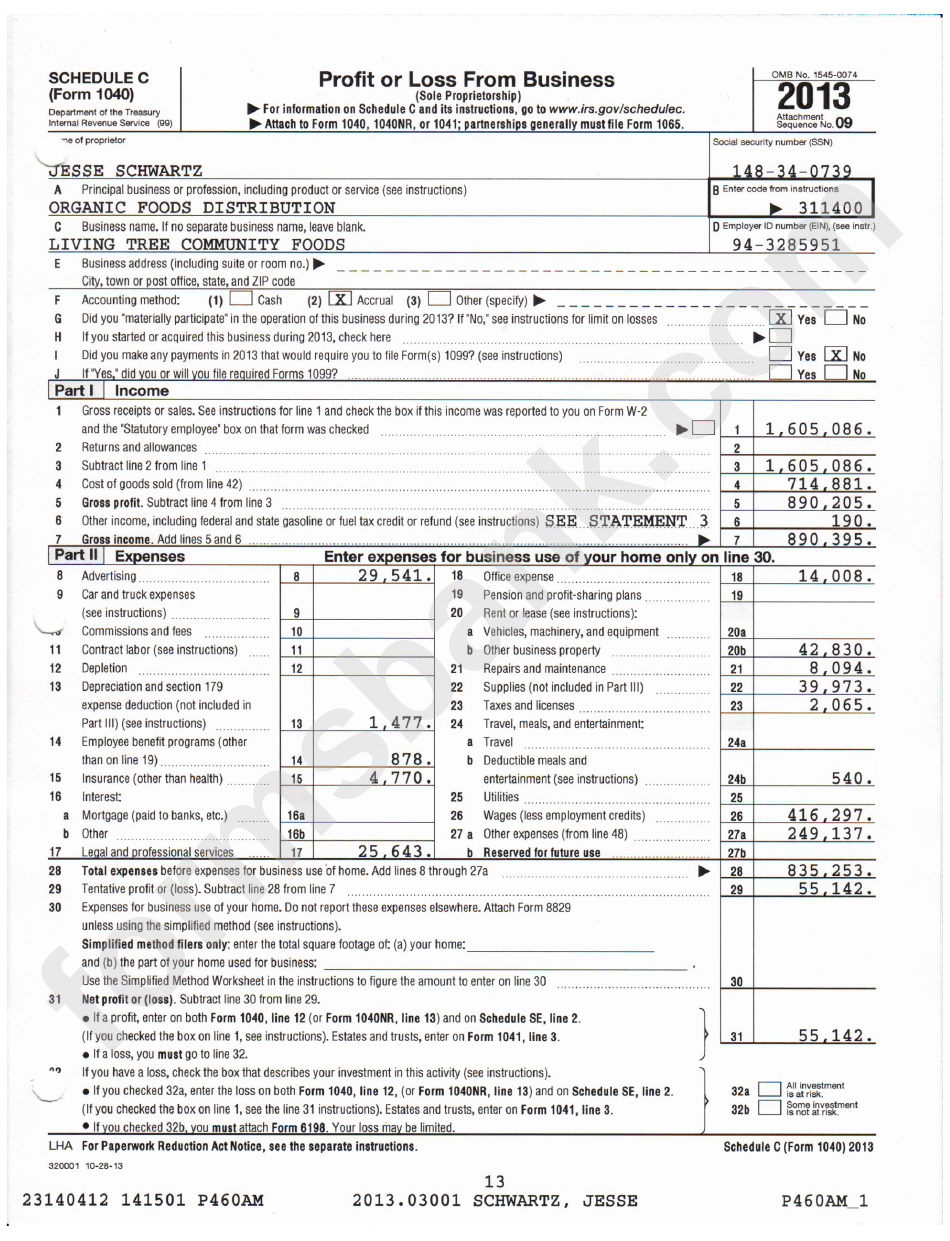

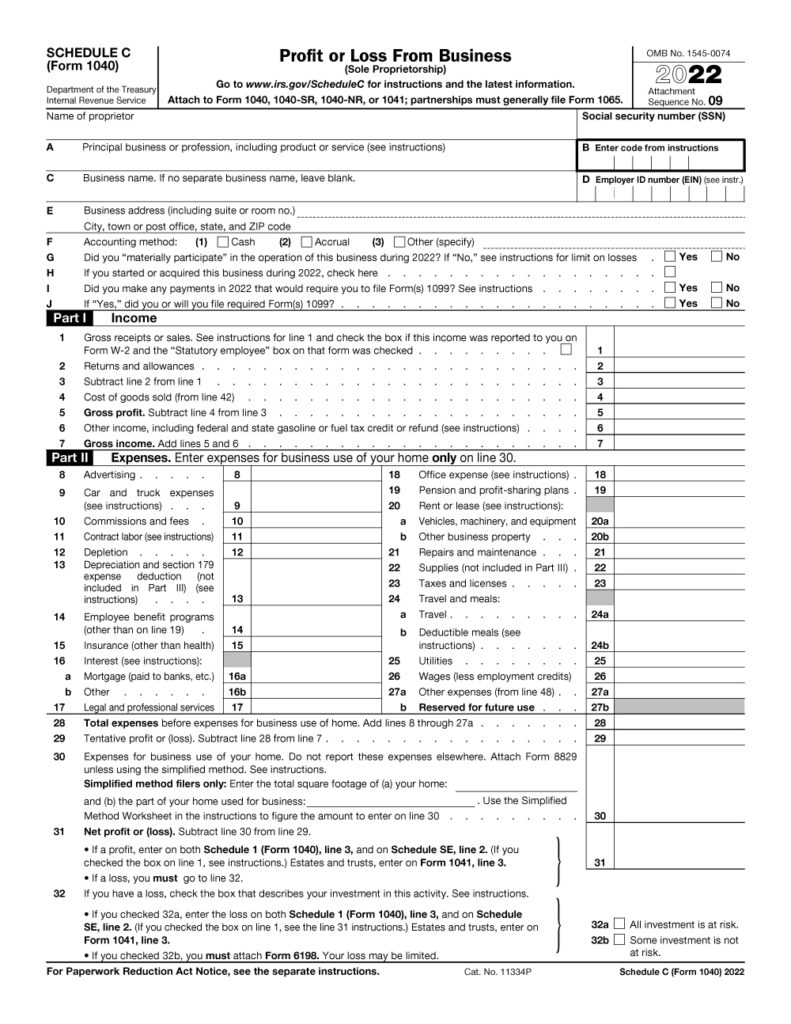

2023 1040 Schedule C Fillable Form - The 2023 form 1040 schedule c is a supplemental form used in conjunction with the form 1040 to report the profit or loss from a sole. If no separate business name, leave blank. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Visite www.irs.gov/schedulecsp para obtener las instrucciones y la información más reciente. Schedule c (form 1040) is used to report income or loss from a business operated as a sole proprietorship. Go to www.irs.gov/schedulec for instructions and the latest information. This essential form also helps. 127 rows review a list of current tax year free file fillable forms and their limitations. (dueño único de un negocio) adjunte al.

Go to www.irs.gov/schedulec for instructions and the latest information. 127 rows review a list of current tax year free file fillable forms and their limitations. The 2023 form 1040 schedule c is a supplemental form used in conjunction with the form 1040 to report the profit or loss from a sole. (dueño único de un negocio) adjunte al. If no separate business name, leave blank. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Visite www.irs.gov/schedulecsp para obtener las instrucciones y la información más reciente. This essential form also helps. Schedule c (form 1040) is used to report income or loss from a business operated as a sole proprietorship.

Go to www.irs.gov/schedulec for instructions and the latest information. (dueño único de un negocio) adjunte al. If no separate business name, leave blank. 127 rows review a list of current tax year free file fillable forms and their limitations. The 2023 form 1040 schedule c is a supplemental form used in conjunction with the form 1040 to report the profit or loss from a sole. This essential form also helps. Visite www.irs.gov/schedulecsp para obtener las instrucciones y la información más reciente. Schedule c (form 1040) is used to report income or loss from a business operated as a sole proprietorship. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession.

Schedule C (1040) 2023 2024

(dueño único de un negocio) adjunte al. If no separate business name, leave blank. The 2023 form 1040 schedule c is a supplemental form used in conjunction with the form 1040 to report the profit or loss from a sole. 127 rows review a list of current tax year free file fillable forms and their limitations. This essential form also.

Irs 2024 Form 1040 Schedule C Tasha Fredelia

This essential form also helps. Go to www.irs.gov/schedulec for instructions and the latest information. If no separate business name, leave blank. The 2023 form 1040 schedule c is a supplemental form used in conjunction with the form 1040 to report the profit or loss from a sole. Visite www.irs.gov/schedulecsp para obtener las instrucciones y la información más reciente.

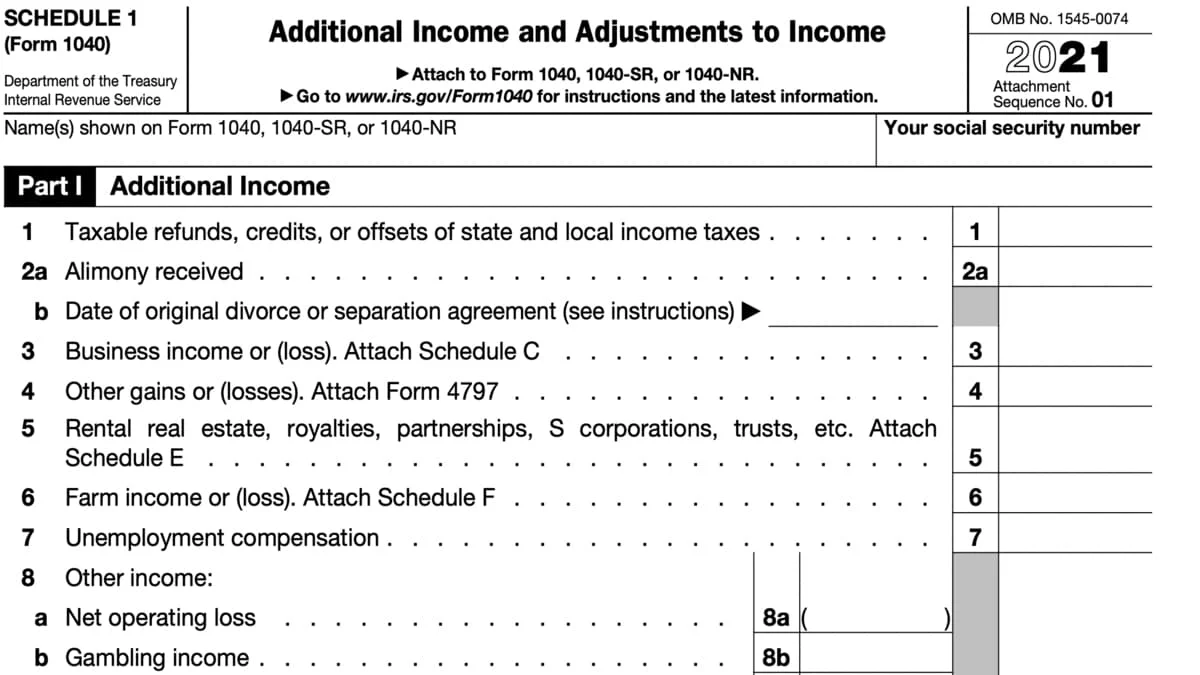

Schedule C (Form 1040) 2023 Instructions

127 rows review a list of current tax year free file fillable forms and their limitations. Schedule c (form 1040) is used to report income or loss from a business operated as a sole proprietorship. Go to www.irs.gov/schedulec for instructions and the latest information. Information about schedule c (form 1040), profit or loss from business, used to report income or.

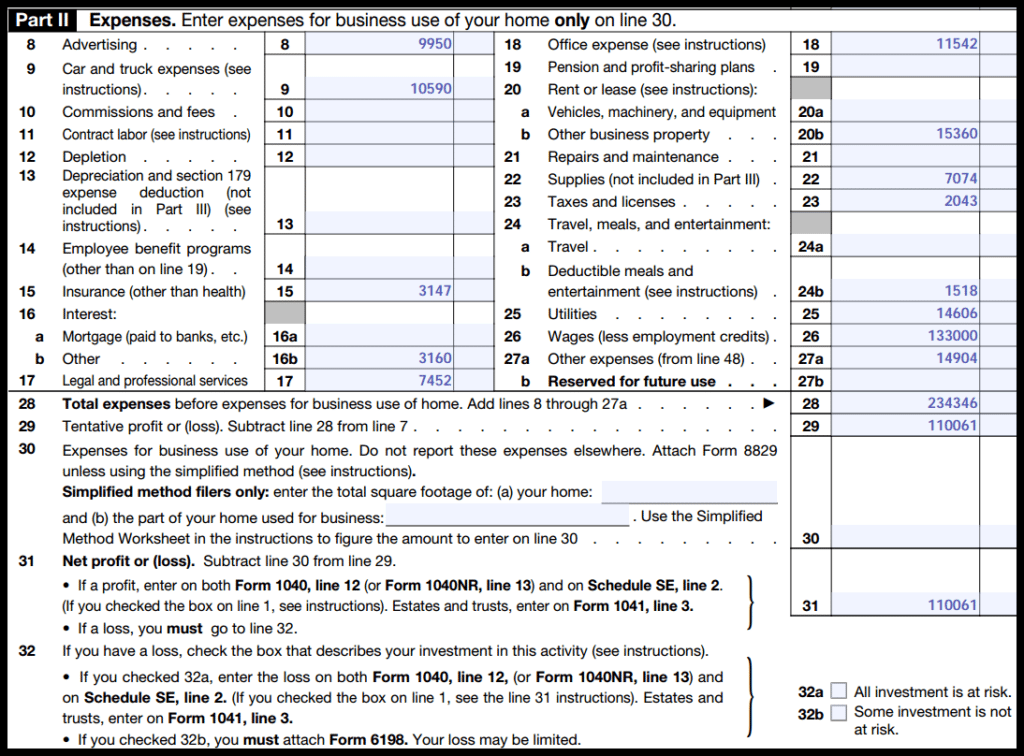

Schedule C Expenses Worksheet 2023

Schedule c (form 1040) is used to report income or loss from a business operated as a sole proprietorship. (dueño único de un negocio) adjunte al. Visite www.irs.gov/schedulecsp para obtener las instrucciones y la información más reciente. If no separate business name, leave blank. 127 rows review a list of current tax year free file fillable forms and their limitations.

Printable Schedule C 2023

Go to www.irs.gov/schedulec for instructions and the latest information. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Visite www.irs.gov/schedulecsp para obtener las instrucciones y la información más reciente. 127 rows review a list of current tax year free file fillable forms and their limitations. (dueño.

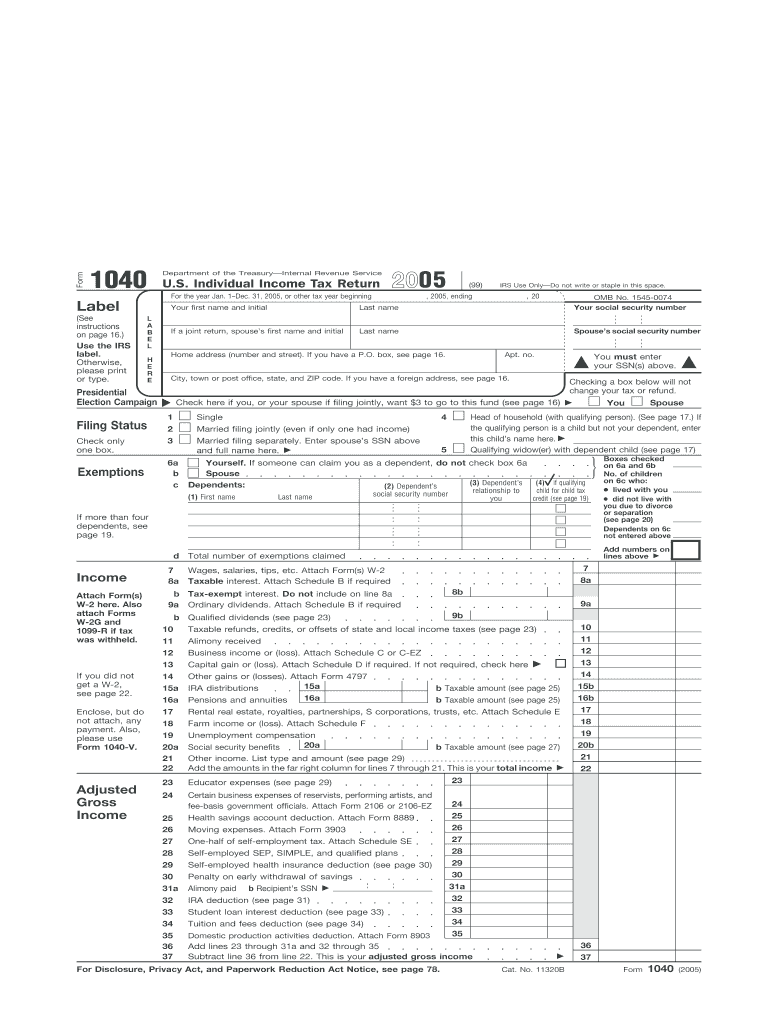

1040 form 2023 Fill out & sign online DocHub

The 2023 form 1040 schedule c is a supplemental form used in conjunction with the form 1040 to report the profit or loss from a sole. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. If no separate business name, leave blank. 127 rows review a.

Printable 1040 Schedule C

Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Schedule c (form 1040) is used to report income or loss from a business operated as a sole proprietorship. The 2023 form 1040 schedule c is a supplemental form used in conjunction with the form 1040 to.

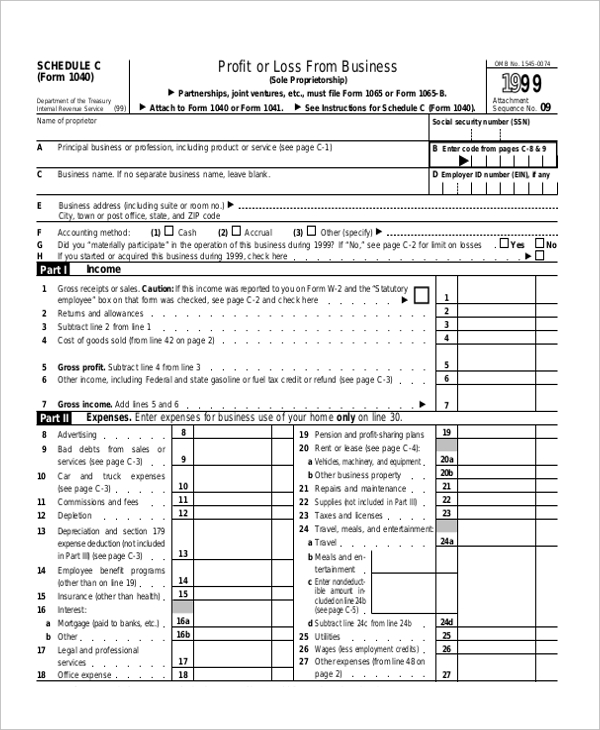

Download Fillable Schedule C Form

127 rows review a list of current tax year free file fillable forms and their limitations. (dueño único de un negocio) adjunte al. Visite www.irs.gov/schedulecsp para obtener las instrucciones y la información más reciente. If no separate business name, leave blank. Go to www.irs.gov/schedulec for instructions and the latest information.

Printable Schedule C 2023

Visite www.irs.gov/schedulecsp para obtener las instrucciones y la información más reciente. (dueño único de un negocio) adjunte al. 127 rows review a list of current tax year free file fillable forms and their limitations. This essential form also helps. Schedule c (form 1040) is used to report income or loss from a business operated as a sole proprietorship.

2023 Form IRS Instructions 1040 Schedule C Fill Online, Printable

Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Schedule c (form 1040) is used to report income or loss from a business operated as a sole proprietorship. If no separate business name, leave blank. 127 rows review a list of current tax year free file.

127 Rows Review A List Of Current Tax Year Free File Fillable Forms And Their Limitations.

Schedule c (form 1040) is used to report income or loss from a business operated as a sole proprietorship. The 2023 form 1040 schedule c is a supplemental form used in conjunction with the form 1040 to report the profit or loss from a sole. If no separate business name, leave blank. Go to www.irs.gov/schedulec for instructions and the latest information.

Information About Schedule C (Form 1040), Profit Or Loss From Business, Used To Report Income Or Loss From A Business Operated Or Profession.

(dueño único de un negocio) adjunte al. This essential form also helps. Visite www.irs.gov/schedulecsp para obtener las instrucciones y la información más reciente.

:max_bytes(150000):strip_icc()/Form1041-36b8feef0014418ab6aa150c951c7609.png)